Asian markets fell on Thursday, as fear over Europe’s debt crisis intensified. In Japan, the Nikkei fell 1.7% to 8377. Scandal-hit Olympus shares tumbled more than 20% after restating earnings, as the company revealed a $1.1 billion loss. Korea’s Kospi dropped 2.1%, and the ASX 200 fell 1.2%. PMI data for China showed a slowdown in factory activity, sending the Shanghai Composite down 2.1% to 2181, and the Hang Seng down 1.8%.

European markets bounced moderately, lifted by upbeat US data. The DAX climbed 1%, the CAC40 gained .8%, and the FTSE rose .6%. The European insurance index rallied 2.3% on news that Old Mutual was selling part of its business for $3.2 billion. Fitch cut the debt rating on Credit Agricole, sending the bank’s shares down 4.4%.

US stocks opened sharply higher, but surrendered most of their gains as the day dragged on. The Dow rose 45 points to 11869, the S&P 500 edged up .3%, and the Nasdaq ended up fractionally.

Dow Gains but Closes well off Lows

Fedex shares surged 8% after reporting earnings which were stronger than expected.

Currencies

The Swiss Franc surged 1.3% to 1.0634, while the Dollar eased modestly against other currencies. The Euro rose .2% to 1.3014, the Pound gained .3% to 1.5510, and the Canadian Dollar advanced .4% to 1.0354.

Economic Outlook

Weekly jobless claims fell to 366K, far better than the 389K forecast, its lowest level in years. The Empire State Manufacturing Index jumped to 9.5, showing a sharp rise in factory activity.

Global Equities Trade Mixed, Metals Advance

Equities

Asian markets rose moderately thanks to Thursday’s upbeat US data. The Nikkei rose .3% to 8402, the Kospi jumped 1.2%, and the ASX 200 rose by .5%. China’s markets surged on hopes for central bank easing in the mainland. The Shanghai Composite rallied 2% to 2225, and the Hang Seng advanced 1.4%.

European markets closed lower, as concerns over possible debt downgrades intensified. The CAC40 slumped .9%, the DAC dropped .5%, and the FTSE lost .3%. Bucking the downtrend, miners rallied, lifted by a bounce in metal prices. Nokia shares declined more than 3% after Research in Motion’s weak earnings weighed on the mobile sector.

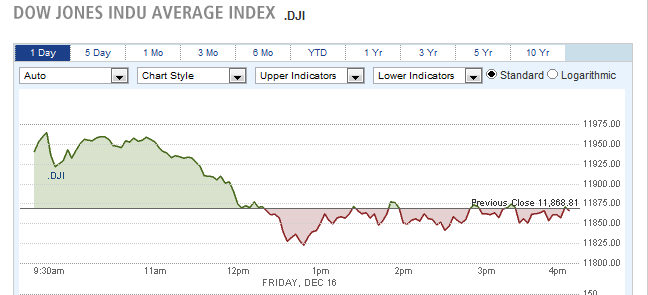

In the US, the major indexes closed mixed. The Nasdaq gained .6%, the S&P 500 rose .3%, while the Dow slipped fractionally. The Dow had opened sharply higher, but those gains evaporated by the afternoon.

Dow Ends Flat, Surrendering Early Gains

Adobe shares climbed 6.6% after reporting solid earnings, while Research in Motion tumbled 11.2% after weak profits and a dismal outlook.

Currencies

The Dollar traded mostly lower on Friday, easing slightly after a strong week. The Euro and Pound both rose .2% to 1.3042 and 1.5546 respectively. The Australian Dollar and Swiss Franc rallied .4%. The Yen edged up .2% to 77.74, while the Canadian Dollar lagged behind, dropping .4% to 1.0384.

China’s yuan reached a record high of 6.3294, which was attributed to intervention by the central bank, in an effort to challenge short sellers.

Economic Outlook

Friday’s CPI data was mixed, as core CPI, which excludes food and energy, rose more than expected, while the broader CPI, remained flat. A drop off in inflation could potentially pave the way for additional easing from the Fed.

US Stocks Drop on ECB Disappointment

Equities

News that North Korea’s leader, Kim Jong il, had died, weighed on Asian markets amid concern for the region’s stability. South Korean shares tumbled, with the Kospi closing down 3.4%, after dropping as much as 4.9%. The Nikkei lost 1.3% to 8296, the ASX 200 dropped 2.4%, and the Hang Seng shed 1.2%. China’s Shanghai Composite outperformed, easing a mere .3%, as it erased an earlier drop of 2.6%.

European markets traded mixed, following a speech by ECB president, Mario Draghi, in which he offered no new stability plans. The DAX fell .5%, and the FTSE lost .4%, while the CAC40 inched up fractionally.

US stocks opened higher, but closed significantly lower. The Dow fell 100 points to 11766, the Nasdaq dropped 1.3%, and the S&P 500 declined 1.2%.

Currencies

The Dollar traded modestly higher against world currencies, in a light session. The Euro dropped .4% to 1.2996, the Pound declined .3% to 1.5498, and the Yen fell .4% to 78.04. The Australian Dollar sank .8% to .9888.

Economic Outlook

The NAHB housing market index rose from 19 to 21 last month, in line with expectations, posted its 3rd straight gain. Additional housing data is due on Tuesday, when the government will release reports on housing starts and building permits.

Western Markets Soar on Upbeat Data

Equities

Asian markets traded mixed as the region calmed following Monday’s slide. Korean shares partially recovered from Monday’s slide, gaining .9%, and the Nikkei rose .5% to 8336, led by a 155 jump in Olympus shares. The ASX 200 slid .2%, the Shanghai Composite slipped .1%, while the Hang Seng edged up fractionally.

European markets surged, boosted by impressive US housing data, and a jump in German business sentiment. The DAX jumped 3.1%, the CAC40 rallied 2.7%, and the FTSE climbed by 1%. The automobile sector advanced by 5.1%, lifted by the bullish outlook. A Spanish short-term debt auction saw yields drop sharply from a month ago, a positive sign for the debt crisis.

The S&P 500 Surges 3%

Jefferies shares rocketed 23% higher after reporting earnings which far exceeded analyst expectations.

Currencies

The Australian Dollar soared 1.8% to 1.0075 as investors switched to “risk on”. The Pound climbed 1% to 1.5659, the Canadian Dollar gained .8% to 1.0300, and the Euro rose by .6% to 1.3078.

Economic Outlook

Housing starts and building permits both rose by 50K, far better than the 10K gain forecast by analysts, a strong sign that the housing market is on the rebound.