Humpty Dumpty sat on a wall,

Humpty Dumpty had a great fall.

All the king's horses and all the king's men

Couldn't put Humpty together again.

Brexit is a Bear Stearns moment, not a Lehman moment. That's not to diminish what's happening (markets felt like death in March, 2008), but this isn't the event to make you run for the hills. Why not? Because it doesn't directly crater the global currency system. It's not too big of a shock for the central banks to control.

It's not a Humpty Dumpty event, where all the Fed's horses and all the Fed's men can't glue the eggshell back together. But it is an event that forces investors to wake up and prepare their portfolios for the very real systemic risks ahead.

There are two market risks associated with Brexit, just as there were two market risks associated with Bear Stearns.

In the short term, the risk is a liquidity shock, or what's more commonly called a Flash Crash. That could happen today, or it could happen next week if some hedge fund or shadow banking counterparty got totally wrong-footed on this trade and — like Bear Stearns — is taken out into the street and shot in the head.

In the long term, the risk is an acceleration of a Eurozone break-up, which is indeed a Lehman moment (literally, as banks like Deutsche Bank will become both insolvent and illiquid). There are two paths for this. Either you get a bad election/referendum in France (a 2017 event) or you get a currency float in China (an anytime event).

Brexit just increased the likelihood of these Humpty Dumpty events by a non-trivial degree.

What's next? From a game theory perspective, the EU and ECB need to crush the UK. It's like the Greek debt negotiations ... it was never about Greece, it was always about sending a signal that dissent and departure will not be tolerated to the countries that matter to the survival of the Eurozone (France, Italy, maybe Spain).

Now they (and by "they" I mean the status quo politicians throughout the EU, not just Germany) are going to send that same signal to the same countries by hurting the UK any way they can, creating a narrative that it's economic death to leave the EU, much less the Eurozone. It's not spite. It's purely rational. It's the smart move.

What's next? Every central bank in the world will step up their direct market interventions, particularly in the FX market, where it's easiest for Plunge Protection Teams to get involved. Every central bank in the world will step up their jawboning and "communication policy" to support financial asset prices and squelch volatility.

It wouldn't surprise me a bit if the Fed started talking about a neutral stance, moving away from their avowed tightening bias. As I write this, Fed funds futures are now pricing in a 17% chance of a rate CUT in September. Yow!

What's the result? I think it works for a while, just like it worked in the aftermath of Bear Stearns. By May 2008, credit and equity markets had retraced almost the entire Bear-driven decline. I remember vividly how the narrative of the day was "systemic risk is off the table." Yeah, well ... we saw how that turned out.

Now to be fair, history only rhymes, it doesn't repeat. Maybe this Bear Stearns event isn't followed by a Lehman event. But that's what we should be watching for. That's what we should be preparing our portfolios for.

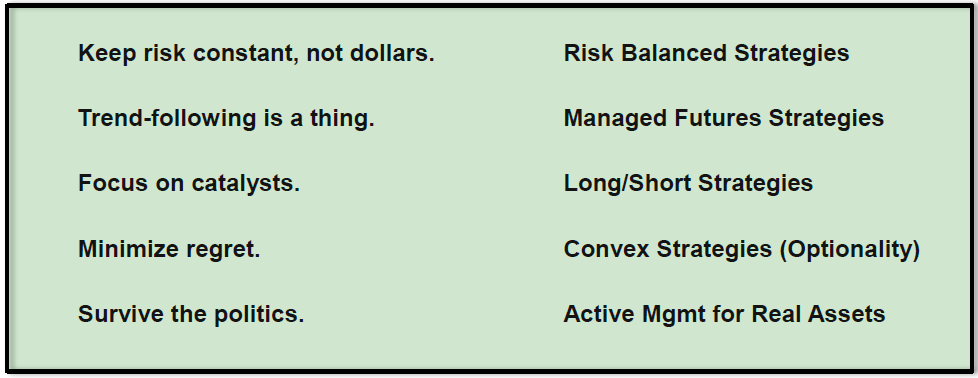

How do we prepare? I've got Five Easy Pieces, five suggestions for surviving these policy-controlled markets, described at length in the Epsilon Theory notes "Cat's Cradle" and "Hobson's Choice".

Here's the skinny:

Bottom line ... if you ever needed a wake-up call that every crystal ball is broken and we are in a political storm of global proportions, today is it. That's at least 3 mixed metaphors, but you get my point.

Brexit isn't a Humpty Dumpty moment itself, and I think The Powers That Be will kinda sorta tape this egg back together. But if there's one thing we know about broken eggs and broken teacups and broken partnerships, it's never the same again, no matter how hard you try to put the pieces back together.

My view is that a Humpty Dumpty moment, in the form of a political/currency shock from China or a core Eurozone country, is a matter of when, not if. Tracking that "when", and thinking about how to invest through it, is what Epsilon Theory is all about.

Disclosures:

This commentary is being provided to you by individual personnel of Salient Partners, L.P. and affiliates (“Salient”) and is provided as general information only and should not be taken as investment advice. The opinions expressed in these materials represent the personal views of the author(s) and do not necessarily represent the opinions of Salient. It is not investment research or a research recommendation, as it does not constitute substantive research or analysis. Any action that you take as a result of information contained in this document is ultimately your responsibility. Salient will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Consult your investment advisor before making any investment decisions. It must be noted, that no one can accurately predict the future of the market with certainty or guarantee future investment performance. Past performance is not a guarantee of future results.

Salient is not responsible for any third-party content that may be accessed through this web site. The distribution or photocopying of Salient information contained on or downloaded from this site is strictly prohibited without the express written consent of Salient.

Statements in this communication are forward-looking statements.

The forward-looking statements and other views expressed herein are as of the date of this publication. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Salient disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Any offering or solicitation will be made only to eligible investors and pursuant to any applicable Private Placement Memorandum and other governing documents, all of which must be read in their entirety.

Salient commentary has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Salient recommends that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.