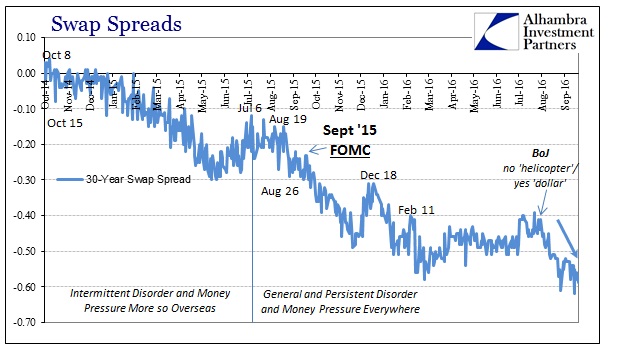

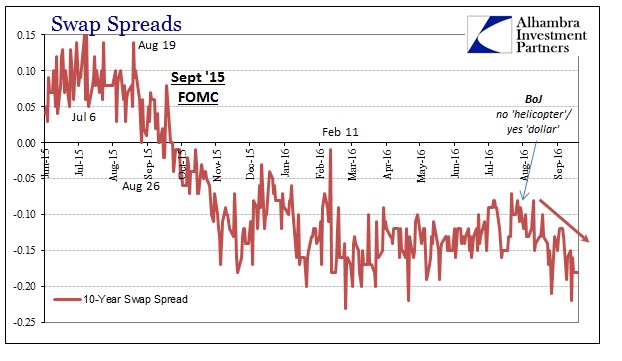

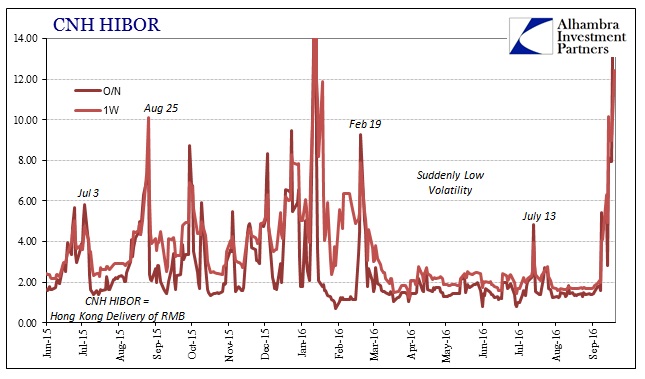

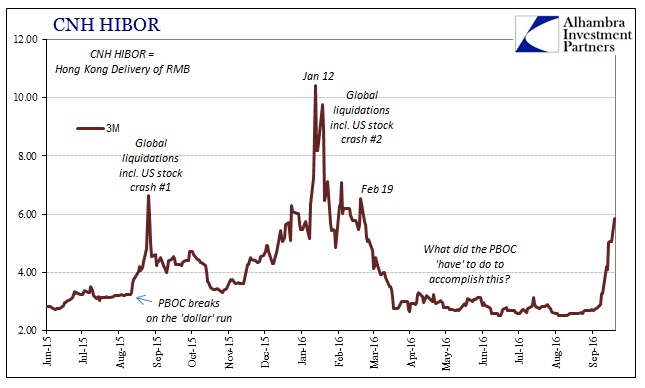

The economy of 2015 started out “unexpectedly” weak before succumbing to “global turmoil.” It was the events of last summer that began to sow serious doubts about not just the economic narrative seeking to dismiss weakness (“transitory”) but rather central banking and QE itself. The repeat in January/February further eroded mainstream credibility, particularly since only a few weeks before the Federal Reserve in particular pronounced full health. It was an embarrassing but poignant “dollar” rebuke.

In the middle of 2015 just prior to the outbreak of the “dollar” “run”, it was perhaps somewhat understandable for the layperson or the general public to wonder what was going on. Any disruption in terms of the domestic economy did seem as Janet Yellen was claiming. For all the grief even by late July last year, everything seemed to be limited to overseas events; a fact which economists and policymakers played up whenever they could. They should have known better.

