At this time last year we had commented on the continued loosening of correlations in the markets from the historic extremes witnessed in the fall of 2011. Our general impression was that underlying market conditions across asset classes buttressed the case that risk appetites would continue to be hearty and it didn't make much sense from a strategic point of view to be overtly bearish in the market. From an inter-market perspective today, we are starting to see some major correlation relationships begin to re-establish themselves - as markets dislocate from offsides expectations and positioning.

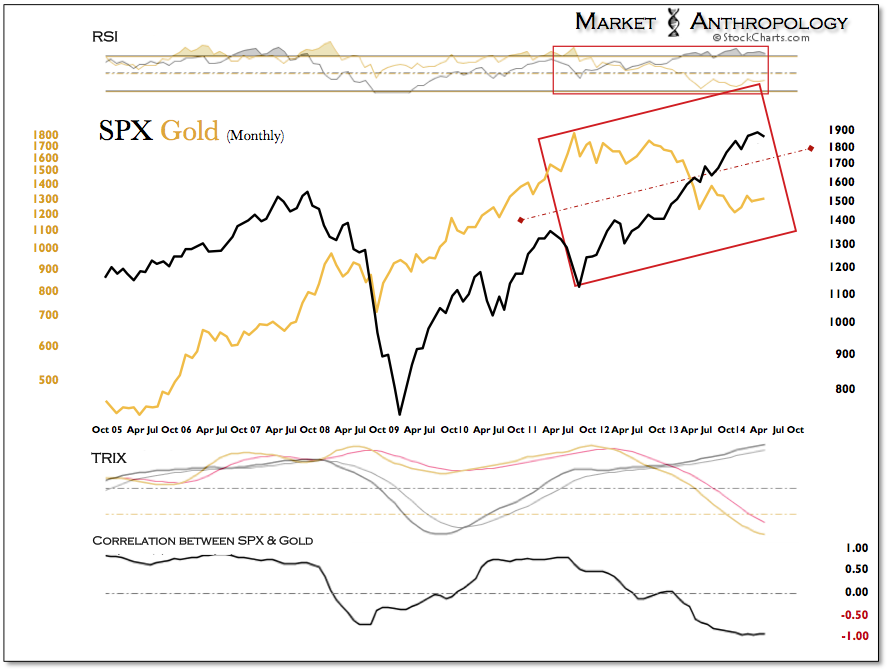

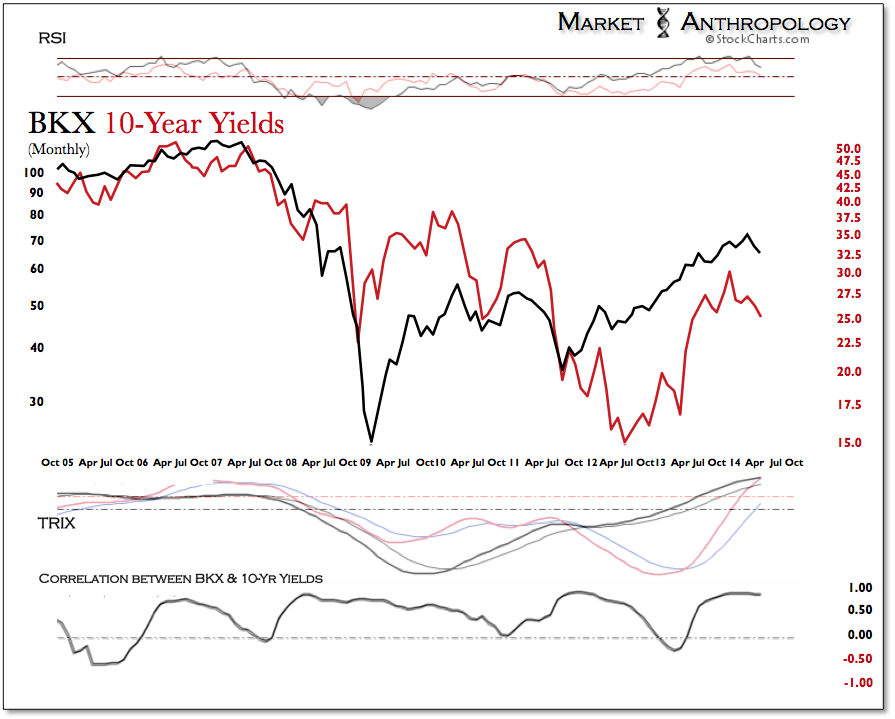

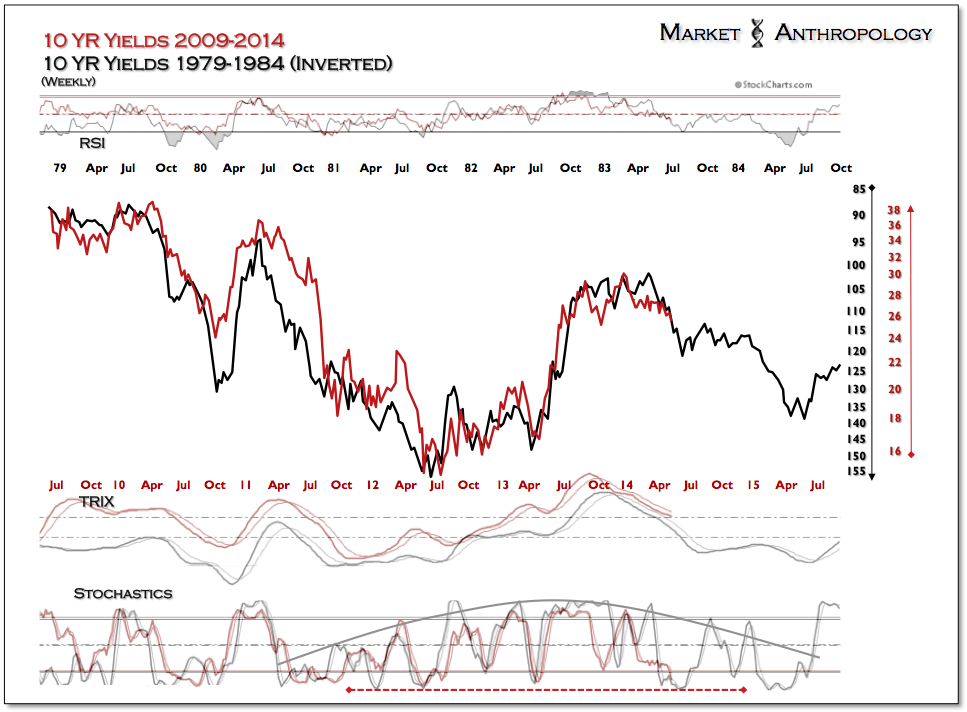

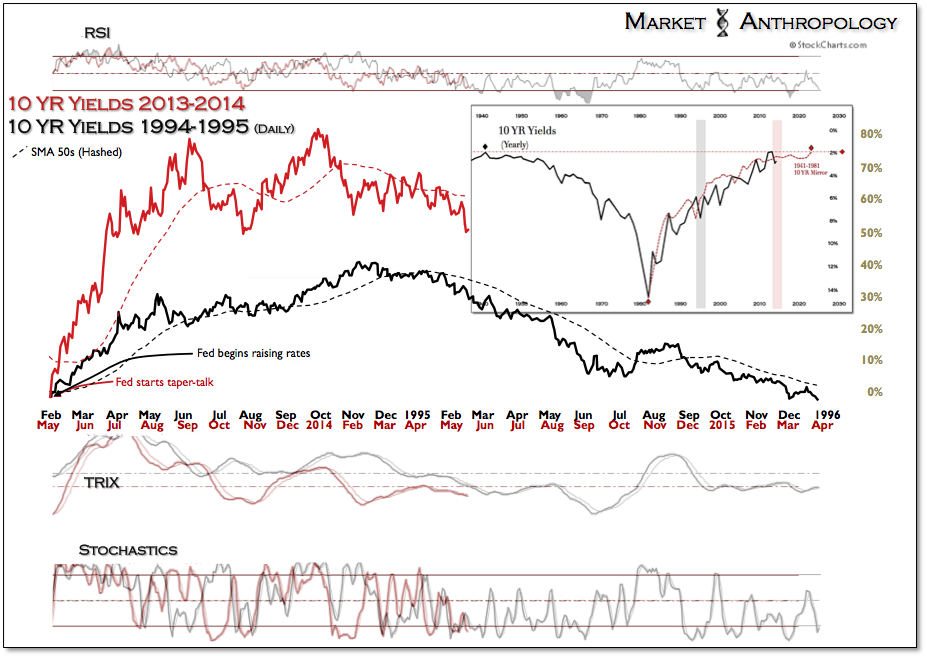

Throughout this year, one of our major focuses has been on 10-year yields, as we expected the market to move harshly against the consensus opinion - likely, introducing greater kinetic conditions across asset classes. Broadly speaking, we felt that the financial sector - which leaned on the steepness of the yield curve, was at risk in a declining yield environment - and if the broader market lost such leadership it became vulnerable for the first time since 2011. Conversely, the commodity markets which had remained under pressure in a rising rate environment would begin to outperform - bolstered by atypical market conditions exemplified with rising inflation expectations, declining yields and a Fed that would continue to be more bark than bite when it came to actually raising rates.

