There has been a continual call from mainstream media to look to China as an investment area since it is expected to start to turn its economy around. This week, noted technician Tom DeMark made a bold call stating that the Shanghai Composite would bottom since it broke 1960 and would be 50% higher in 9 months.

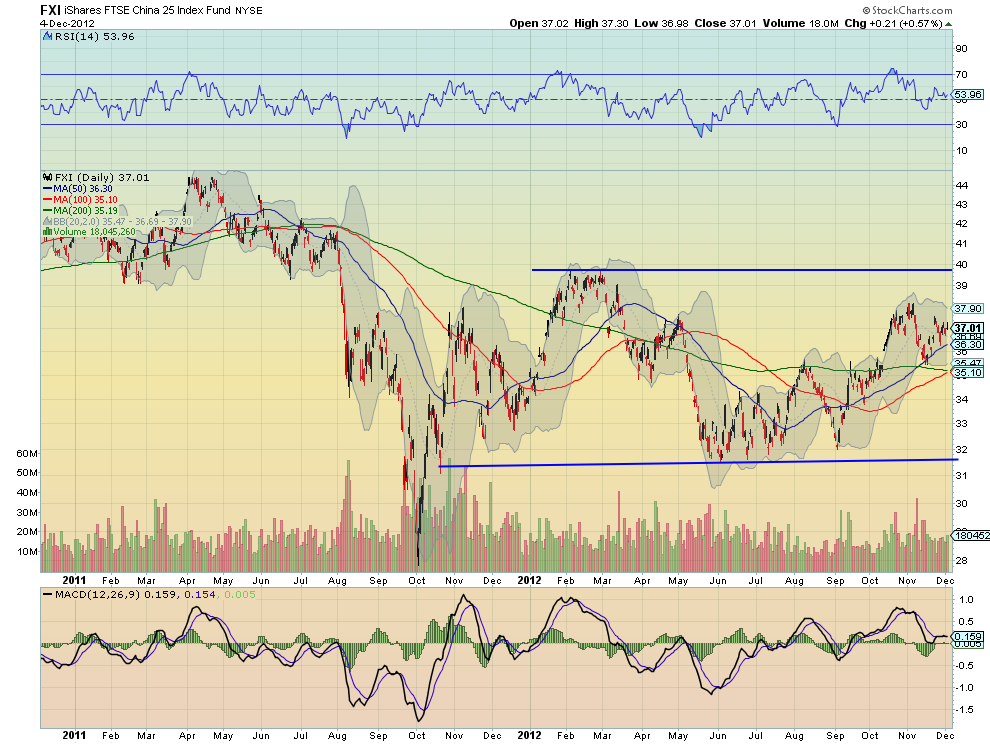

Really? With one extra voice and two months of screaming the same 'invest in China' mantra, the Shanghai Composite just keeps going lower. Are they not watching? The pundits will point to the iShares FTSE China 25 ETF, (FXI), when they talk about investing in China. But that is not the broad Chinese market. Rather, it's an index of state sponsored companies as explained here last week.

But aside from that, it has done nothing but drift towards the top of a range as noted in the chart above. A great move if you caught the bottom but now what?

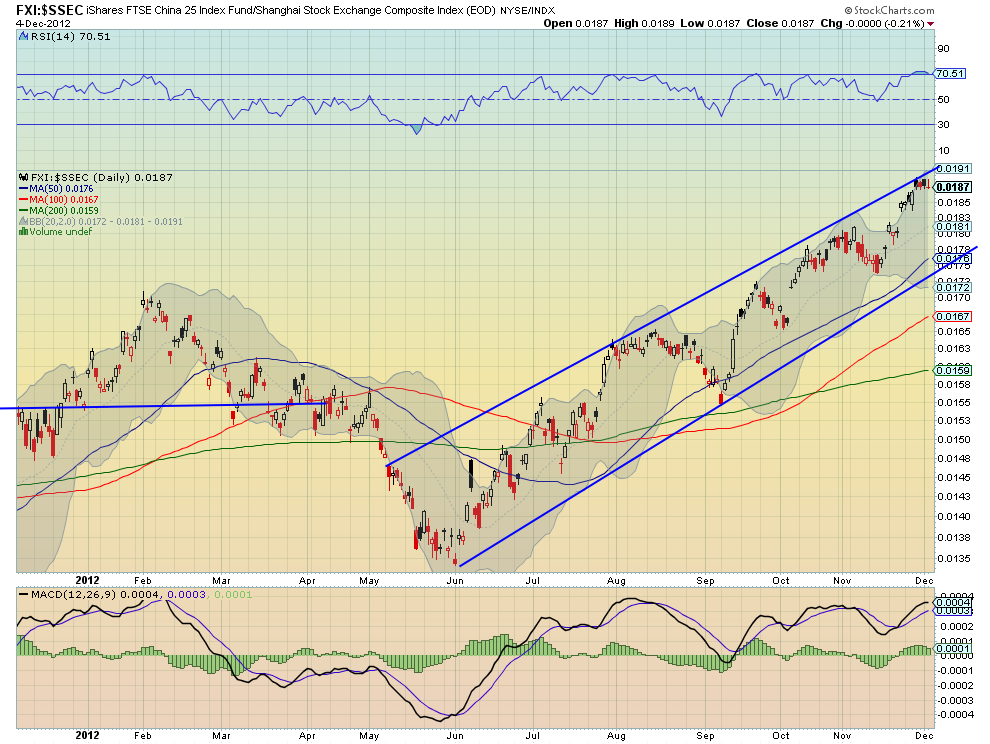

And there is a widening disconnect between the FTSE China 25 and the Shanghai Composite that is getting stretched to the extremes. The chart below shows the rising wedge in the ratio chart of FTSE China 25 against the Shanghai Composite. The momentum indicators are suggesting at least a consolidation if not a pullback is due.

Certainly this could resolve with a pop higher in the Shanghai Composite. But isn’t that beside the point? Making a case to invest in China is making a case to take money out of the US markets.

The relationship between the Shanghai Composite and the S&P 500 was reviewed last here in late September. Since then nothing has changed. The ratio bounced in the 4 year falling channel in the chart below, allowing the RSI to reset, for another leg lower in the ratio. And it did move lower. It is now in the disaster zone.

Under the red support line near 13.60 there is nothing to show support until the 11.20 area, 17% lower.

A move in the Shanghai Composite itself to support at 1825 would only account for half of that move. The rest would have to come from a 8% move higher in the S&P 500 or a continuation lower in the Shanghai Composite. Does it still seem like a good idea to invest in China now?

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why Would Anyone Want To Invest In China?

Published 12/06/2012, 12:27 AM

Updated 05/14/2017, 06:45 AM

Why Would Anyone Want To Invest In China?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.