I wrote at the end of last July that what was going on overseas was yet another warning even though it may not have seemed like it had anything to do with the United States:

Sticking with purely financial expression of the eurodollar standard it is easy at times to forget such monetary influence has very real consequences. That is true in the US in particular, as even though the recovery is both deficient and waning it isn’t the disaster it is in other, connected places. It was, after all, the rise of the eurodollar standard as a wholesale system starting in the middle 1990’s that more tightly stitched the global economy, an open system architecture that eludes, still, the grasp of monetary policymakers. As such, they have a great tendency to miss and misapprehend what is really happening and because of that they will simply make it all worse without much hope for an upside.

That might be the biggest difference between this year and last, at least as far as credibility. Warnings aren’t so easily set aside anymore, meaning central banker assurances aren’t nearly so potent. From February 11 forward, economists and policymakers have had everything going for them; the end of the liquidations and the further lack of a third; economic accounts that seem, on the surface, to be much better certainly in comparison to the start of the year; and stocks, the go-to signal for everything that is supposed to be right, at new record highs (S&P 500 anyway). Yet, for all that, there remain very clear nagging doubts.

These start with the steady stream of “anomalies”, market or economic hurdles that continue to crop up with some noticeable regularity. Learning from last year, people now understand (even if they don’t get why) that supposedly random “overseas” occurrences have had a consistent tendency to cross any and all boundaries. Even stocks like those of the S&P 500 that while the overall index hit a record high it wasn’t as if that started another leg in the “bull market.” Since mid-July, stocks have more or less pushed sideways, following a great many other markets into conspicuous indecision.

Many will attribute that to uncertainty over monetary policy, especially this week with both the Federal Reserve and Bank of Japan awaiting each their turn to try to recapture lost reverence (long gone are the days of Greenspan and the media love affair with his briefcase). But this indecisiveness predates any incorporation of September policy; not to mention gives central banks far too much credit to begin with. Stocks have been mostly sideways and now a little lower, thanks to money market (not 2a7) events last week and the week before , all tracing back to mid-July. We find a lot of markets that have been in the same condition since that time.

Perhaps most conspicuous and important is the eurodollar futures market. Going back to the rumors of the Japanese “helicopter” in mid-July, this hugely important part of the global money market system has settled into a remarkably narrow range. As if perfectly emblematic, trading today was constrained to the slimmest trading in a very long time – the June 2018 contract, an important benchmark maturity, was stuck the whole session within only 3.5 bps.

