Life as an investor has been very different since the Great Recession - and I did not anticipate the large drop in oil prices this year. Oil price decline will have so many knock-on effects (good and bad) that it is difficult to understand the timing or intensity of the effects.

Follow up:

Many pundits are pointing to increased consumer buying on the back of reduced oil prices. I believe reduced oil prices will have the opposite effect on many non-retail business which will end up offsetting (how much is the question) the positive retail growth. The offsetting factors are out of phase with with increased consumer spending. I expect the effect of the offsetting factors to begin to set in during the first half of 2015.

In any event, consider that headline GDP is determined relative to the previous quarter. Once the increased consumer spending GROWTH bump occurs - IF oil prices remain the same - the growth in the following quarter will fall back to the current trend. And what happens if oil prices rise? Oil prices must continue to fall for any GDP GROWTH benefit to continue for the USA.

My belief is the market is over-valued relative to the business cycle. One reason the market reacted positively to the drop in the price of oil is that the Federal Reserve said it will have a positive effect . Fed Chair Janet Yellen stated during her post-December FOMC Meeting Press Conference:

.... that the decline we have seen in oil prices is likely to be, on net, a positive. It’s something that’s certainly good for families, for households. It’s putting more money in their pockets. Having to spend less on gas and energy, and so, in that sense, it’s like a tax cut that boosts their spending power. The United States remains—although our production of oil has increased dramatically, we still remain a net importer of oil. Of course there may be some offset in the form of reduced drilling activity, and possibly some change, some reduction in cap-ex plans in the drilling area. But, on balance, I would see these developments as a positive for the standpoint of the U.S. economy.

Investors seemed to go with that assurance (until actual numbers will show otherwise) - and my guess is that we will soon start to see evidence of the damage caused by the drop of oil prices shortly.

Market movements are thought to anticipate the change in the business cycle. There are also other dynamics in play which will effect the business cycle:

- As long as global economies do not contract (and at this point I only anticipate a slowing) - the USA business cycle should grow during 2015;

- It seems a currency war has been triggered by Japan. If the dollar continues to strengthen, it will reduces business profits (USA exports grow more expensive whilst global operations will see lower profits caused by slowing global economies and currency exchange rates). On the other hand, it allows USA consumers and business to buy now cheaper imported items which acts like a reduction in taxes. The question is how much will the dollar strengthen?

There is always uncertainty about the future - and the weighting of the uncertainty is problematic in making predictions. It seems most uncertainty is over-weighted, and ends up having little effect on the economy. But we are NOT talking about the economy here, but the markets and business cycles (which are related but not joined at the hips).

I see oil prices as the major uncertainty for 2015 followed closely by the relative strength of the US dollar and the slowing of the global economies. This is a war in the USA between the benefits and the damage which will be inflicted by these dynamics.

Other Economic News this Week:

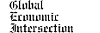

The Econintersect Economic Index for December 2014 is showing our index on the high side of a tight growth range for almost a year. Although there are no warning flags in the data which is used to compile our forecast, there also is no signs that the rate of economic growth will improve. Additionally there are no warning signs in other leading indices that the economy is stalling - EXCEPT ECRI's Weekly Leading Index which is slightly below the zero growth line.

The ECRI WLI growth index value crossed slightly into negative territory which implies the economy will not have grown six months from today.

Current ECRI WLI Growth Index

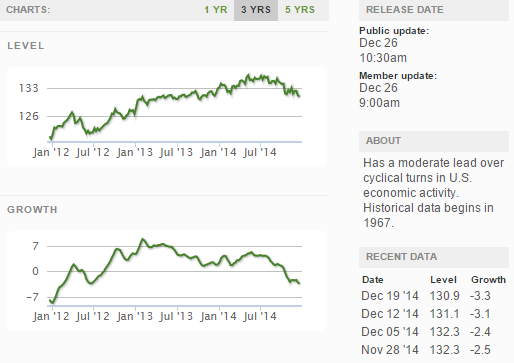

The market was expecting the weekly initial unemployment claims at 275,000 to 290,000 (consensus 290,000) vs the 298,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 290,500 (reported last week as 290,250) to 290,750. Rolling averages under 300,000 are excellent.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line)

Bankruptcies this Week: Tengion

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: