The yen remains at high levels, but is steady in Tuesday trading. USD/JPY continues to trade in the low-101 range in Monday’s European session. Taking a look at Japanese releases, M2 Money Stock, released on Monday, showed another increase, as we continue to see more domestic money in circulation. The indicator gained 3.8%, beating the estimate of 3.4%. On Tuesday, Preliminary Machine Tool Orders posted another sharp decline, shedding 12.4%. There are three more releases scheduled for late Tuesday. The Bank of Japan will release the minutes of its most recent policy meeting, and Tertiary Industry Activity will be posted. As well, the Corporate Goods Price Index will be released, and the markets are expecting a strong gain of 1.2%. Will the inflation index be able to meet or beat this rosy prediction? In the US, there are just two releases on schedule.

The US dollar is enjoying broad strength against the major currencies, thanks to a solid Non-Farm Payrolls release on Friday. The key indicator hit a four-month high, posting 200 thousand new jobs. This was well above the estimate of 163 thousand. Earlier in the week, Unemployment Claims came in just below the estimate. The unemployment rate was unchanged at 7.6%. There are two factors here which have contributed to the dollar’s strength. First, last week’s strong employment data points to an improving US economy. Second, there is increased likelihood that the Federal Reserve could taper QE, which would be a dollar-positive event.

The Japanese yen continues to drop, but there are signs that Japan’s aggressive monetary policy is pulling the economy out of the doldrums, as we see Japanese economic indicators point upwards and signs of inflation in the economy. Manufacturing, housing and retail sales numbers are looking better and the important Tankan indexes, which are released quarterly, were both positive. If economic data continues to look positive, we could see increased market confidence in the Japanese economy as well as a stronger yen.

The Greece bailout avoided a potential crisis this week. Eurozone financial ministers met in Brussels on Monday, and decided to release more bailout aid to Greece, but with a catch, as only part of the scheduled tranche of 8.1 billion euros will be transferred to Athens. Under the new arrangement, Greece will receive 3 billion euros in July and additional funds in August and October. The Eurogroup decision to give Greece only a portion of the funds currently reflects growing unease with the lack of progress by Athens in implementing the bailout conditions, including improved tax collection and cuts to the bloated public service. Greece has been put on notice that it will have to show more progress in economic restructuring before the troika releases more bailout funds. USD/JPY" width="400" height="300">

USD/JPY" width="400" height="300">

USD/JPY July 9 at 11:00 GMT

USD/JPY 101.19 H: 101.29 L: 100.90

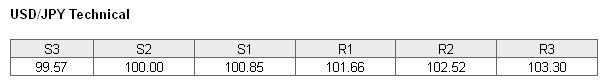

USD/JPY remains steady, as the proximate support and resistance lines remain in place (S1 and R1 above). The pair continues to face resistance at 101.66. This line could face pressure if the yen keeps loses ground. The next resistance line is at 102.52. This line was last tested in late May. On the downside, the pair is receiving support at 100.85. This is followed by the all-important 100 line.

Current range: 100.85 to 101.66

Further levels in both directions:

- Below: 100.85, 100.00, 99.57, 98.43, 97.83 and 97.18

- Above: 101.66, 102.52, 1.03.30 and 105.16

USD/JPY ratio is showing slight movement towards long positions. This is in line with the pair’s current movement, as the dollar has posted very small gains against the yen. Long positions continue to dominate the open positions, indicating a strong trader bias towards the dollar continuing to move to higher levels.

USD/JPY is not showing much activity in the Tuesday session. This could change dramatically as the BOJ releases minutes of its last policy meeting late Tuesday, so we could see some volatility from the pair.

USD/JPY Fundamentals

- 6:00 Japanese Preliminary Machine Tool Orders. Actual -12.4%.

- 11:30 US NFIB Small Business Index. Estimate 96.2 points.

- 14:00 US JOLTS Job Openings. Estimate 3.81M.