Euro ended January generally lower as dragged by firstly by SNB's removal of the EUR/CHF floor, then by ECB's massive quantitative easing program. Nonetheless, the common currency was overwhelmed by Canadian dollar's weakness after BoC's surprised rate cut and then a string of weak economic data, including last week's GDP release. New Zealand dollar followed as the second weakest currency after Canadian, after RBNZ turned neutral last week and opened the door for rate cut. Australian dollar came as the fourth major currency after Euro, as markets are still waiting for RBA rate decision this week and there are strong speculation of a cut. Swiss Franc was the strongest currency in January but it pared back much of the gains last week. Yen was the second strongest as selloff in commodity markets continued. Dollar was the third strongest.

After a month of exceptional volatility, markets could yet have another week of big move in the first week of February. Dollar somewhat lost some momentum last week even though the FOMC statement sounded optimistic on the economy. The greenback will face the tests of a number of economic data this week including ISM indices and non-farm payroll. Data from Eurozone might not trigger much reactions in the markets but focus will be on the development in Greece. Sterling will face the tests of PMIs while BoE will likely keep policies unchanged.

Meanwhile, there are key events scheduled in Canada, Australia and New Zealand which could trigger another round of selloff in these currencies. In particular, if RBA does cut interest rate on Tuesday, the Aussie will likely catch up with Loonie and Kiwi and be sold off sharply. Australia will also release trade balance and retail sales. Kiwi will face the test of employment data on Wednesday while Canada will also release employment data on Friday.

We mentioned earlier in January in our weekly report that Euro and Aussie were the favorite to sell against dollar for medium term trades. We were surprised by the moves in elsewhere, like CHF, Canadian and Kiwi and such moves overwhelmed the moves in EUR/USD and AUD/USD. Nonetheless, we were not wrong in the expectation as over the month EUR/USD lost -7.26% and AUD/USD lost -5.12%.

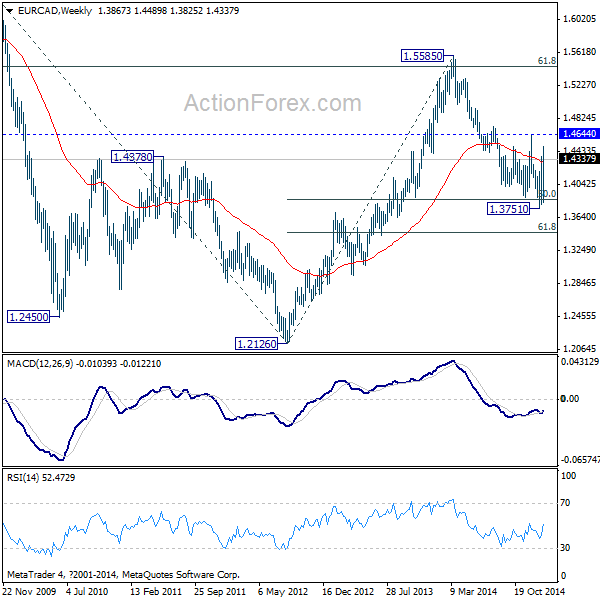

Take a look at EUR/CAD and we saw that it lost much downside momentum after hitting 50% retracement of 1.2126 to 1.5585 at 1.3856. A near term bottom should be in place at 1.3751. But with 1.4644 resistance intact, there is no confirmation of reversal yet. We'd possibly see some sideway trading ahead.

Taking a look at AUD/CAD, the decline from 1.0349 should have completed at 0.9395 and the rebound from there could extend higher. But then, the cross is also bounded in a sideway pattern from 1.0784 and more corrective trading is in favor. Even if further rise could be seen, we might see strong resistance around 1.0349 to limit upside.

Overall, we won't expect weakness in Canadian dollar to overwhelm Euro and Aussie further, unless 1.4644 in EUR/CAD and 1.0349 in AUD/CAD are firmly broken. That is, these three currencies could be relatively neutral to each other, with a bit larger fluctuation in relative strength between Canadian and Aussie. EUR/USD, USD/CAD and AUD/USD will be in our watchlist in near term. As for this week, as USD/CAD looks rather overbought, we'll avoid. We're facing risk of RBA and AUD/USD looks oversold too, and thus we'll also avoid AUD/USD. We'll try to sell EUR/USD on break of 1.1096 or on stronger recovery to 1.1600.