- Japan’s Core CPI eases to 2.3%

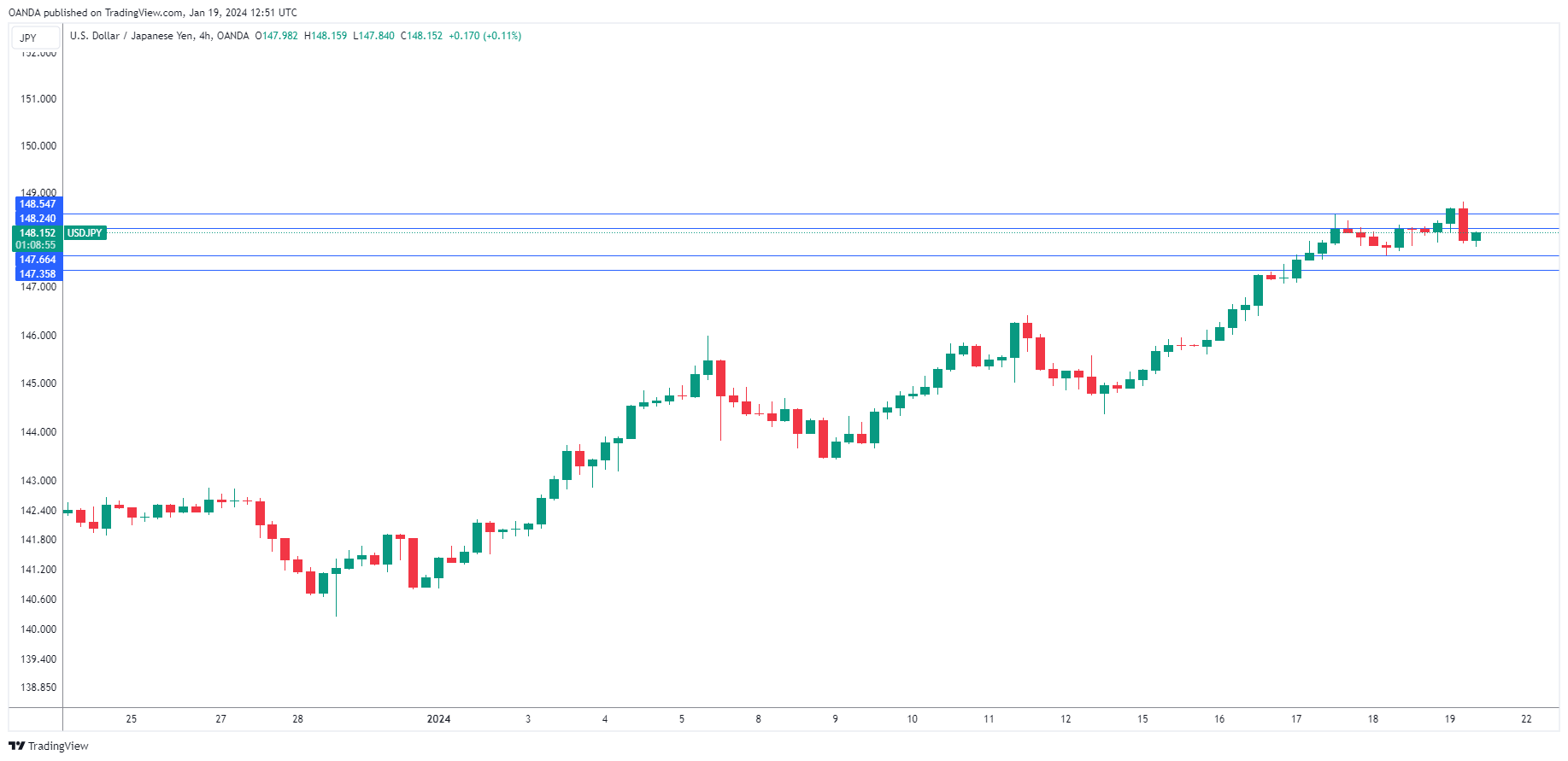

- USD/JPY pushed past resistance at 148.24 and 148.55 before retreating.

- There is support at 147.67 and 147.36

The Japanese yen has recovered after losing ground earlier in the day. USD/JPY rose as high as 148.80, its highest level in three weeks. The yen has rebounded and is trading in Europe at 148.10, down 0.03%. It has been a rough week for the yen which has fallen 2.1% and is moving closer to the key 150 level.

Japan’s Core CPI Falls to 2.3%

Japan’s core inflation slowed for a second consecutive month, easing to 2.3% y/y in December. This matched the market estimate and was down from 2.5% in November. This was the lowest inflation rate since December 2022 and points to weaker inflationary pressure. Core inflation has been above the Bank of Japan’s target for 21 straight months, but the BoJ appears in no rush to tighten policy, arguing that inflation has been driven by cost-push factors and is not sustainable above the 2% level.

Still, the markets expect the BoJ will tighten policy, which would likely send the Japanese yen soaring. Every BoJ meeting has become a must-watch event in case there is a bombshell announcement. The BoJ meets next Tuesday, with the BoJ likely to maintain current policy settings.

Atlanta Fed President Rafael Bostic has been making the rounds and preaching a message of caution with regard to rate policy. Bostic has said that he doesn’t expect a rate hike until the third-quarter and said caution was essential in order to avoid a scenario where the Fed lowered rates, inflation rose and the Fed had to again raise rates. Bostic’s comments were the latest example of the Fed pushing back against expectations of a rate cut in March. The markets have lowered the odds of a March cut to 54%, compared to 77% just a week ago, according to the CME’s FedWatch tool.