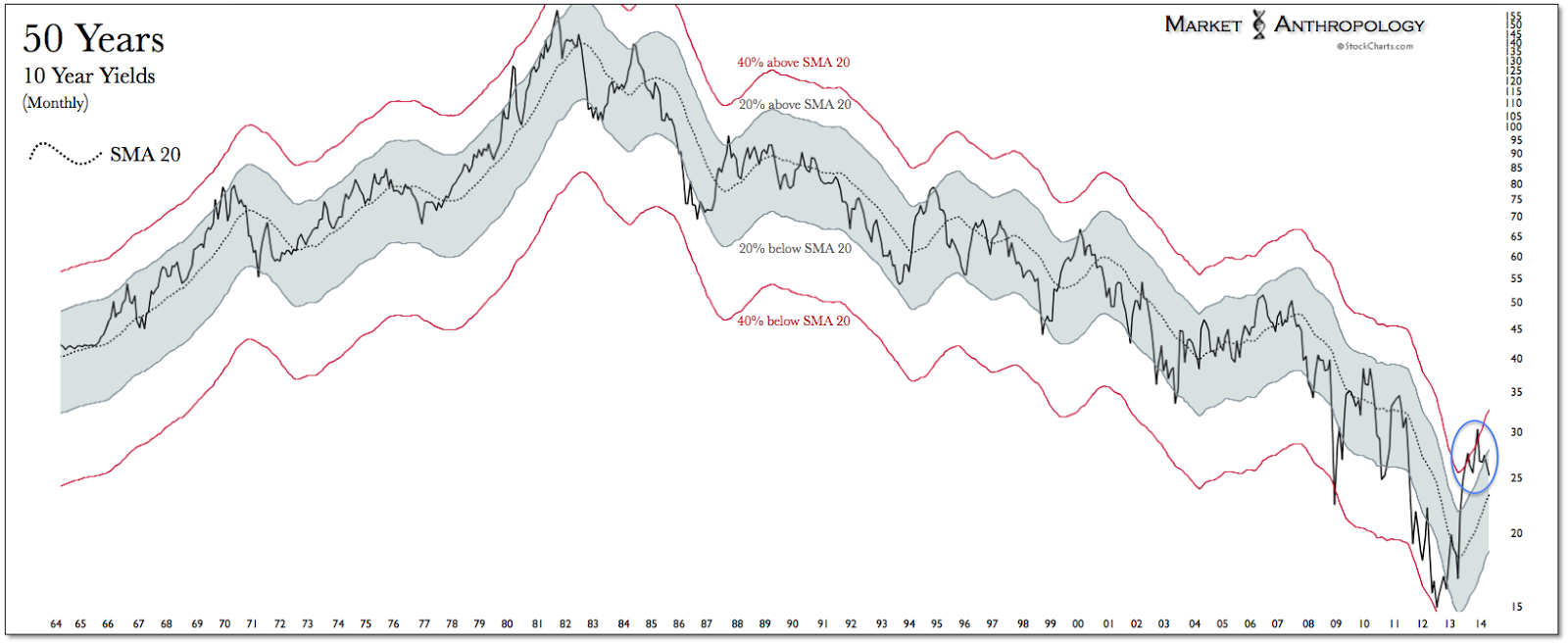

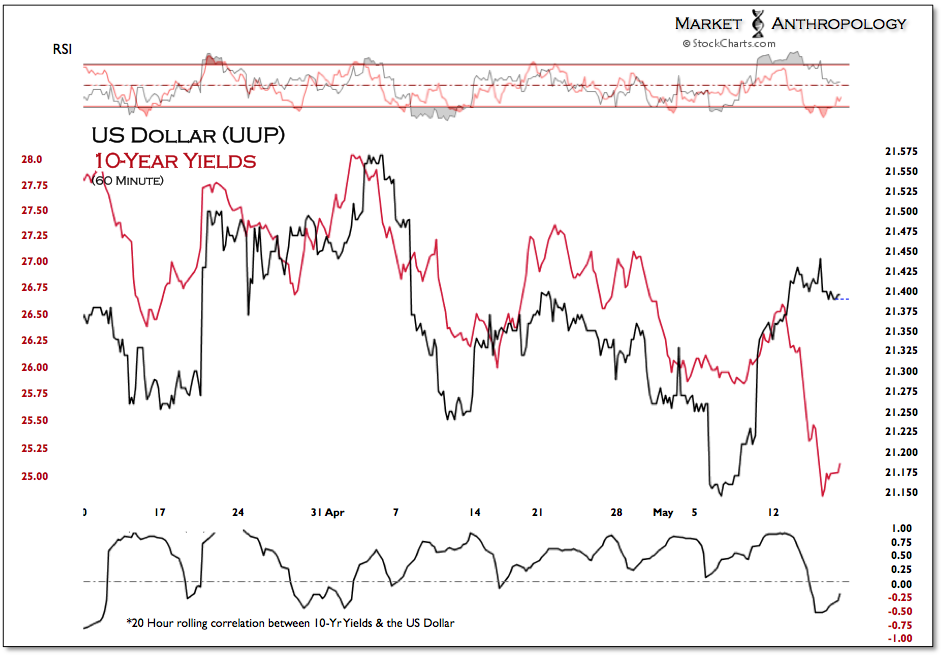

This past week, U.S. 10-Year yields continued to move lower against the consensus, although we did notice anecdotally that many participants were quick to comment and weigh its context that the move was already over-extended. While from a short-term perspective this may well be true, with respect to what we see across our own research - it has considerable room to run and its effects are just beginning to influence other markets. Moreover, the very real risk of creating a negative feedback loop in yields is present.

