USD/JPY has posted small losses on Thursday, following sharp gains on Wednesday. In the European session, the pair is trading just below the 110 line. On the release front, Japanese Core Machinery Orders jumped 5.5%, easily beating the estimate of a 1.9% decline. In the US, there are two key releases. Philly Fed Manufacturing Index is expected to climb 3.2 points, while the forecast for Unemployment Claims is 276 thousand.

Japanese economic growth has been unimpressive, so the Preliminary GDP report for the first quarter was a pleasant surprise. GDP expanded 0.4%, a marked improvement over Final GDP in Q4, which declined by 0.3%. There was more good news from the manufacturing sector, as Core Machinery Orders climbed 5.5% in March, after a decline of 9.2% a month earlier. Still, with the Japanese economy facing the threat of deflation and the strong yen hurting exports, speculation has risen that the BoJ will adopt further easing measures in June or July. The BoJ has warned that it could intervene to curb the climb of the high-flying yen, but analysts say that the BoJ is unlikely to make any such moves until after the G7 meeting later in May, which is being hosted by Japan. Japan has tried to “talk down” the yen, with a series of warnings from senior policymakers. On Monday, Masatsugu Asakawa, vice-minister of finance for international affairs, said that Japan is considering intervening to lower the yen’s value, since the high-flying yen poses a significant risk to the stability of the economy. BoJ Governor Haruhiko Kuroda said last week that the BoJ had plenty of room for further easing measures, given that the BoJ has already adopted negative interest rates. Despite strong action from the central bank, inflation levels remain very low. PPI, which measures inflation in the manufacturing sector, continues to post sharp declines, and the April reading of -4.2% was worse than expected.

The highly-anticipated Federal Reserve minutes were released on Wednesday. The minutes indicated that a June rate hike remains firmly on the table, and the currency markets have reacted with strong volatility. According to the minutes, the Fed wants to see stronger growth in the second quarter as well as better numbers from the inflation and employment fronts. If this is achieved, the Fed said it “likely would be appropriate” to raise rates at the June meeting. This message is somewhat hawkish, as statements from Fed chair Janet Yellen were more cautious in nature, dampening speculation about a June hike. The markets were skeptical that June would be a “live meeting”, but there are no more doubters that the June meeting will be crucial, as it could mark the Fed’s first interest rate hike this year. With the Fed saying that a key factor in a rate hike decision will be the strength of the US economy, key economic indicators will be under the market microscope.

USD/JPY Fundamentals

Wednesday (May 17)

- 23:50 Japanese Core Machinery Orders. Estimate -1.9%. Actual 5.5%

Thursday (May 18)

- 12:30 US Philly Fed Manufacturing Index. Estimate 3.2

- 12:30 US Unemployment Claims. Estimate 276K

- 13:15 US FOMC Member Stanley Fischer Speaks

- 14:00 US CB Leading Index. Estimate 0.4%

- 14:30 US Natural Gas Storage. Estimate 75B

Upcoming Key Events

Friday (May 20)

14:00 US Existing Home Sales. Estimate 5.40M

*Key releases are highlighted in bold

*All release times are EDT

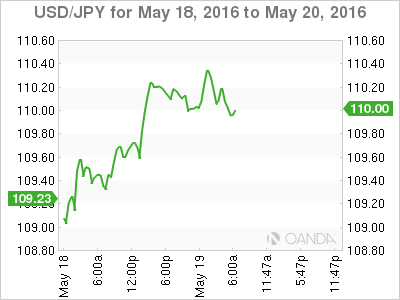

USD/JPY for Thursday, May 19, 2016

USD/JPY May 19 at 10:10 EDT

Open: 110.19 Low: 109.91 High: 110.37 Close: 109.95

- USD/JPY has shown choppiness in the Asian and European sessions

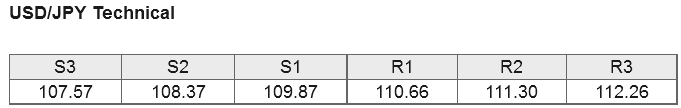

- There is resistance at 110.66

- 109.87 is under strong pressure in support and could break during the Thursday session

- Current range: 108.37 to 109.87

Further levels in both directions:

- Below: 109.87, 108.37, 107.57 and 106.19

- Above: 110.66, 111.30 and 112.26

OANDA’s Open Positions Ratio

USD/JPY ratio is almost unchanged on Thursday. Long positions continue to command a strong majority (60%), indicative of strong trader bias towards USD/JPY reversing directions and moving higher.