FTSE 100

The FTSE FT100 TR (UKX) ended the week up + 0.57%. For the week ahead, we see consolidation between 7,400 and 7,500.

Indicators

After the strong recovery of the past weeks, we believe that the FTSE100 can lateralize and possibly perform a back test of previous support areas. Potential support areas that we identify are on the the 50MA, (currently at 7,430) and 7,300. If the first target is quickly broken, we would aim for the second as a possible reversal area.

MACD and RSI confirm the excellent recovery of the index, but are both showing signs of weakening given the strong recovery in recent weeks.

Before continuing to the upside, we believe the FTSE100 may retrace slightly: Thursday's strong bearish candlestick, coupled with a weakening of internal indicators keep us cautious and waiting for a slight reversal.

Support at 7,405

Resistance at 7.520 (level unchanged)

FTSEMIB

The FTSE MIB Net Total Return (Lux) had a week up + 1.95%. This week, we could expect a possible retracement to the area of 24,000-24,500.

Indicators

The strong indecision of the last few weeks makes us remain cautious on the Italian index. We can in fact see a recovery formed for the most part by indecision candles that do not give a strong direction to the index.

MACD and RSI confirm the recovery of the index, with the former approaching the 0 line (positive momentum) and the latter having just exceeded the 50 level (bullish). At the same time, we are noticing a slowdown, more than normal given the past few weeks of recovery.

Recently, the price has consolidated below the 50MA and we believe that before exceeding it, the FTSEMIB may retrace slightly. This hypothesis is supported by a slowdown in internal indicators.

We believe that the index is close to a bullish recovery, but in the very short term, we are leaning towards a slight retracement.

Support at 24,000

Resistance at 24.960 (left unchanged)