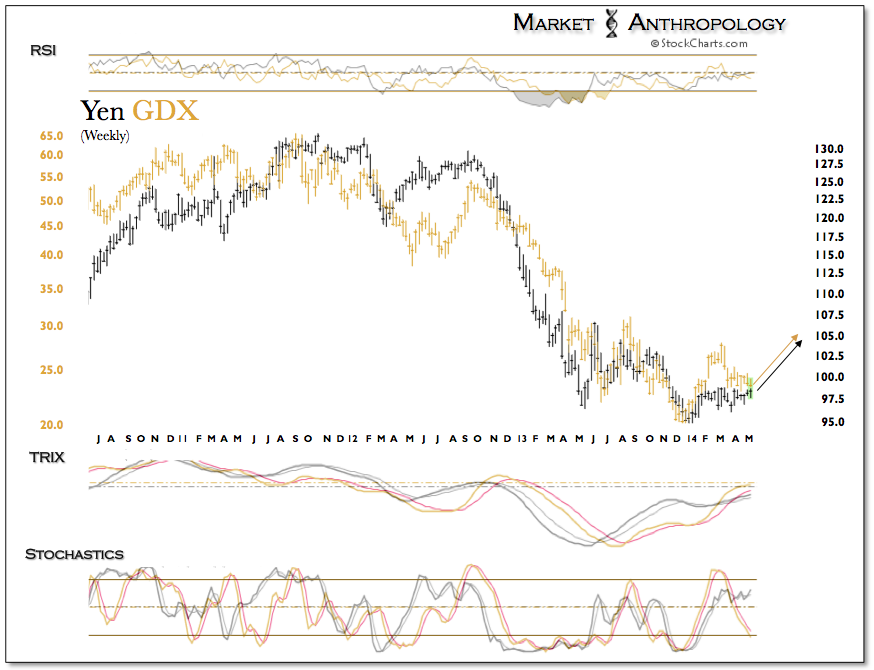

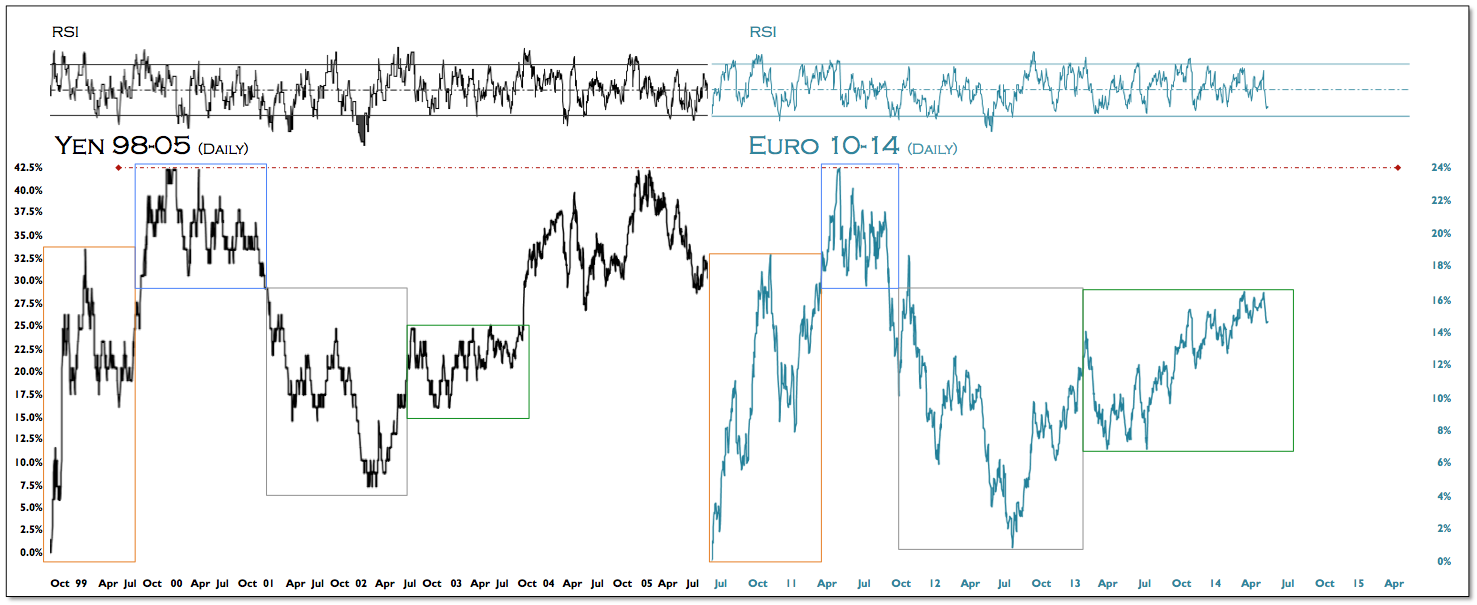

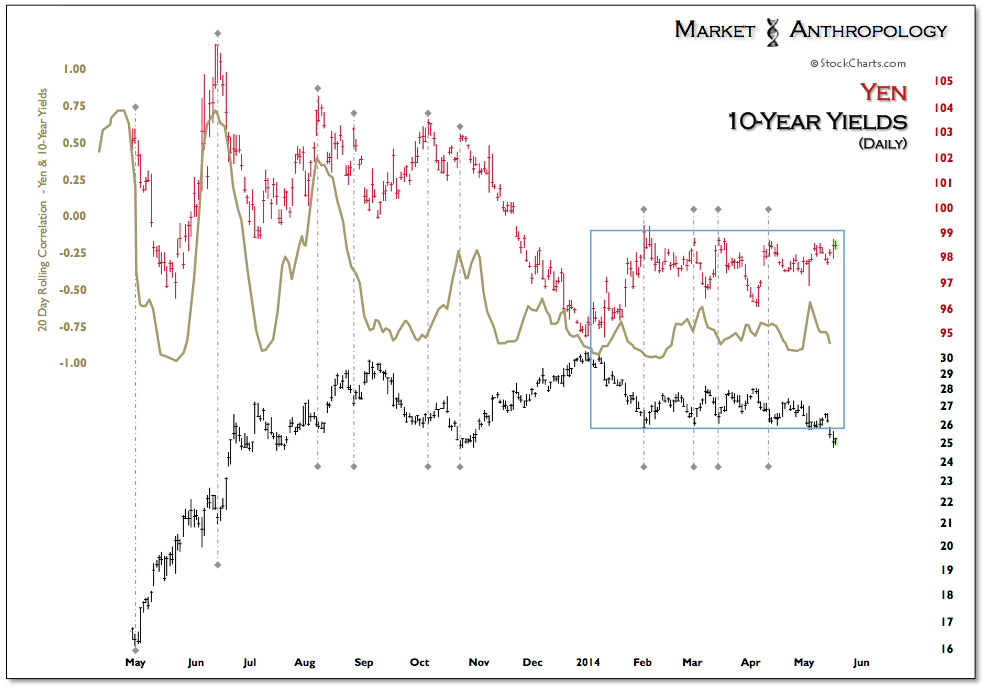

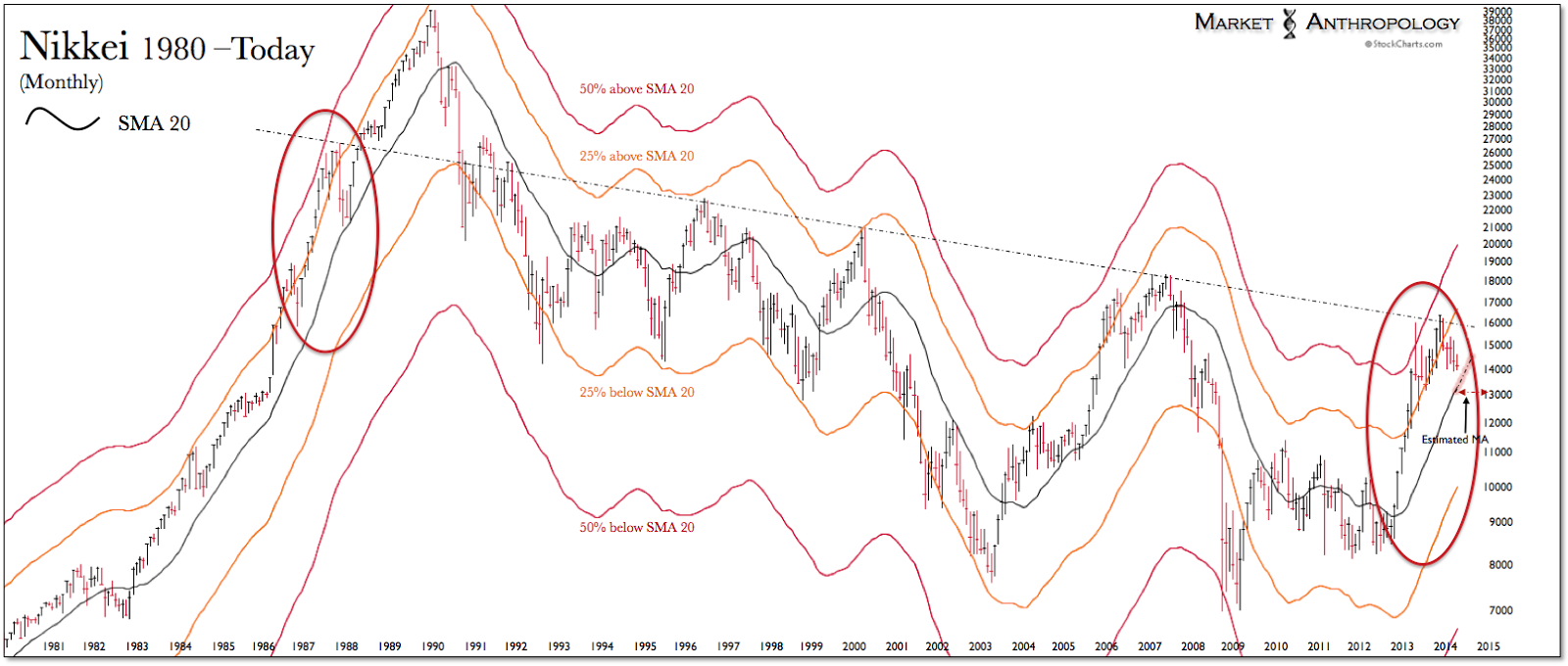

While yields have started to accelerate their breakdown, the Japanese yen has remained in a flagging and narrowed range. Our expectations remain that it's only a matter of time before the yen converts its potential energy and broadly influences downstream markets. The Nikkei once again made a return trip to ~ 14,000 - even after a strong GDP report was digested by the market. Going into next week, the Nikkei looks increasingly vulnerable of loosing 14,000 as the yen appears on the brink of a breakout.

