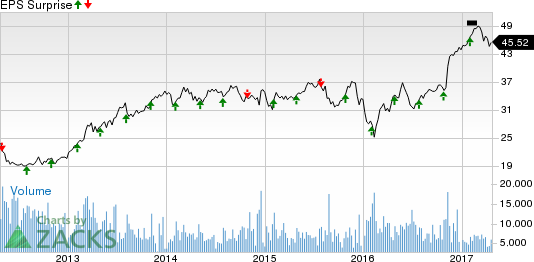

Unum Group (NYSE:UNM) is set to report first-quarter 2017 results on Apr 26, after the market closes. Last quarter, the company had a positive earnings surprise of 2.04%. Let’s see how things are shaping up for this announcement.

Factors to Influence Q1 Results

The company’s overall results are likely to have improved in the to-be-reported quarter on strong performance by Unum U.S. and Colonial Life. Both segments are expected to post higher premiums and favorable risk results. Strategic acquisitions are expected to have added to the performance. Persistency should also have improved. Also, prudent pricing and underwriting practices are positives.

Increase in interest rate, though still low, should have cushioned investment results.

Continued buybacks are also likelyto have boosted the bottom line.

However, results at Unum U.K. are likely to have remained soft with benefit ratio deteriorating. This was due to increasing average claim size and higher claim incidence rate in group life as well as a higher average claim size in group long-term disability. Also, management expects operating revenues at Closed Block and Corporate segment to remain low as these closed blocks of business wind down. Nonetheless, management estimates additional premium income associated with long-term care rate increases.

With respect to the surprise trend, the company delivered positive surprises in each of the last four quarters with an average beat of 4.28%.

Earnings Whispers

Our proven model does not conclusively show that Unum Group is likely to beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Unum Group has an Earnings ESP of -1.00%. This is because the Most Accurate estimate stands at 99 cents while the Zacks Consensus Estimate is pegged at $1.00. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Unum Group carries a Zacks Rank #3, which increases the predictive power of ESP. However, an Earnings ESP of -1.00% makes surprise prediction difficult.

Conversely, we caution against Sell-rated stocks (Zacks Rank #4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies from the insurance industry that you may want to consider as these have the right combination of elements to post an earnings beat this quarter.

Chubb Limited (NYSE:CB) has an Earnings ESP of +0.82% and a Zacks Rank #3. The company is set to report first-quarter earnings on Apr 25.

Selective Insurance Group, Inc. (NASDAQ:SIGI) , which is set to report first-quarter earnings on Apr 26, has an Earnings ESP of +9.59% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Reinsurance Group of America Inc. (NYSE:RGA) has an Earnings ESP of +1.42% and a Zacks Rank #2. The company is slated to report first-quarter earnings on Apr 27.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Unum Group (UNM): Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA): Free Stock Analysis Report

D/B/A Chubb Limited New (CB): Free Stock Analysis Report

Selective Insurance Group, Inc. (SIGI): Free Stock Analysis Report

Original post

Zacks Investment Research