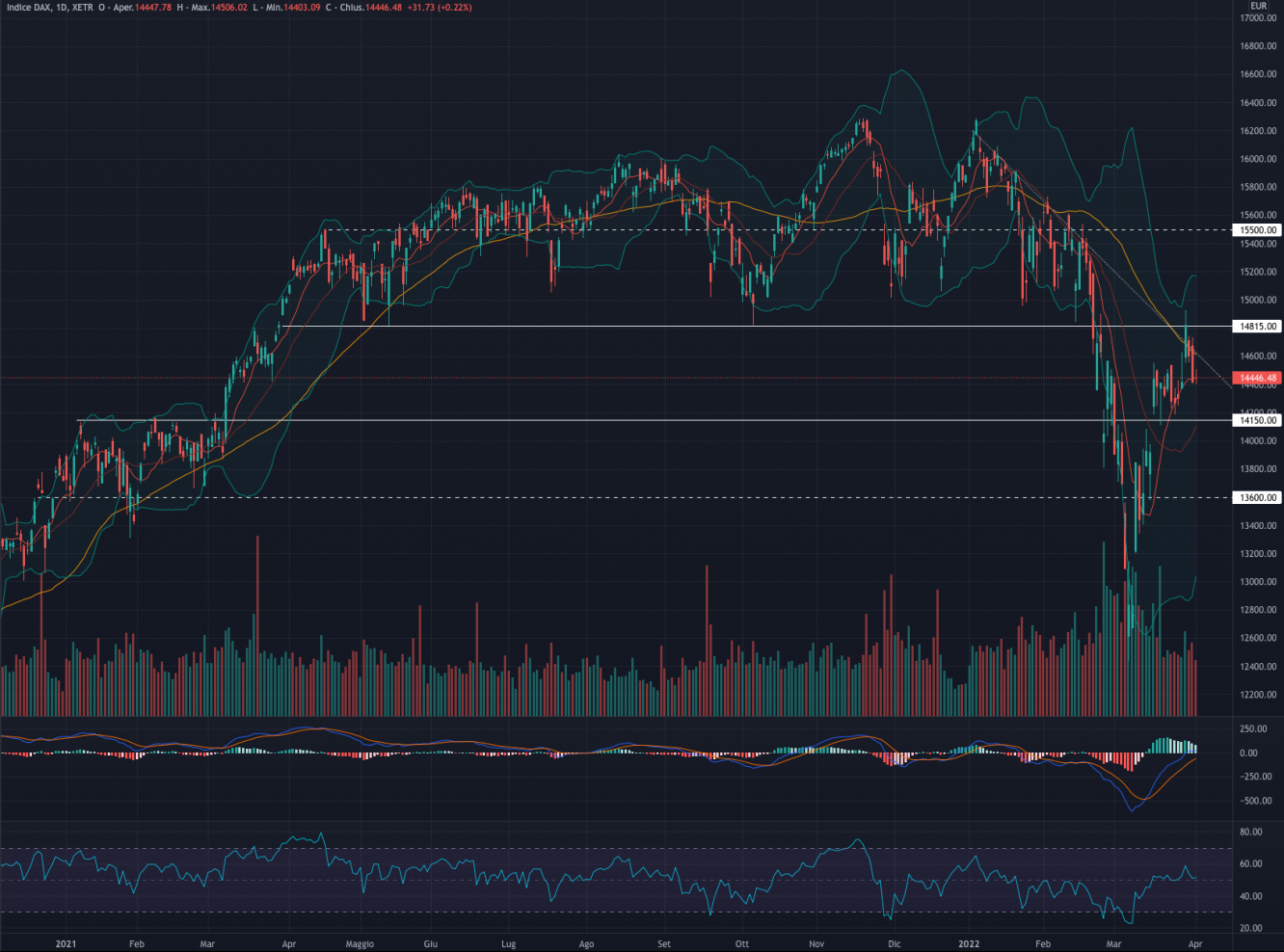

DAX 40

The DAX ended the week down -0.02%. This week, we could see a slight retracement to 14,000.

Indicators

After the strong price action of the past weeks, we believe that the DAX can slow down and then, in our opinion, continue to rise. The bearish trend-line in existence since January 2022 has played the role of resistance and we believe that it can now lead the index to retrace slightly and then break it to the upside.

MACD and RSI are positive but slowing. The MACD is gradually returning above 0 (positive momentum) and the RSI is now moving above 50 (bullish).

As highlighted last week, a decrease in volumes in moments of upward price action is never a good sign of its strength. In addition, internal indicators are also showing signs of slowing.

We remain positive in the medium term for the DAX, but in the very short term we are in favor of a slight retracement.