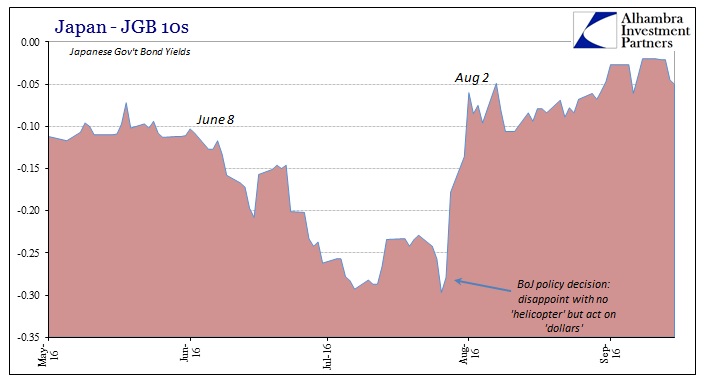

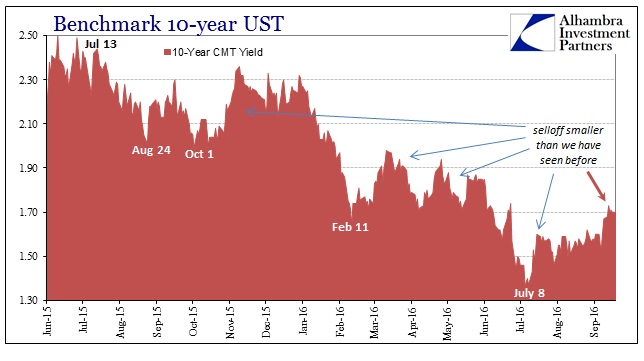

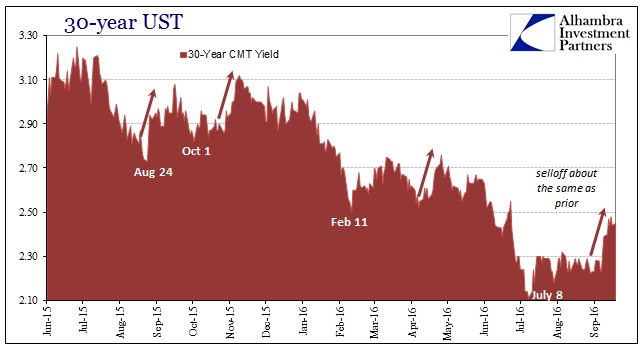

Even the one market that has been moving, sovereign bonds around the world, has once again stopped. The UST selloff, for example, reached its climax a week ago. The 10-year CMT yield pushed up to 1.73% last Tuesday and has been (what else?) sideways ever since. Without conviction in money rates (at least in terms of eurodollar futures charting a course for the future path of short-term rates) it may be that what was surely the catalyst in the bond selloff, JGB’s, has re-entered market consciousness now that it isn’t any longer a catalyst. The severe shock of JGB’s getting sold actually ended weeks ago, with Japanese governments trading (what else?) sideways for almost all of this month.

And even when we analyze the bond market/UST selloff, it really wasn’t all that impressive or earth-shattering except perhaps by how much the mainstream really pushed it; “they” clearly wanted it to be real because if it was it would have meant compelling, non-mathematical evidence that markets were accepting the more positive and always-optimistic outlook of policymakers and economists (redundant).

In other words, even the bond market selloff wasn’t anything we haven’t seen before, and in many ways (such as at the 10s and in the belly) it was actually quite less. The fact that it wasn’t really that big a deal (at least to this point) is perhaps a further nod to nagging uncertainty and indecision about fears that just won’t fade into history.

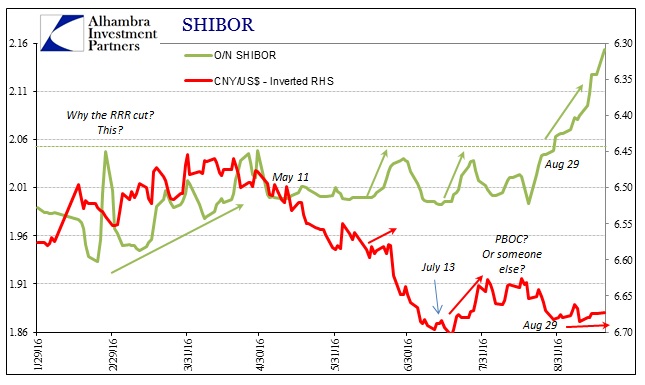

All these sideways or hesitant markets (for lack of a better term) have, of course, very good reason for the disinclination. It’s not just the very, very poor track record of central bankers and their proven inability to forecast even their own actions, there are rumbles of “overseas” thunder all over again. For now, that has largely remained a distant worry, but history, especially recent history, counsels nothing but caution. Way far in the background, another market has been stirring and though it hasn’t wreaked havoc so far I think almost every market is on edge understanding this year that the longer it persists the greater that potential – no matter what Janet Yellen, Haruhiko Kuroda, or Mario Draghi say (or even do).

It seems as if everything is once again coming to a head; markets seem to be on edge no matter how much is purported to be going right, waiting to find out if the distant but serious “overseas” commotion will remain an object for foreign consideration alone, or, as last year, confirm this summer’s apparently unshakable suspicions (that really aren’t so far away after all; see below) that nothing has truly changed.