Most of the old idols of Rock and Roll are withering away. Many of my generation are trying to keep the memory alive though. Old groups are touring and tribute bands popping up with a following. Paul McCartney may be an exception. As a Beatle he sang a song that asked will you still need me when I’m 64. He has proven that he is still relevant, at least to some, and is touring again, well past 64. One legend did not make it to 64. Elvis Presley died 39 years ago today at the age of 42. Perhaps America’s first Rock and Roll legend, he inspired many to keep his music and performances alive. Tribute Artists are everywhere. One of them is an old Treasury Bond Repo trader friend of mine. I met him at an Indians game yesterday. He was in town to sing the National Anthem. Repo trader to Elvis Tribute Artist to singing the National Anthem.

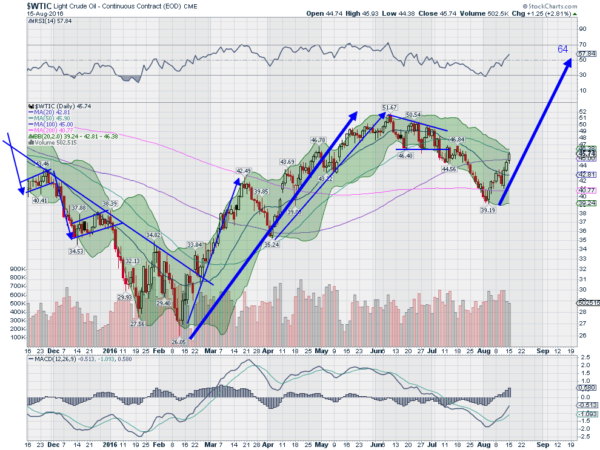

I thought about this as I looked at the chart of Crude Oil. Last week it seemed to be waking up from a sleep. It moved higher through the week and continued early this week. The chart below is what brought Rock and Roll to mind. Now that Crude Oil has definitely bounced it sets up an AB=CD pattern. That gives a target to 64 above.

There are a lot of positives in the chart. It made a higher low at the start of August. The momentum indicators are rising. The RSI is near a shift into the bullish zone while the MACD is crossed up and near a move to positive. There are a few more pieces of information that would go far to confirming a reversal and not just a bounce. A break back over the 20 day SMA would be one. And a turn higher in the Bollinger Bands®. But generally things are looking up. Next stop 64?

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.