Independent oil & gas exploration and production firm Cimarex Energy Company (NYSE:XEC) is expected to release second-quarter 2016 results on Wednesday, Aug 3.

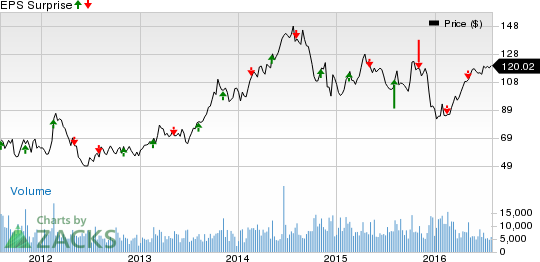

Last quarter, the company delivered a negative surprise of 5.26% owing to the challenges associated with a steep drop in oil price. Also, the company missed the Zacks Consensus Estimate in three of the past four quarters. However, Cimarex managed an average beat of 38.93%.

Let’s see how things are shaping up for this announcement.

Earnings Whispers

Our proven model shows that Cimarex is likely to beat on earnings because it has the perfect combination of two key ingredients.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is +200.00%. This is because the Most Accurate estimate stands at earnings of a penny, while the Zacks Consensus Estimate is pegged at a loss of a penny. This is a meaningful and leading indicator of a likely positive earnings surprise.

Zacks Rank: Cimarex holds a Zacks Rank #2 (Buy), which when combined with a positive Earnings ESP, makes us confident about an earnings beat.

Note that stocks with a Zacks Rank #1 (Strong Buy), 2 or 3 (Hold) have a significantly higher chance of beating earnings. The Sell-rated stocks (Zacks Rank #4 and 5) should never be considered going into an earnings announcement.

What is Driving the Better-than-Expected Earnings?

Cimarex has established a track record of focused and disciplined exploration and production (E&P) capital spending that has driven profitable growth in the past. Notably, the company has strong financial flexibility and balance sheet, which are real assets for it in this highly volatile economy.

The company’s substantial acreage in core operating areas gives it a detailed inventory of exploration and development (E&D) prospects that provide it with relatively low-risk volume growth opportunities. Cimarex is also increasing its ownership interests in the wells in which it participates. As a result, successful projects are favorably impacting the company’s volumes and reserves.

Overall, the company’s activities have been successful in winning analysts’ confidence. As a result, the Zacks Consensus Estimate for the second quarter narrowed to a loss of a penny from a loss of 12 cents per share over the last 30 days.

Stocks to Consider

Here are some companies to consider as our model shows that these have the right combination of elements to post an earnings beat this quarter.

Legacy Reserves LP (NASDAQ:LGCY) has an Earnings ESP of +12.50% and a Zacks Rank #2.

Northern Oil and Gas, Inc. (NYSE:NOG) has an Earnings ESP of +25.00% and a Zacks Rank #1.

Spectra Energy Corp (NYSE:SE) has an Earnings ESP of +12.00 % and a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

SPECTRA ENERGY (SE): Free Stock Analysis Report

LEGACY RESERVES (LGCY): Free Stock Analysis Report

CIMAREX ENERGY (XEC): Free Stock Analysis Report

NORTHRN OIL&GAS (NOG): Free Stock Analysis Report

Original post

Zacks Investment Research