Support at 14,150

Resistance at 14.815

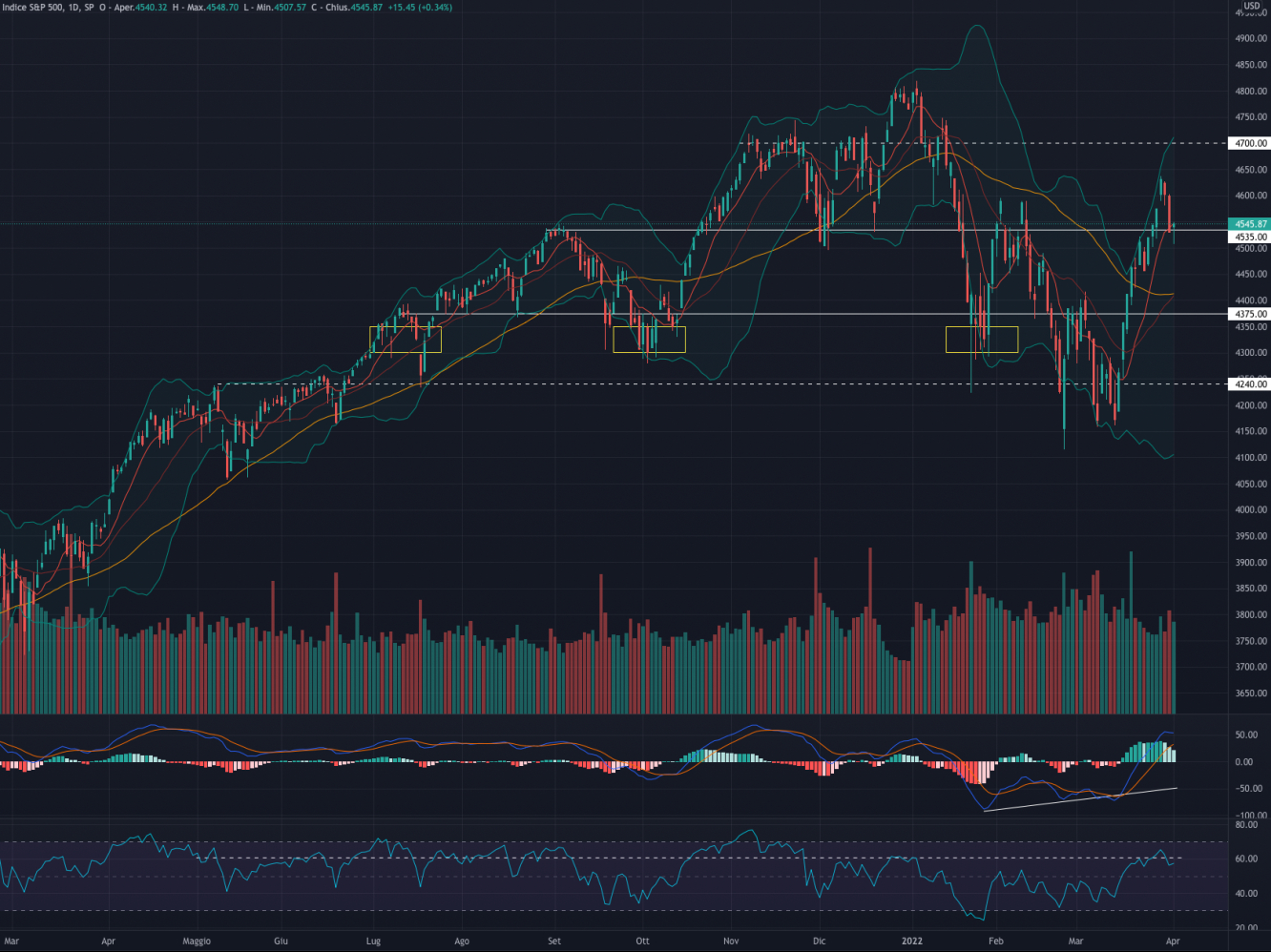

S&P 500

The S&P 500 had a week up + 0.22%. For the week ahead, we see consolidation between 4.420 and 4.500.

Indicators

The consolidation above the 50MA is very encouraging for medium-term bullish scenarios. At the same time, we believe that the price action at the end of the week may allude to a slight short-term retracement.

MACD and RSI are positive but slowing down. The MACD seems to want to curve down and the RSI is close to the overbought area.

We remain bullish on the S&P 500, but before continuing its upward move, we believe that a backtest of the 50-day moving average can make the recovery more natural and sustainable.

Support at 4.375

Resistance at 4.535 (left unchanged)

