USD/JPY is showing little movement in the Tuesday session, as the pair trades at 104.70. In the US, today’s highlight is the US presidential election. The key event on the schedule is JOLTS Job Openings, with the indicator expected to improve to 5.67 million. Japan will release Current Account, with the surplus expected to remain at JPY 1.98 trillion.

After a bruising and bitter campaign, Election Day has finally arrived. US voters in their millions will flock to the polls and choose either Hillary Clinton or Donald Trump as their new president. Although polls continue to point to a tight race, Clinton appears to have the upper hand as she has an easier path to garnering the 270 electoral votes needed to claim victory.

The most recent polls indicate that voters favor Clinton over Donald Trump by a margin of three to five percent. On the weekend, the Clinton campaign received a boost as the FBI announced that it had no reason to change its conclusion that Clinton should not face criminal charges in her use of private emails while she was secretary of state.

There are different market scenarios depending on the actual outcome of the election, with the worst case scenario being a too-close-to-call result. If either candidate fails to deliver a decisive victory, the leadership vacuum and uncertainty surrounding the result could trigger higher volatility in the markets. However, if Clinton wins a clear victory, the US dollar could respond with broad gains.

The election could also have a significant effect on monetary rate policy. Currently, the odds of a rate hike in December stands at 71.5 percent. However, if the election results trigger market volatility, the Federal Reserve could hold off from raising interest rates at its next policy meeting in December.

The BoJ released its minutes from the September policy meeting on Monday. Policymakers acknowledged that it “may take time to heighten inflation expectations”, a sentiment stated recently by BoJ Governor Haruhiko Kuroda. The governor lowered expectations about reaching its inflation target of 2.0 percent, saying that this goal is unlikely to be reached prior to 2018.

The BOJ’s has adopted a massive stimulus program and cut interest rates into negative territory in order to kick-start the economy and raise inflation levels. However, the program has failed on both accounts, as the economy remains weak and continues to grapple with deflation.

USD/JPY Fundamentals

Tuesday (November 8)

- 00:02 Japanese Leading Indicators. Estimate 100.5%. Actual 100.5%.

- 11:00 US NFIB Small Business Index. Estimate 94.6

- 15:00 US JOLTS Jobs Openings. Estimate 5.67M

- All Day – US Presidential Election

- All Day – Congressional Elections

- 18:50 Japanese Current Account. Estimate 1.98T

- 18:50 Japanese Bank Lending. Estimate 2.2%

*All release times are EDT

*Key events are in bold

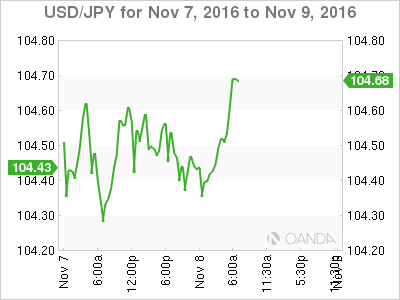

USD/JPY for Tuesday, November 8, 2016

USD/JPY November 8 at 6:20 EDT

Open: 104.46 High: 104.69 Low: 103.29 Close: 104.69

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 102.36 | 103.02 | 104.32 | 105.44 | 106.72 | 107.49 |

- USD/JPY has posted limited movement in the Asian and European session

- 104.32 is a weak support line

- 105.44 is a strong resistance line

- Current range: 104.32 to 105.44

Further levels in both directions:

- Below: 104.32, 103.02 and 102.36

- Above: 105.44, 106.72 and 107.49

OANDA’s Open Positions Ratio

USD/JPY ratio is unchanged in the Tuesday session. Currently, long positions command a majority (56%), indicative of trader bias towards USD/JPY continuing to move higher.