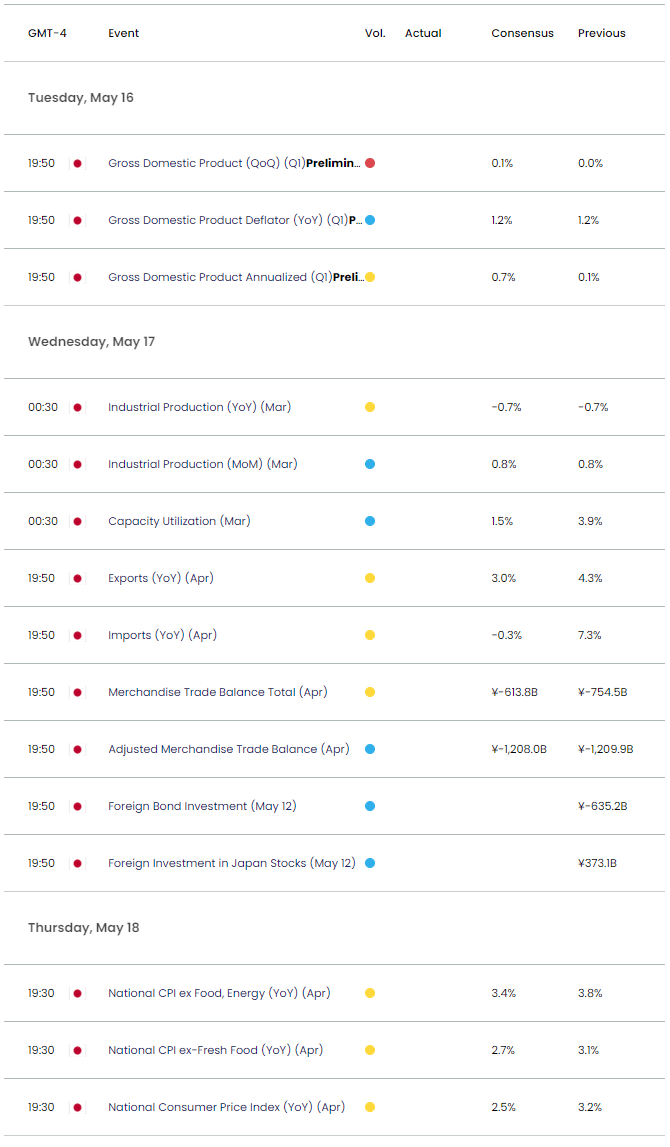

- Traders will get the latest updates on Q1 GDP, Industrial Production, Trade Balance, and National CPI data out of Japan over the next 48 hours.

