AUD/NZD Daily Chart

- Price Moving Into Daily Resistance

Recently, we discussed the very large pin bar price had formed on the daily chart of this pair.

At the time I spoke about how it would have been a little nicer if the price for AUD/NZD formed up higher, at more of a swing high and with a bit more room to fall into.

The pin bar is still in play, but the price has so far held at the daily support and is now looking to make a test of the overhead resistance.

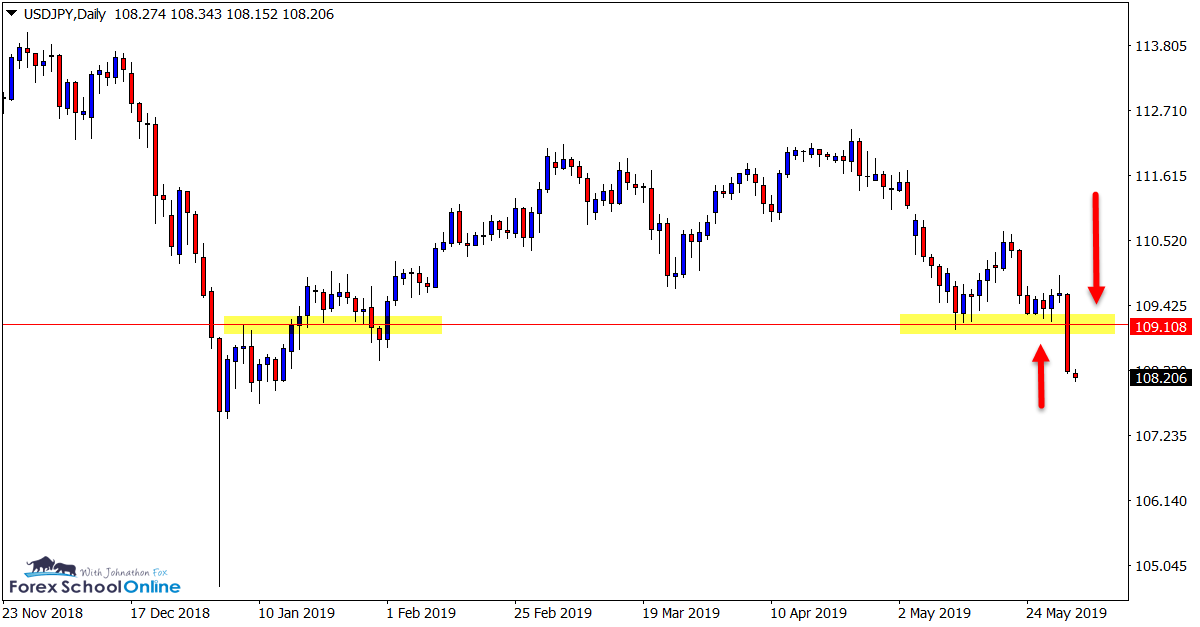

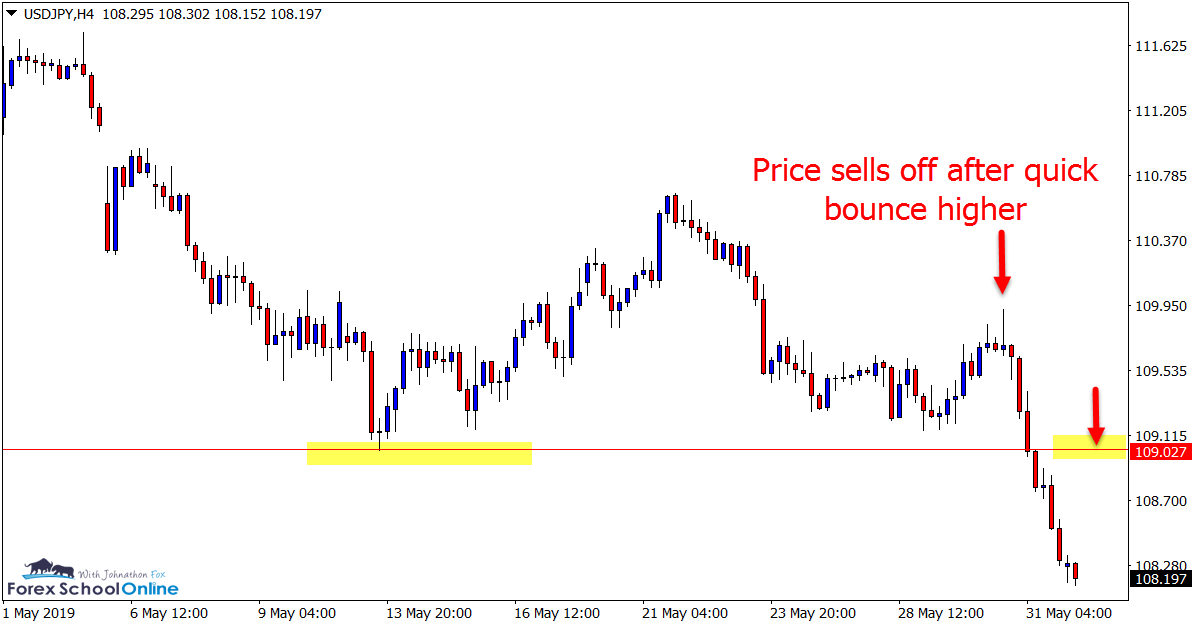

USD/JPY Daily and 4 Hour Charts

- Possible Re-test Old Support / New Resistance

In last week’s trade ideas forUSD/JPY, we were looking to see if the daily support level would hold or break. Whilst price paused, found support and popped higher, as the 4-hour chart clearly shows below; it has since reversed and slammed through the major daily support level.

The momentum is all lower at the moment and if the price could retrace higher it could open the way for potential short trades.

If we can see price rotate back into the old support and potential new resistance, bearish traders could look for short trades should any bearish trigger signals fire off.

