World stock indices showed on Wednesday that they could not hold the peaks near monthly highs. The published macroeconomic data does not allow investors to return to purchases despite the large-scale stimulus and expectations of upcoming easing of restrictive measures.

Market sentiment has worsened by the data on the amounts the largest US banks are saving to cover possible losses, as well as new reports of possible bankruptcies of large companies. Weak oil producers (FTS, earlier Whiting) and retailers (JC Penney (NYSE:JCP)) are in the process of insolvency. However, they were not performing well even before all these events. This situation acts as a catalyst to these destructive processes. You may treat this process as a natural cleanup of the market field as long as it did not touch relatively healthy companies.

We can see the same on a country level. The International Monetary Fund reported that about 100 countries have applied to it for help with financing or requesting deferral of debt repayment. The wave of defaults at the level of states is dangerous because it will attract both changes in attitudes to other “weak” countries, and revision of the ratings of companies in these countries, increasing pressure on the financial markets.

Currency markets often mirror these hidden processes, and here it is worth noting the alarm signals.

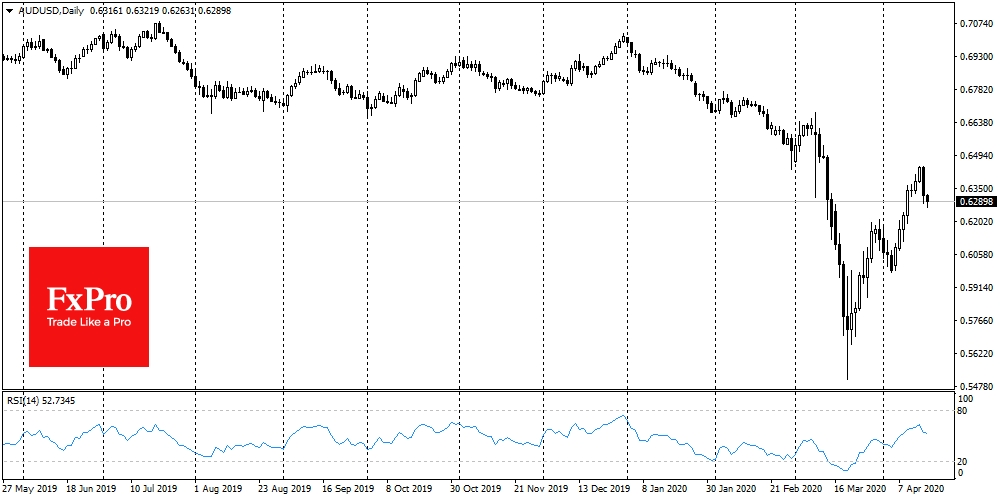

The Australian dollar and the Chinese yuan turned to decline on Wednesday, and this process continues on Thursday morning. The AUD/USD dropped from 0.6700 to 0.5500 in March but recovered to 0.6440 by Wednesday. The Chinese yuan stopped its growth at 7.04 per dollar. In both cases, the currencies attracted bears, when they offset the decline, which was abnormal in the second decade of March.

This may be a signal from Asian investors that they are not ready to believe that the situation has turned to improvement, forecasting that economic activity won’t recover quickly.

The model for the markets can be the situation of 2008/09, when the rebound after a significant decline ended in a new wave of decreasing. In AUDUSD it was a return to the same levels, while the stock market was updating its lows.

In the EUR/USD, the level of 1.1000 was an essential battlefront for the bulls and bears. The recovery in the first half of the month stalled on the way to this psychologically important level. It may be an important watershed in the market sentiment. The increase in sales reflects investors’ caution, and the ability to stay above this level and growth above the 200 SMA (now passing through 1.1050) might act as a turning point. But we have not passed this point yet.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weak Economic Data Worsened Market Sentiment

Published 04/16/2020, 05:17 AM

Updated 03/21/2024, 07:45 AM

Weak Economic Data Worsened Market Sentiment

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.