Ongoing QE-Tailwind For Stocks

Using simple principles of human nature, we can conclude the Fed, and central banks around the world, will continue to print money longer than most market participants believe. Therefore, a bullish tailwind may remain behind stock prices longer than most market participants believe.

Why Do They Keep Printing?

The following valid question is often asked by U.S. investors and taxpayers:

If quantitative easing (QE) has not significantly impacted job creation or economic growth, why does the Fed keep printing money and buying bonds?

Before we answer that question, it is important to note there is very little difference between QE and normal open market operations used by the Fed to adjust interest rates in all economic climates. The difference is QE occurs when interest rates are already hovering near zero. Therefore, if QE “does not work” then questions may arise about why we need central banks at all.

Ego And Self Preservation Are Powerful Forces

Let’s assume the Fed came out and said:

After a thorough analysis, we have concluded QE has not positively impacted the economy or job creation. Therefore, we will begin phasing out QE by reducing our bond purchases each month.

If they admit QE did not work and say it will not be used in the future, the governors will have effectively given the Fed a very significant demotion on the global power org chart. They would also be admitting that all of their white papers about the importance of monetary policy drew inaccurate conclusions. In short, central bankers would have to admit (a) they were wrong, and (b) it is now unclear that central banks can materially impact the economy or business cycle.

We Are All Human

How many people do you know in your personal or professional life that will not go down swinging before they (a) take a significant power-reducing demotion and (b) admit they were wrong? We are all human. We all want to be relevant and right. We all innately protect our power base. Nobody wants to be wrong or less relevant. Central bankers are human too. According to Wikipedia:

Self-preservation is behavior that ensures the survival of an organism. It is almost universal among living organisms. Pain and fear are parts of this mechanism. Pain motivates the individual to withdraw from damaging situations, to protect a damaged body part while it heals, and to avoid similar experiences in the future. Most pain resolves promptly once the painful stimulus is removed and the body has healed, but sometimes pain persists despite removal of the stimulus and apparent healing of the body; and sometimes pain arises in the absence of any detectable stimulus, damage or disease. Fear causes the organism to seek safety and may cause a release of adrenaline, which has the effect of increased strength and heightened senses such as hearing, smell, and sight. Self-preservation may also be interpreted figuratively; in regard to the coping mechanisms one needs to prevent emotional trauma from distorting the mind.

But, If We Keep Printing

We have already shown that admitting QE did not work will cause harm to central bankers personally and to their institutions. The more reasonable assumption is that central bankers will continue printing money and buying bonds hoping the economy will improve, which will in turn (a) prove they were right, and (b) increase the power of central banks. We think it is fair to say printing longer than most expect and hoping things improve is far more likely than throwing in the QE towel anytime soon.

QE Improves Outlook For Stocks

We are not fans of (a) altering free markets, (b) government intervention, or (c) quantitative easing. However, as we outlined in detail on October 25, the markets do not care what you think and they do not care what we think. The corollary is the Fed does not care what you think or what we think. Central bankers are going to continue to use the tools they have (creating money out of thin air) in an effort to meet the objectives outlined in their dual mandate: maximum employment and stable prices. If you think the concept of the market does not care what you think is inaccurate or harsh, keep in mind it helped us draw the following dated conclusions, and more importantly begin redeploying cash into stocks on October 10:

Fed May Be Digging In

How can the Fed not see that QE is not helping the economy, nor creating employment opportunities? The concepts below may help explain the Fed’s stance. From NPR’s Talk of the Nation:

We’d like to believe that most of what we know is accurate and that if presented with facts to prove we’re wrong, we would sheepishly accept the truth and change our views accordingly. A new body of research out of the University of Michigan suggests that’s not what happens, that we base our opinions on beliefs and when presented with contradictory facts, we adhere to our original belief even more strongly.

Investment Implications

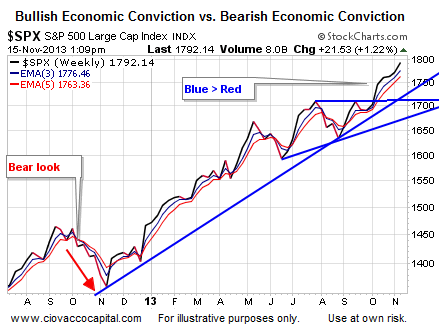

As shown in the weekly chart of the S&P 500 below, bullish economic conviction continues to trend positively relative to bearish economic conviction. The expectation of future Fed policy is reflected in the chart of the market’s pricing mechanism.

Our market model detected an observable improvement in the market’s risk-reward profile after stocks made an intraday low on October 9. Since then, the S&P 500 has gained 145 points. Our game plan remains unchanged; we maintain our “risk-on” allocation as long as the market’s risk-reward profile allows. When the evidence changes, we must be willing to reduce our current exposure to U.S. stocks (SPY), technology (QQQ), financials (XLF), small caps (IJR), energy (XLE), foreign stocks (EFA), China (FXI), and emerging markets (EEM).