Dave & Buster's Entertainment, Inc. (NASDAQ:PLAY) is scheduled to report first-quarter fiscal 2017 numbers on Jun 6, after market close.

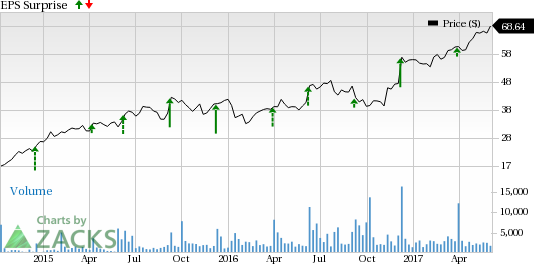

Last quarter, Dave & Buster's posted a positive earnings surprise of 8.62%. In fact, the company’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, with an average beat of 34.15%.

Let’s see how things are shaping up for this announcement.

Factors Likely to Affect Q1 Results

Since the launch of its IPO in Oct 2014, Dave & Buster's has been performing well on the back of the unique customizable experience that it offers across its four platforms, “Eat Drink Play and Watch”. Continual opening of stores, menu innovation, and increased marketing efforts along with launch of new games should boost its top and bottom line in the fiscal first quarter as well.

Apart from great food and beverages, the company’s amusement and other segment is expected to boost results in the to-be-reported quarter. Notably, the segment accounts for over 50% of the company’s revenues, and increased dependence on gaming should thus somewhat insulate the company from the pressures facing the broader restaurant industry of late. Meanwhile, implementation of cost saving initiatives should continue aiding margins.

However, rising labor costs, pre-opening costs of outlets given the company’s unit expansion plans and expenses incurred to execute the sales initiatives might dent the quarter’s profits. Additionally, a choppy sales environment in the U.S. restaurant space is likely to limit the to-be-reported quarter’s revenue growth.

Earnings Whispers

Our proven model does not conclusively show earnings beat for Dave & Buster's this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as elaborated below.

Zacks ESP: Dave & Buster's has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 80 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Dave & Buster's has a Zacks Rank #3, which increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult.

Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies to consider as our model shows that they have the right combination of elements to post an earnings beat this quarter:

Fred's, Inc. (NASDAQ:FRED) has an Earnings ESP of +16.67% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sonic Corp. (NASDAQ:SONC) has an Earnings ESP of +4.88% and a Zacks Rank #3.

Bed Bath & Beyond Inc. (NASDAQ:BBBY) has an Earnings ESP of +1.52% and a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Fred's, Inc. (FRED): Free Stock Analysis Report

Sonic Corp. (SONC): Free Stock Analysis Report

Dave & Buster's Entertainment, Inc. (PLAY): Free Stock Analysis Report

Bed Bath & Beyond Inc. (BBBY): Free Stock Analysis Report

Original post