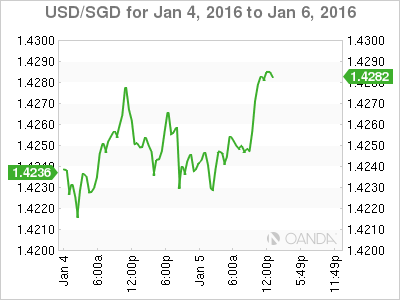

USD/SGD has leveled off on Tuesday, after posting sharp gains to start the trading week. Early in the North American session, the pair is trading at 1.4250. On the release front, it is a quiet day. There are no Singapore events until Thursday, with the release of Foreign Currency Reserves. There is one minor event out of the US today, Total Vehicle Sales.

The Singapore dollar started the New Year on a sour note. The currency sustained sharp losses on Monday, as USD/SGD slipped 90 points. Investors headed for the safety of the US dollar, dumping risky currencies such as the Singapore dollar. The appetite for risk waned following the release of weak Chinese manufacturing data, which has underscored the slowdown affecting the world’s second-largest economy. The sharp drop was largely due to a disappointing reading from Chinese Caixin Manufacturing PMI. The key indicator slipped to 48.2 points in December, short of the forecast of 48.9 points. The index managed to break above the 50-point level only once in 2015, pointing to ongoing contraction in the Chinese manufacturing sector. As well, another crisis in the Middle East is brewing, as Saudi Arabia abruptly cut off relations with Iran following the execution of a Saudi cleric which led to the ransacking of the Saudi embassy in Tehran.

The US economy heads into 2016 in good shape, and received a crucial vote of confidence from the Federal Reserve, which raised interest rates just before the end of the year. At the same time, certain sectors have lagged behind the recovery, such as the manufacturing industry. Recent manufacturing releases have missed expectations, and the negative trend continued on Monday. ISM Manufacturing PMI, a key indicator, slipped to 48.2 points, well short of the forecast of 49.1 points. This weak reading is raising concerns, since it marks back-to back releases below the 50-point level, which separates expansion from contraction. It is also the sixth consecutive month that the PMI has softened. As well, ISM Manufacturing Prices dipped to 33.5 points, well below expectations.

USD/SGD Fundamentals

Tuesday (Jan. 5)

- All Day – US Total Vehicle Sales. Estimate 18.1M

USD/SGD for Tuesday, January 5, 2016

USD/SGD January 5 at 14:15 GMT

- USD/SGD 142.49 H: 142.63 L: 142.25

USD/SGD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.4073 | 1.4139 | 1.4248 | 1.4368 | 1.4459 | 1.4530 |

- USD/SGD has shown marginal movement over the course of the day

- 1.4248 is under strong pressure in support

- There is resistance at 1.4368

- Current range: 1.4248 to 1.4368

Further levels in both directions:

- Below: 1.4248, 1.4139 and 1.4073

- Above: 1.4368, 1.4459 and 1.4530