For the last 7 trading days, the EUR/JPY has been confined to a 250 pip range between the big figure at 130.00 and 132.50. Although the uptrend is still holding, 5 of the last 7 days have been bear closes. For now, we have to play the range short term, looking for longs off 130.00 and shorts off 132. I suspect the range will crack this week, so should the floor go first, 129 and 127.21 are up next. Bulls meanwhile have more to chop through resistance wise, as there is 132.50, and the large pin bar rejection at 133.78 to be cleared. Watch intra-day price action charts for the next leg. EUR/JPY" title="EUR/JPY" width="638" height="430">

EUR/JPY" title="EUR/JPY" width="638" height="430">

USD/JPY – Sitting Just Above Key Level

While the EUR/JPY and GBP/JPY have broken below key levels, the USD/JPY has maintained some buoyancy above its key level at 100.00. Daunting for the bulls is the fact the pair has sold off 6 of its last 7 days, along with two closes below the 20ema, so short term control is in bearish hands. But the bulls have one defense coming up at 100.00. If this holds, and forms an obvious price action signal, upside targets would be 101 and 102. If we see a daily close below this, then 98.84 and 97.00 will come under attack. USD/JPY" title="USD/JPY" width="638" height="430">

USD/JPY" title="USD/JPY" width="638" height="430">

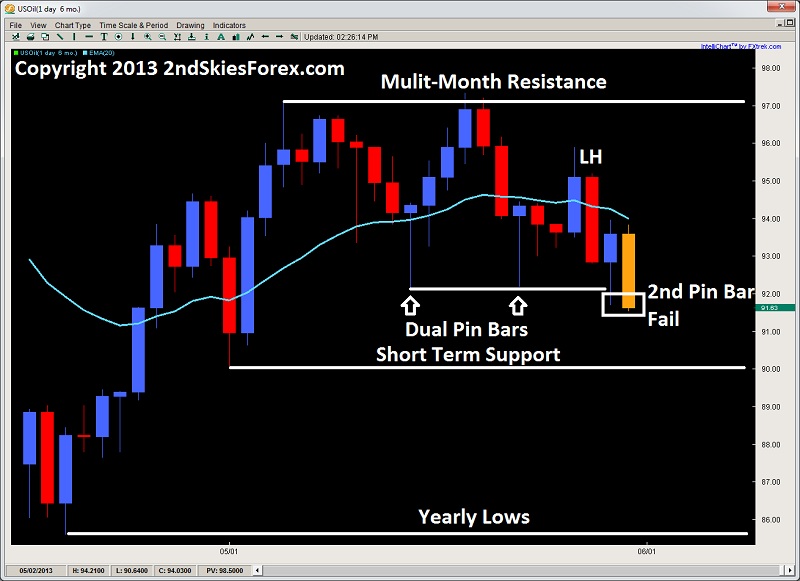

Crude Oil – Pin Bar At Support Fails, More Downside?

In last weeks market commentary, I opined the pin bar at the 92.00 support would likely fail. And it did just that last week, having its first daily close below 92 since the first days of May. The formation of the LH (lower high) and LL (lower low) suggests a likely further breakdown. Up next is 90.00, but should this fail, 89.00 and the yearly lows at 86.00 are up next. Bulls will have to regain 95.00 to re-inspire more bulls into the frey.

Gold – Prints Bearish Engulfing Bar

After climbing over $80 across the last 9 days, the Gold bears sold the precious metal heavily, knocking it down $35 in the last 16hrs of trading, forming a bearish engulfing bar in the process. If you notice, the last two corrective uplegs have had weaker angles, suggesting the push backs from the gold bulls are getting weaker. Bears can look for intra-day pullbacks into $1415, targeting $1387 and $1363. Bulls will need to wait for deeper pullback towards $1340 before considering longs, as the bearish pressure still remains.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Forex Price Action Chart Outlook: June 2-7, 2013

Published 06/02/2013, 05:44 AM

Updated 05/14/2017, 06:45 AM

Weekly Forex Price Action Chart Outlook: June 2-7, 2013

EUR/JPY – 7 day Range Still Holding…For Now

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.