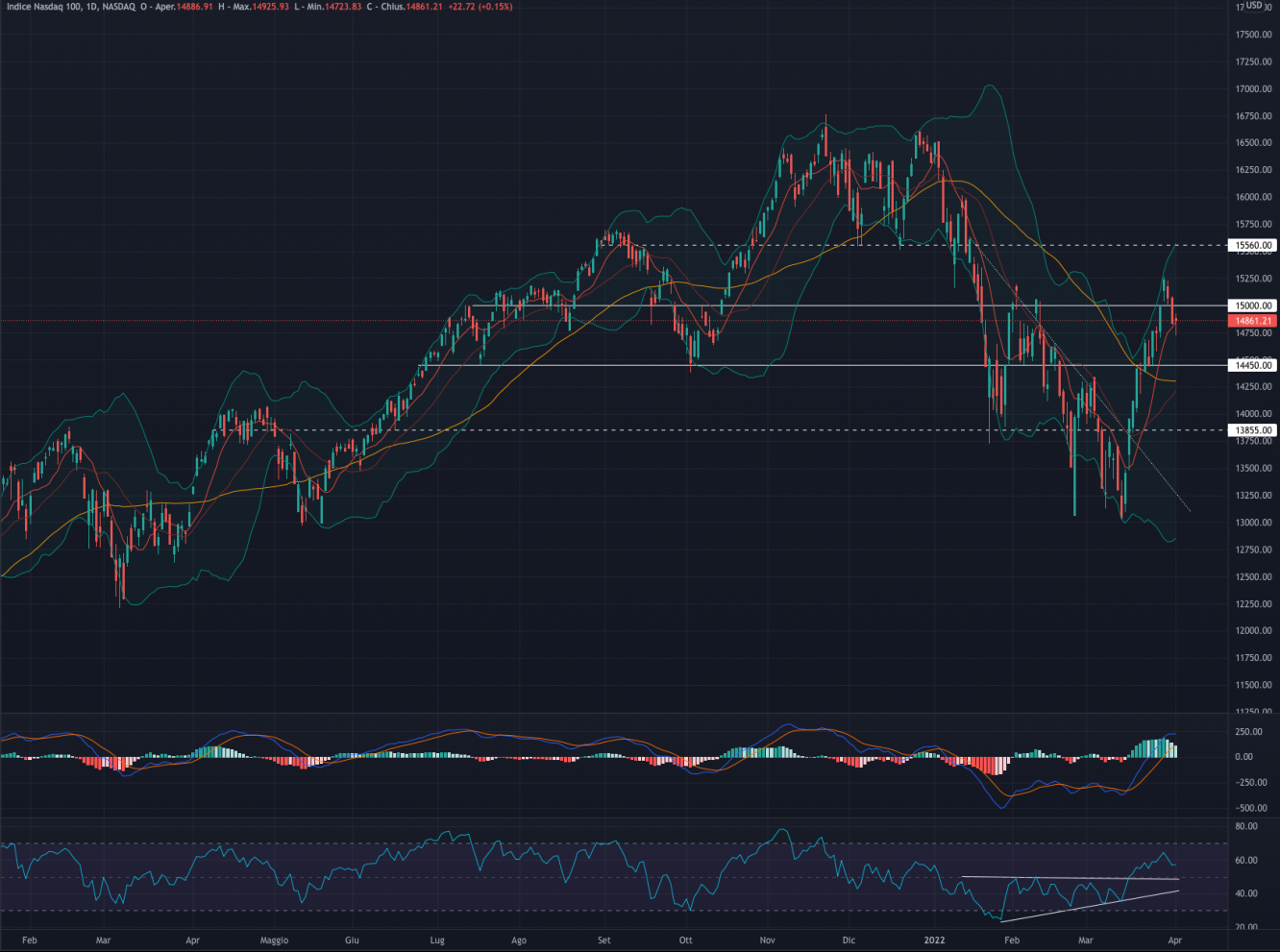

NASDAQ 100

The NASDAQ ended the week up + 0.32%. For the week ahead, we see slight downward consolidation between 14,600 and 14,300.

Indicators

The strong recovery in recent weeks has again reached the range near 15,000: breaking point in January and backtest level in February.

MACD and RSI both confirm the resumption of strength of the index, but at the moment they are slowing down. The former seems close to a bearish cross over and the RSI is near the overbought area.

Post the past weeks' strong moves, we believe that the index can first consolidate downwards and then continue the bullish recovery, in order to avoid situations of overbought and divergences with the price. A slight retracement in the area of 14,000-14,200 would be optimal for new long positions.