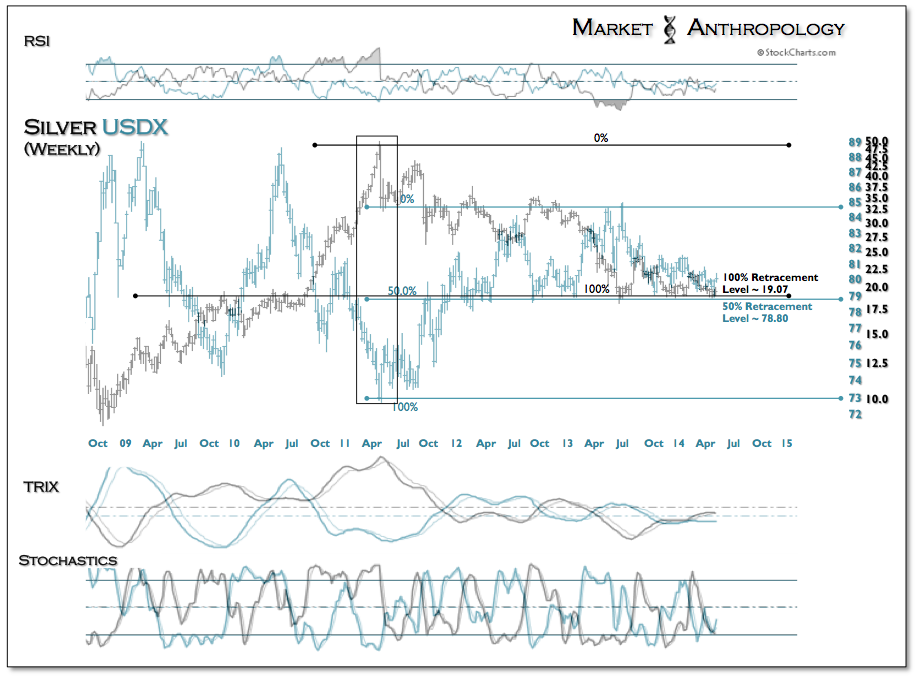

Led by Silver, precious metals firmed this week - albeit coming in considerably in the back half. We remain bullish and expect more material weakness in the equity markets to support an upside breakout for the sector. The confluence of trends noted in the yen, the US Dollar and yields also strongly supports positions in precious metals.