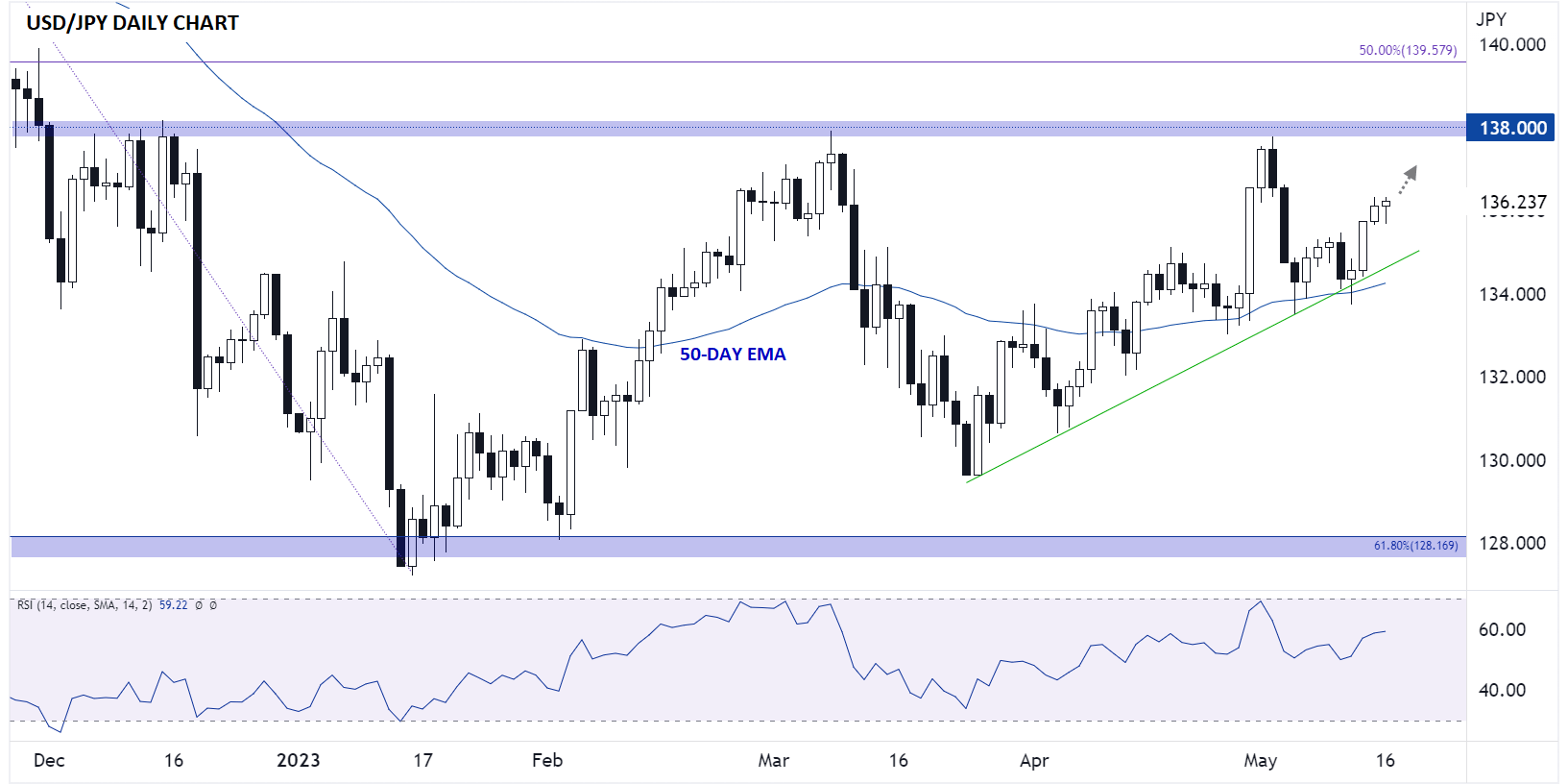

- USD/JPY found support at its rising trend line and 50-day EMA last week, keeping the near-term bullish bias intact.

- The next resistance level to watch will be the year-to-date high near 138.00.

Japanese yen fundamental analysis

Ahead of this weekend’s G7 summit in Hiroshima, it’s a big week for Japanese economic data. Over the next 48 hours, traders will be treated to the latest updates on Q1 GDP, Industrial Production, Trade Balance, and National CPI data.

Outside of traditional economic data, it’s also notable that Prime Minister Kishida has called for the BOJ to examine the sustainability of recent wage increases, a possible precursor to an eventual hawkish shift in monetary and/or fiscal policy, though like everything in Japan, that may take longer than many traders would hope to bear fruit.

Source: StoneX

Japanese yen technical analysis – USD/JPY daily chart

Turning our attention to the daily chart of USD/JPY, rates remain in an uptrend after testing rising trend line support and the 50-day EMA midway through last week. Today’s rally is particularly impressive given this morning’s lackluster US data, with retail sales rising by just 0.4% month-over-month, half of the projected 0.8% gain:

Source: Tradingview, StoneX

Moving forward, USD/JPY has little in the way of nearby resistance, and bulls may therefore look to drive the pair back toward its year-to-date high near 138.00, especially if Japanese economic data comes in worse than expected. At this point, only a bearish reversal back down below the confluence of the rising trend line and 50-day EMA near 134.50 would erase the current bullish bias and open the door for additional losses.