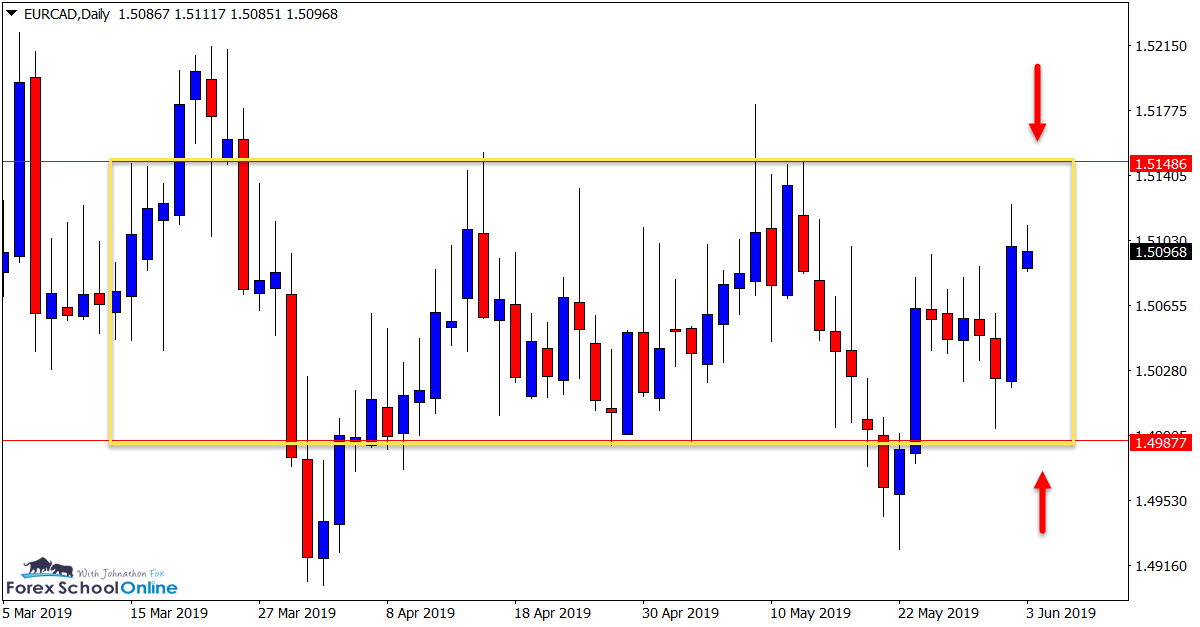

EUR/CAD Daily Chart

- Stuck in Sideways Traffic

The EUR/CAD is stuck in a clear sideways box and traffic jam. These markets are a nightmare to play at the best of times because even if you do pick the correct direction you are likely to be whipped out before price makes you a winner.

If you insist on playing these types of ranging markets, the best plays are from the range highs and lows.

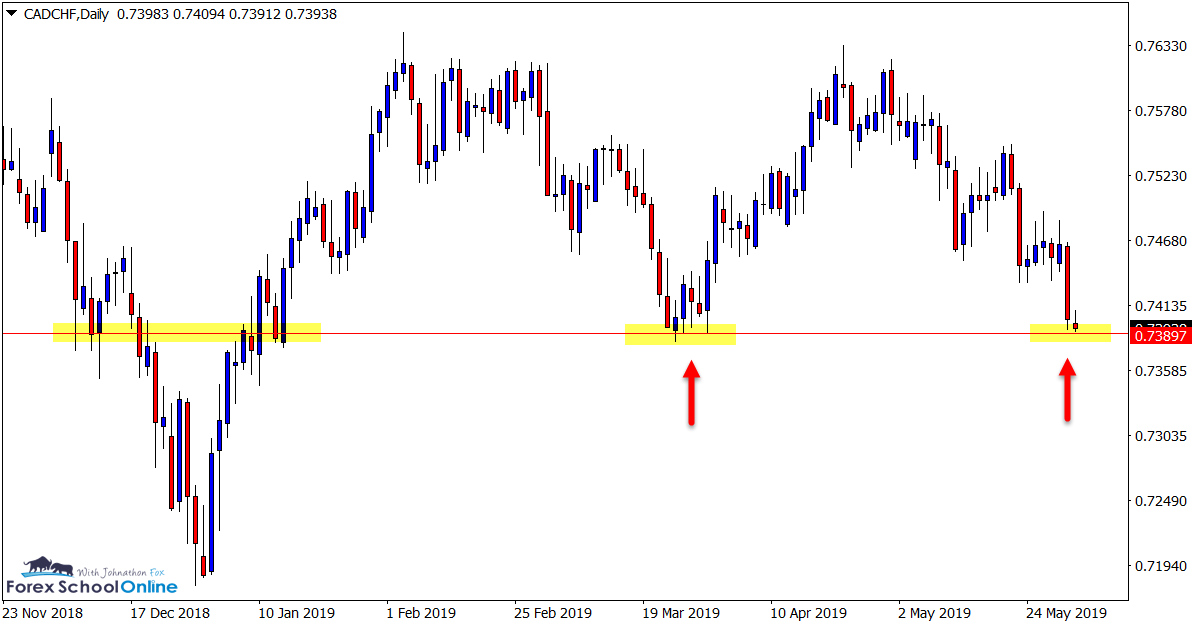

CAD/CHF Daily Chart

- Testing Major Support

Price of CAD/CHF slammed lower in recent sessions to now be testing the crucial daily support level.

Whilst price has moved lower in very recent times, there is still no clear trend or bias on the daily chart lending this market to being played both ways.

If price holds at the support with a clear bullish trigger to get long it could open the way for high probability bullish entries, but we could also watch for the momentum to continue lower and for a quick break and intraday re-test setup.