Support at 14,450

Resistance at 15,000

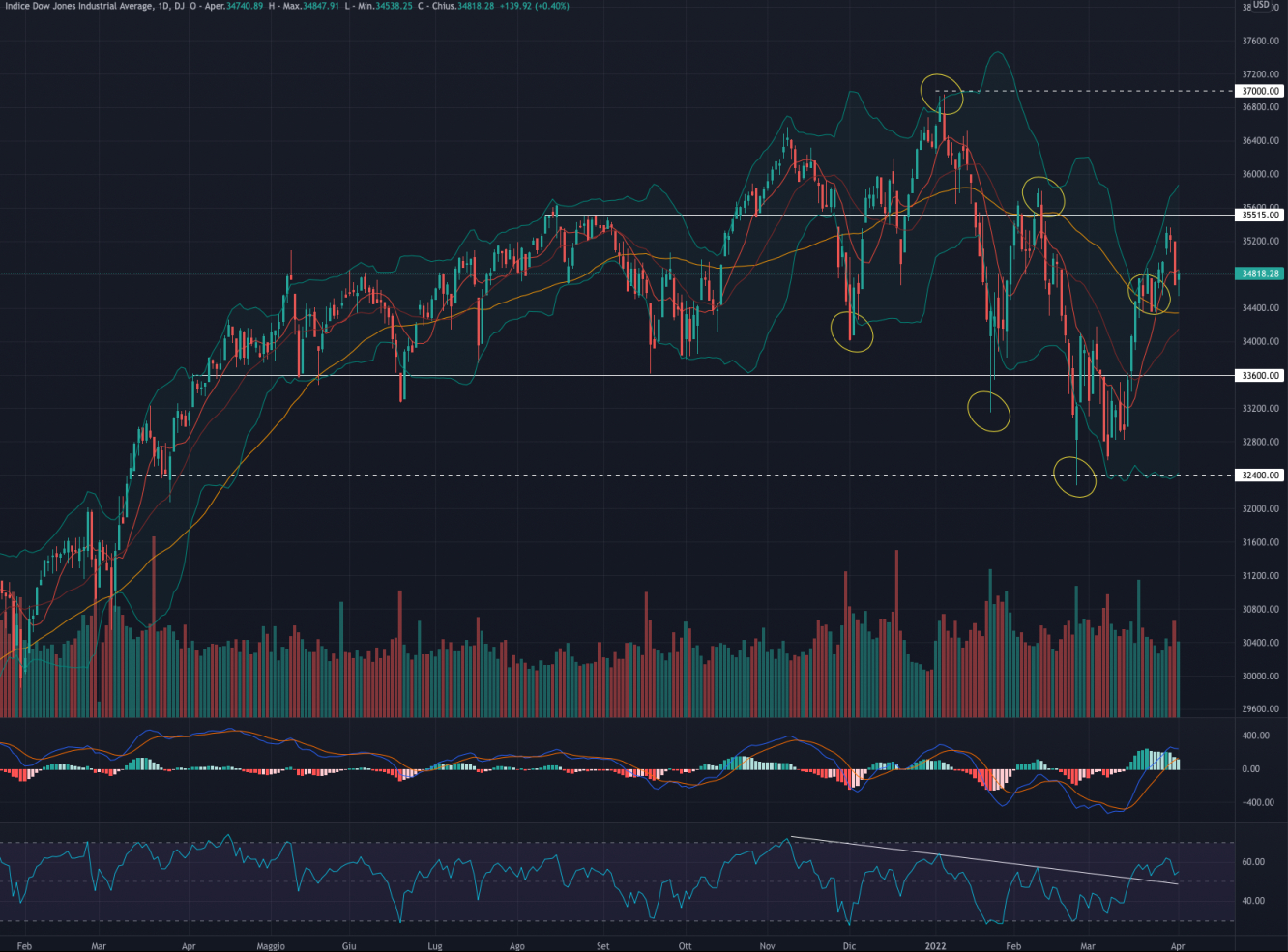

Dow Jones

The Dow Jones had a week up + 0.27%. For the week ahead, we expect continued consolidation between 34,500 and 34,000.

Indicators

The index continues to move on the upper part of the broad bearish channel (yellow points on the chart) and within the wide side band 33.600 - 35.515 (support and resistance) in place since April 2021.

MACD and RSI continue to support the rise in the index, but their weakening in the last few days makes us remain cautious. The MACD seems to want to cross to the downside and the RSI is now fluctuating again on the 50 line.

A slight retracement on the 34,000 - 33,600 area could be ideal for further long positions. This would in fact avoid situations of overbought and divergence with the price.

Support at 33,600

Resistance 35.515