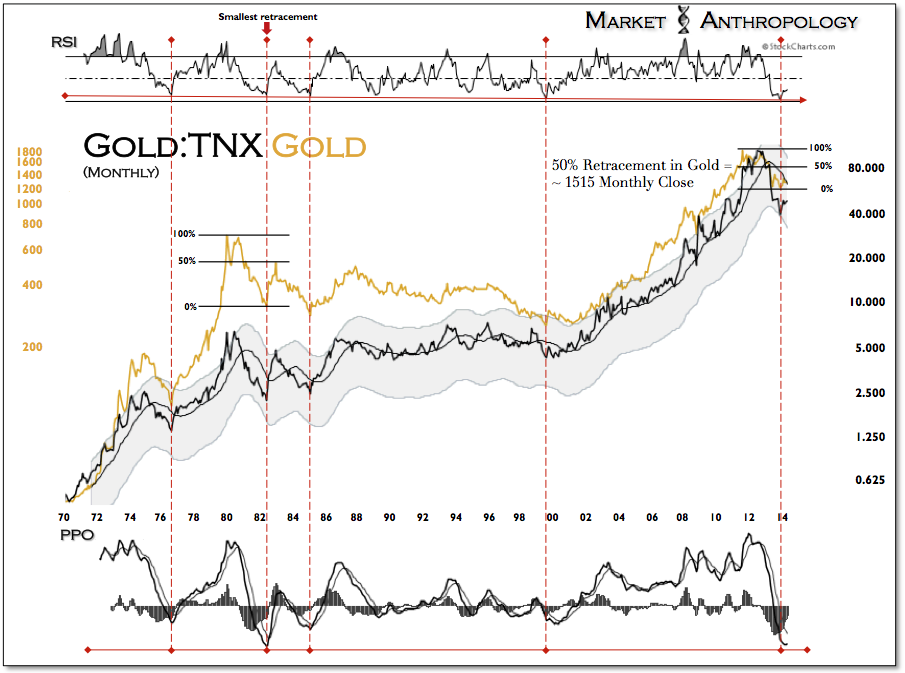

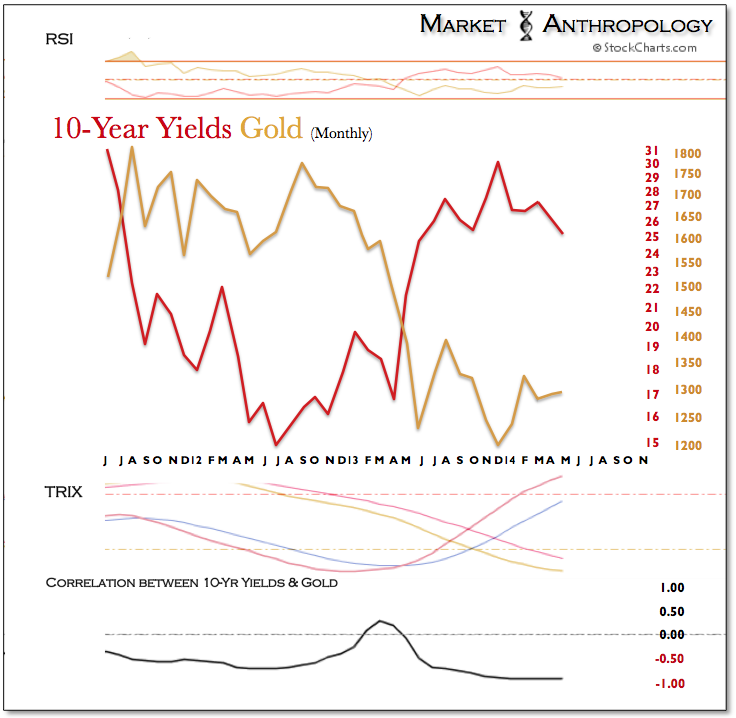

From a historical perspective over the last forty years, the relationship between long-term yields and Gold reached a relative extreme last December. Momentum continues to favor the upside, which from a comparative perspective would suggest a minimum target of ~ 1515.

