The Japanese yen is down sharply on Monday, as USD/JPY has gained 170 points. The pair is trading at 102.40.

In economic news, Japan’s governing coalition won a convincing election victory. On the manufacturing front, Core Machinery Orders was unexpectedly strong, posting a gain of 3.1 percent. Preliminary Machine Tool Orders posted a decline of 19.9%, its smallest decline in five months.

Later in the day, Japan releases PPI, with the markets braced for a sharp decline of 4.1 percent. In the US, it’s quiet day with just one minor release on the schedule, the Labor Market Conditions Index. As well, FOMC member Esther George will speak at an event in Missouri.

Japanese Prime Minister Shinzo Abe’s coalition scored an impressive election victory on Sunday, as the government is expected to have a super-majority in the upper house. This has raised expectations for further monetary stimulus as part of the government’s economic platform, popularly known as ‘Abenomics’. This controversial program is characterized by ultra-easy monetary policy and fiscal spending, with the aim of kick-starting the economy and creating inflation.

Previous rounds of monetary easing have made the yen less attractive compared to other currencies, pushing down its value. Abe announced after the election results that he will continue Abenomics, and the yen responded with sharp losses. The Japanese currency had improved since the Brexit vote last month, as jittery investors snapped up the safe-haven yen.

US employment numbers were positive on Friday, but the US dollar failed to make any headway against the euro. The Nonfarm Employment Change surged to 287 thousand in June, crushing the estimate of 175 thousand. This followed a dismal reading of 37 thousand a month earlier.

There was further encouraging news as the work participation rate improved, following two straight declines. At the same time, Average Hourly Earnings remains weak, as the wage growth indicator posted a weak gain of 0.1%, shy of the forecast of 0.2%. The unemployment rate rose to 4.9%, above the estimate of 4.8%. The employment picture remains bright, but weak wage growth continues to be the Achilles heel of the US labor market.

The Federal Reserve released the minutes of its June policy meeting last week and there were no real surprises. Policymakers expressed concerns about a slowdown in hiring and the health of the US economy, and the underlying tone was one of prudence and caution.

The June meeting took place just one week before the Brexit referendum vote, and the minutes showed that Fed policymakers adopted a “wait and see” attitude about Brexit. The vote by Britain to leave the EU stunned the markets, causing turmoil in the markets and sending bond yields to record lows.

The minutes indicated that Fed members projected two rate increases before the end of the year, but that forecast is likely out-of-date following the shock waves from the Brexit earthquake.

Given the current economic climate, the markets are pessimistic about any rates moves before 2017. Investors have priced in no chance of a rate increase at the next Fed meeting on July 26-27, and just an eight percent chance of a hike in 2016. However, if US employment and inflation numbers improve in the second half of the year, the likelihood of a rate hike will certainly increase.

USD/JPY Fundamentals

Sunday (July 10)

- All Day – Japanese Upper House Elections

- 19:50 Japanese Core Machinery Orders. Estimate +3.1%. Actual -1.4%.

- 19:50 Japanese M2 Money Stock. Estimate 3.4%. Actual 3.4%.

Monday (July 11)

- 2:00 Japanese Preliminary Machine Tool Orders. Actual -19.9%

- 10:00 US FOMC Member Esther George Speaks

- 10:00 US Labor Market Conditions Index

- 19:50 Japanese PPI. Estimate -4.1%

- 23:45 Japanese 30-year Bond Auction

Tuesday (July 12)

- Japanese Tertiary Industry Activity. Estimate -0.7%

*Key events are in bold

*All release times are EDT

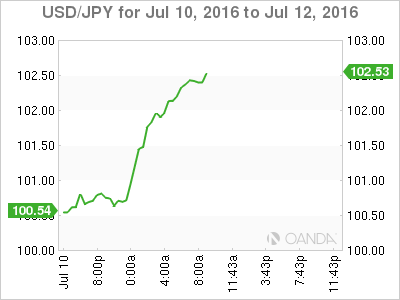

USD/JPY for Monday, July 11, 2016

USD/JPY July 11 at 8:20 EDT

Open: 100.69 Low: 100.55 High: 102.51 Close: 102.42

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 99.71 | 101.07 | 102.36 | 103.73 | 104.99 | 105.87 |

- USD/JPY moved higher in the Asian session and has posted sharp gains in European trade

- 102.36 is fluid and is currently providing weak support

- There is resistance at 103.73

- Current range: 102.36 to 103.73

Further levels in both directions:

- Below: 102.36, 101.07, 99.71 and 98.88

- Above: 103.73, 104.99 and 105.87

OANDA’s Open Positions Ratio

The USD/JPY ratio is unchanged on Monday, despite strong gains from USD/JPY. Long positions retain a strong majority (69%), indicative of trader bias towards USD/JPY continuing to move higher.