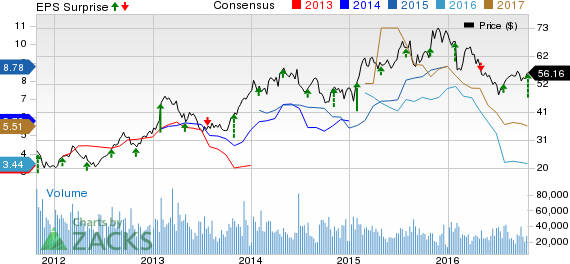

Valero Energy Corporation (NYSE:VLO) reported adjusted third-quarter 2016 earnings of $1.24 per share that surpassed the Zacks Consensus Estimate of 91 cents, primarily owing to lower operating expenses. The upside, however, was partially limited by weak margins from gasoline and distillate. We note that the bottom line decreased substantially from the year-ago adjusted income of $2.79 per share.

Total quarterly revenue of $19,649 million handily beat the Zacks Consensus Estimate of $16,497 million but plunged 13% year over year.

Throughput Volumes

During the quarter, refining throughput volumes were 2.9 million barrels per day (bbls/d), almost same as the prior-year quarter.

By feedstock composition, sweet crude, medium/light sour crude and heavy sour crude accounted for 43%, 18% and 14%, respectively. The remainder came from residuals, other feedstock as well as blendstocks and others.

The Gulf Coast accounted for about 58% of the total volume, while the Mid-Continent, North Atlantic and West Coast regions accounted for 16%, 17% and 9%, respectively.

Throughput Margins

Company-wide throughput margins decreased to $9.07 per barrel from the year-ago level of $14.38. The decline stemmed from weak margins from gasoline and distillate.

Average throughput margin realized was $9.02 per barrel in the U.S. Gulf Coast as against $12.93 in the year-earlier period, was $9.52 per barrel in the U.S. Mid-Continent compared with $16.74 last year, was $7.74 per barrel in the North Atlantic as against $12.78 in the prior-year period and was $11.02 per barrel in the U.S. West Coast compared with $ 21.61 in the previous year.

Total operating cost per barrel was $5.31 during the quarter, down 4.3% from the prior-year figure of $5.55. Refining operating expenses per barrel were $3.63 as against $3.80 in the year-ago quarter. Unit depreciation and amortization expenses decreased year over year to $1.68 per barrel from $1.75.

Operating Expenses

Valero Energy reported operating spending of $1,062 million, down 4% from $1,102 million spent in the year-ago comparable period.

Capital Expenditure & Balance Sheet

Third-quarter capital expenditure totaled $453 million. At the end of the third quarter, the company had cash and temporary cash equivalents of $5.9 billion. Valero also returned $778 million to shareholders through dividends and repurchased 9.2 million shares worth $502 million.

Guidance

The company slightly lowered its 2016 capital spending to $2.4 billion from the prior projection of $2.6 billion.

Zacks Rank

Valero Energy currently carries a Zacks Rank #3 (Hold). Some better-ranked players in the energy sector include Helix Energy Solutions Group, Inc. (NYSE:HLX) , EQT Midstream Partners, LP (NYSE:EQM) and Ultra Petroleum Corp. (OTC:UPLMQ) . Each of these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Helix Energy posted an average positive earnings surprise of 56.42% over the last four quarters.

EQT Midstream is projected to witness year-over-year earnings growth of almost 14% for the current year.

Ultra Petroleum is likely to witness year-over-year earnings growth of 148.4% for the current year.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

VALERO ENERGY (VLO): Free Stock Analysis Report

HELIX EGY SOLUT (HLX): Free Stock Analysis Report

EQT MIDSTRM PTR (EQM): Free Stock Analysis Report

ULTRA PETRO CP (UPLMQ): Free Stock Analysis Report

Original post

Zacks Investment Research