Dithering by the Fed, coupled with associated weakness in the US dollar have both combined to provide gold bugs with some much needed good news in the last couple of weeks, with Gold rising Lazarus-like from its trough of despondency in the $1110 per ounce region, to positively sparkle at the $1190 per ounce. So much to be joyful about.

For speculative commodity traders, the last two weeks have been a welcome change with buy orders taking precedence over the sell button. For gold investors, the question now is whether the precious metal has finally turned a corner. To answer that, we need to consider the longer-term charts, starting with the monthly and followed by the weekly.

If we start with the monthly chart for gold, the trend is self evident, with the various key levels now clearly defined. The first, and perhaps most significant is the volume point of control (VPOC) level which defines the fulcrum of price agreement for this time frame, and which currently sits in the $1265 per ounce region (as shown by the yellow dotted line, above). This price region also denotes the deepest concentration of transacted volume.

As such, it represents a significant region of price resistance should gold continue to rise further. Above this level, we also have a further sustained area of resistance in the $1330 per ounce region which capped the rally in mid 2014. Whilst the VPOC remains overhead, bearish sentiment continues to be the dominant driver for the metal longer-term, with the trend monitor indicator continuing to confirm the longer term sentiment. Moving to the volume price relationship itself, there is little to suggest major buying at present, with September’s narrow spread candle on average volume merely confirming a lack of selling pressure, rather than a strong level of buying.

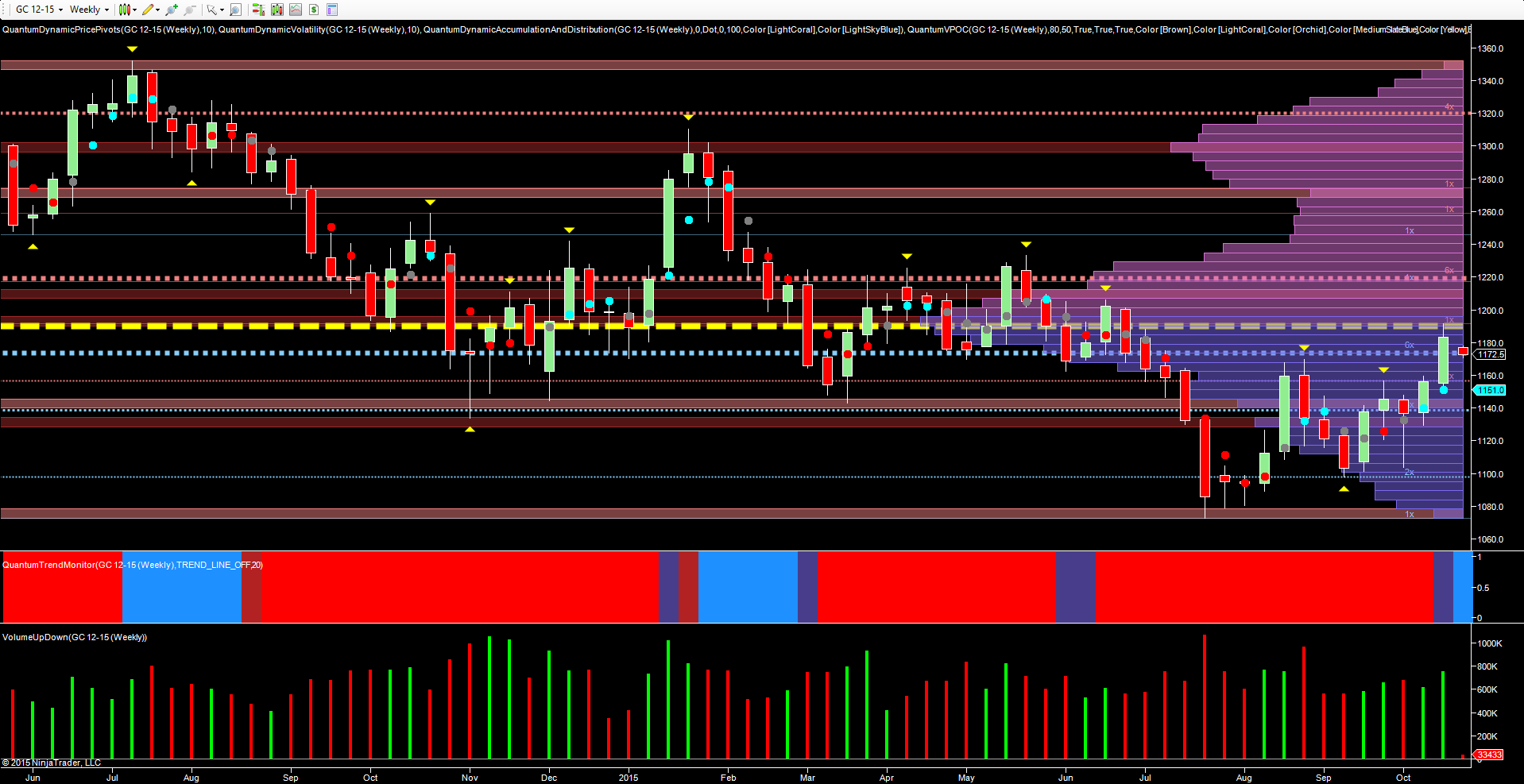

Moving to the weekly chart, above, this is the most demonstrable of the three time-frames of the monthly weekly and daily combination from a volume price perspective. The selling of late June and throughout July finally came to an end, following the wide spread down candle on high volume, with two stopping volume signals as price action narrowed and selling volume declined. The subsequent rally ran into resistance at $1170 per ounce.

However, the subsequent sell-off was associated with weak volume, confirming the lack of selling pressure once again. A further confirmation of this lack of selling pressure occured in the first week of October with the hammer candle sending a strong signal of short term bullish momentum. This has been duly followed through in the last two weeks on rising volume. However, as with the monthly chart, we are now approaching the volume point of control (VPOC) on this time-frame, which is currently balanced in the $1190 per ounce region, a level that was duly tested last week before the precious metal closed marginally lower, at $1183 per ounce. In this time frame too we are showing further resistance overhead in the $1220 per ounce region.

And so to the daily chart, above, where the bullish sentiment of the last two weeks has seen gold prices rise off the support platform of $1110 per ounce (as denoted by the blue dotted line). This price action also saw the precious metal move through the VPOC at $1132 per ounce on rising volume, a good and positive sign. However, Wednesday’s price action also suggested a degree of short term weakness ahead, given the deep wick to the top of the candle, with last Thursday’s price action failing to follow through, and reversing off the same area of resistance. Friday’s price action and volume simply confirmed this lack of momentum. In early trading this morning, gold prices have moved lower once again to test the platform of support now in place in the $1169 per ounce area.

Finally, of course, it’s back to the Fed. And whilst the dithering continues, with doubts surrounding the decision of when (or even whether) to raise interest rates, it has been no surprise to see gold benefit from this indecision and uncertainty. It is against this backdrop that the current price action for gold has to be viewed, coupled with continued weakness in the US dollar. In the context of volume price analysis, we have yet to see any sustained buying across the time-frames. It is the VPOC regions on the charts which are now becoming increasingly significant, and which will ultimately dictate the extent of the current rally, and any continuation longer term.