Actionable ideas for the busy trader delivered daily right up front

- Wednesday higher, low confidence..

- ES pivot 1575.83. Holding above is bullish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias lower.

- ES Fantasy Trader standing aside.

Last night I was thinking it was looking like we were near a reversal point but the recent down moves have been so vicious I couldn't bring myself to call it for Tuesday. Too bad too, because the Dow put in a handy 101 point gain apparently courtesy of some BTE housing numbers. It wasn't really the doji I was half-expecting and in a way this move makes figuring out Wednesday harder. But we're up to the challenge, so let's rock & roll.

The technicals (daily)

The Dow: The Dow retraced most of Monday's losses with a bullish inside harami on Tuesday while remaining oversold. This move was also enough to exit the descending RTC for a bullish setup, and the bullish stochastic crossover is now complete. And support in the 14,670 area held up nicely, so this chart is looking promising for Wednesday.

The VIX: Last night I wrote "I'm ready to give better than even odds that the VIX moves lower on Tuesday." Turns out no one was willing to take me up on that and it was just as well, since the VIX dropped 8.16% on a big gap-down red doji - the third doji in as many days. With a bearish stochastic crossover now complete, RSI just coming off overbought, and a classic bearish evening star now complete on the VVIX, I'd say the VIX is headed lower again on Wednesday.

Market index futures: Tonight all three futures are lower at 1:06 AM EDT with ES down by 0.33%. On Tuesday, ES put in a bullish harami like the Dow, and that was just good enough for a bullish RTC exit setup. We remain oversold though the bullish stochastic crossover kind of fell apart. ES seems to be having a bit of trouble finding any traction in the overnight but the technicals seem to be favoring a move higher on Wednesday at this point.

ES daily pivot: Tonight the pivot advances from 1568.58 to 1575.83. After declining in the evening trade, ES just nicked the corner of the new pivot and remained above, just barely. But as I write, it tested the new pivot. So far it looks like it's going to be successful, but sitting less than one tick above the pivot now, it's far from certain. So no guidance from this metric tonight.

Dollar index: I was looking for the dollar to move lower on Tuesday and it did - sort of. The candle opened and closed below Monday's midline but the result was a net gain of 0.21%. However, it traded entirely outside the rising RTC so that's a bearish trigger. And RSI got even more overbought (90.9) and the stochastic is within a hair now of a bearish crossover. So I'm going to stick to my call for a lower dollar on Wednesday..

Euro: My expectation for a higher euro on Tuesday was also wrong as it gave up all of Monday's gains plus a bit more, though it retested the 200 day MA and once again, it held. A third test is underway as I write with the euro exactly on the 200 MA at 1.3074. With indicators now even more oversold than Monday, I'm expect4ing the 200 MA to hold up which would mean a higher euro on Wednesday and that would square with my call for a lower dollar.

Transportation: As the trans had been leading the Dow lately, so it did once again on Tuesday but this time to the upside as it gained 1.85% to the Dow's 0.69%. The candle was also a bullish one white soldier. It also easily exited the descending RTC for a bullish setup, peeled off the lower BB after three days, and the stochastic executed a bullish crossover. So everything is looking positive for Wednesday on this chart.

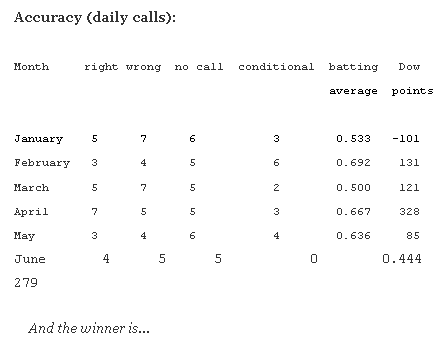

Sentiment: Once again it's time for the latest weekly TickerSense Blogger Sentiment Poll. We continue to track the poll to see how well it performs. Note that I've corrected the data in the accuracy columns due to a mistake I made in week 13 but only just noticed now.

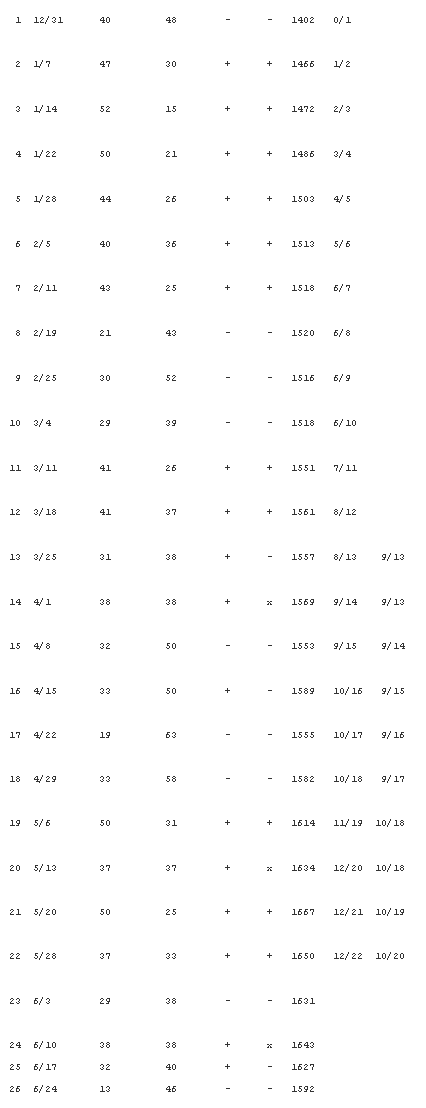

Wk.# Week % Bullish % Bearish NightOwl Poll SPX Accuracy Poll

Again, the SPX number is the closing price of the S&P on the Friday before each new poll comes out. The "NightOwl" column is how I voted. The "Poll" column is how the majority of participants voted. Since the poll is for 30 days out, after the first four weeks we're able to see how well we did. This week we see that both I and the poll I voted bullish four weeks ago, so we were both wrong. Therefore we continue the year with an accuracy of 12 for 22, or 55%. The poll as a whole drops to 10 for 20 or 50%.

This week we see that bullish sentiment has now dropped to its lowest level not only of the year so far, but all the way back to October 2011, and is now nearly just one third of what it was a week ago. Presumably, last week's action had a lot to do with this. Interestingly though, bearish sentiment only rose 6% and remains below the peak of 58% we hit on April 29th. Still, this sort of sentiment shift is making me lean in the direction that the poll may now be flashing a contrarian signal. For my part, both the weekly and monthly SPX charts were looking pretty gloomy at the close last Friday, and that's mostly what I base my vote on.

The technical signs are by and large bullish tonight with the lone exception of the futures. I'll note again that the last week in June is historically quite weak and this may still reassert itself as it did on Monday. But much as I hate going against history and the overnight futures (because I always feel that someone else out there knows something I don't) I'm going to have to follow the preponderance of evidence as outlined above and call Wednesday higher.

BTW - the $RHSPX chart I put up in this spot last night played out rather nicely on Tuesday, wouldn't you say?

ES Fantasy Trader

Portfolio stats: the account remains at $108,250 after 13 trades (10 for 13 total, 5 for 5 longs, 5 for 8 short) starting from $100,000 on 1/1/13. Tonight we stand aside because of the disconnect between the futures and the technicals.