If you had checked USD/CHF’s exchange rate at Friday’s close and a mere 30 minutes after Monday’s open, you wouldn’t think anything was amiss…at least if you didn’t have any stop losses within 100 pips!

As the charts show (and anyone who experienced it live can viscerally recall), the Swiss franc went for a big ride at the weekly market open. USD/CHF exploded nearly 100 pips higher in just 10 minutes before reversing that entire move over the next 20 minutes, eventually settling back down around the parity (1.00) level. The quick round-trip move remains unexplained, though no doubt it was exacerbated by the low liquidity conditions with Japan out on holiday (a factor we also cited as contributing to USD/JPY’s ongoing rally to 2019 highs).

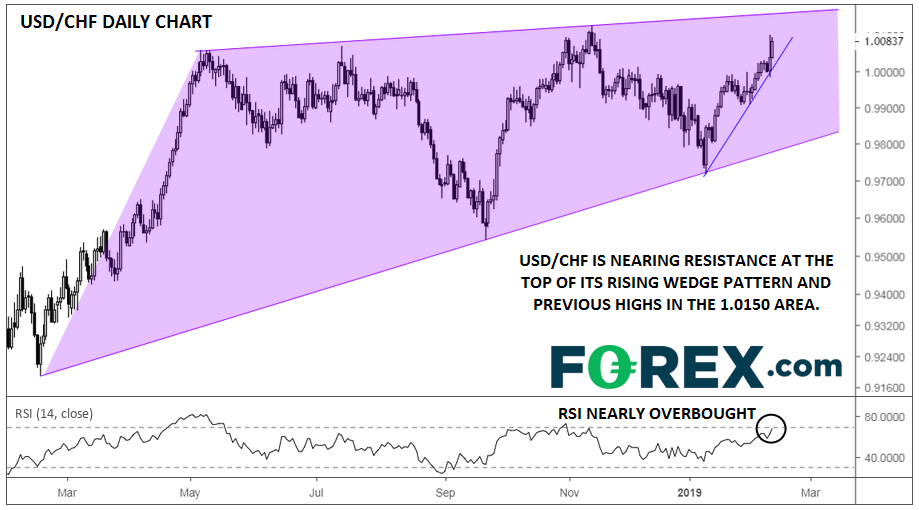

That move may have nonetheless primed traders for franc weakness heading into today’s trade, where the Swissie is the worst-performing major currency. The ongoing rally in USD/CHF has rates once again approaching a critical resistance level around the 1.0100 area, where previous highs and the upper boundary of a potential rising wedge pattern coincide.

With the daily RSI indicator nearly in overbought territory and the exchange rate working on its seventh bullish close in the last eight days, bulls may be aggressive about taking profits into this resistance level. Traders who are looking to establish new long positions may opt to wait for a pullback to the near-term bullish trend line closer to parity.

From a longer-term perspective, a move through that trend line would open the door for a move back toward the bottom of the wedge in the 0.9850-0.9900 zone, while a confirmed break above the 1.0150 area could pave the way for a rally toward the 8.5-year high around 1.0350.

Source: TradingView, FOREX.com

Cheers