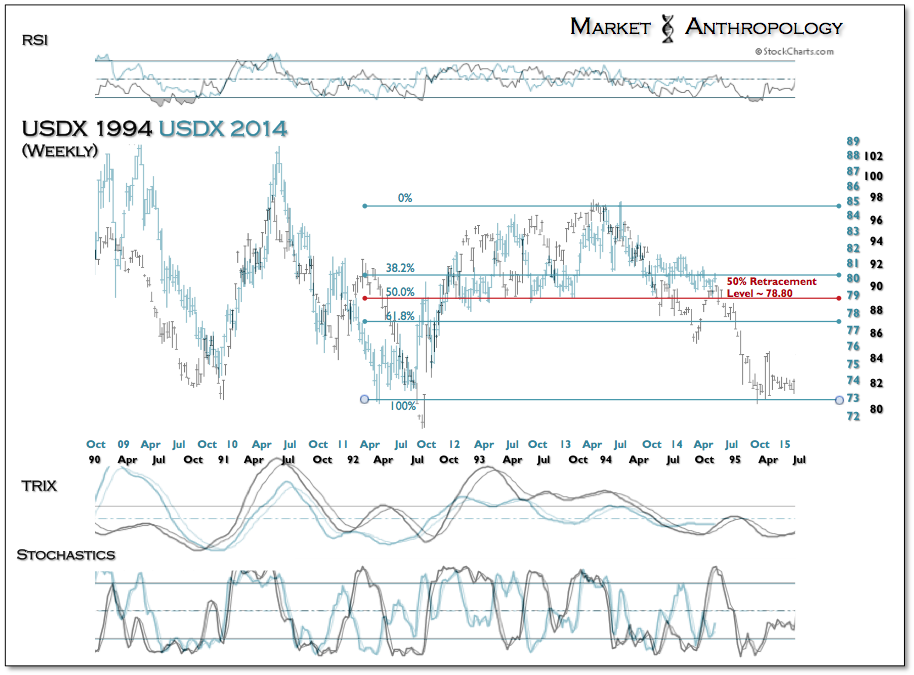

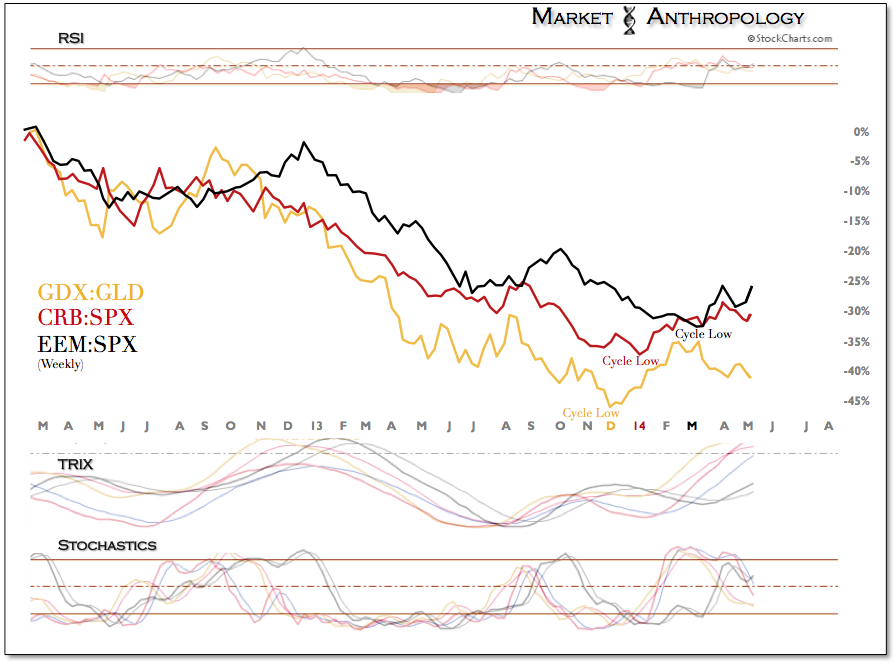

We continue to like the strong relative performance from what we expect was a cyclical low in Q1 in emerging market equities (iShares MSCI Emerging Markets (ARCA:EEM)) and China (iShares FTSE/Xinhua China 25 Index (ARCA:FXI)) relative to the S&P 500 and expect these trends to strengthen as the US dollar once again pivots lower.