The dollar was trading more or less sideways ahead of today’s big risk event which is the Federal Reserve meeting. The statement, accompanying material and projections and Yellen’s press conference will be closely scrutinized. Investors appear divided as to what changes to expect – particularly in the statement. For example, there is a lot of debate on whether the Fed will maintain its pledge to keep interest rates low for a “considerable” period. According to a well-informed reporter of the Wall Street Journal, the phrase “considerable” will likely stay in the statement and this caused some dollar selling.

Overall, one should expect a significant reaction to what the Fed says, but quite possibly investors may also be looking to buy the dollar on dips; such is the bullish sentiment towards the greenback. Therefore there is the scenario that even if the Fed delays its language change for now, time will still be on the side of US dollar bulls – as long as economic data out of the United States continues to come out relatively upbeat.

The Australian dollar was trading relatively strong – relative to its recent sub-90 cent weakness anyway – at 0.9067. The aussie was boosted by the profit-taking in the dollar and the powerful risk rally that took place in Wall Street overnight. It was also hurt by news that the People’s Bank of China (PBOC) would inject 500 billion yuan’s (around 81 billion dollars) worth of liquidity into the country’s 5 biggest banks. Therefore it is already evident that Chinese authorities are taking action to prevent an economic slowdown and boost the country’s financial system.

Finally, the pound was also up on growing hopes that the Scottish independence referendum would return a “No” vote. The three latest polls showed a 52-48 percent lead in favor of “No”. Still it was too close to call as there was still a significant portion (8 to 14%) of voters that remained undecided. The pound traded at 1.6275 against the dollar. Minutes from the September Bank of England meeting will also be released today.

Other important economic statistics today include the eurozone final and US inflation numbers.

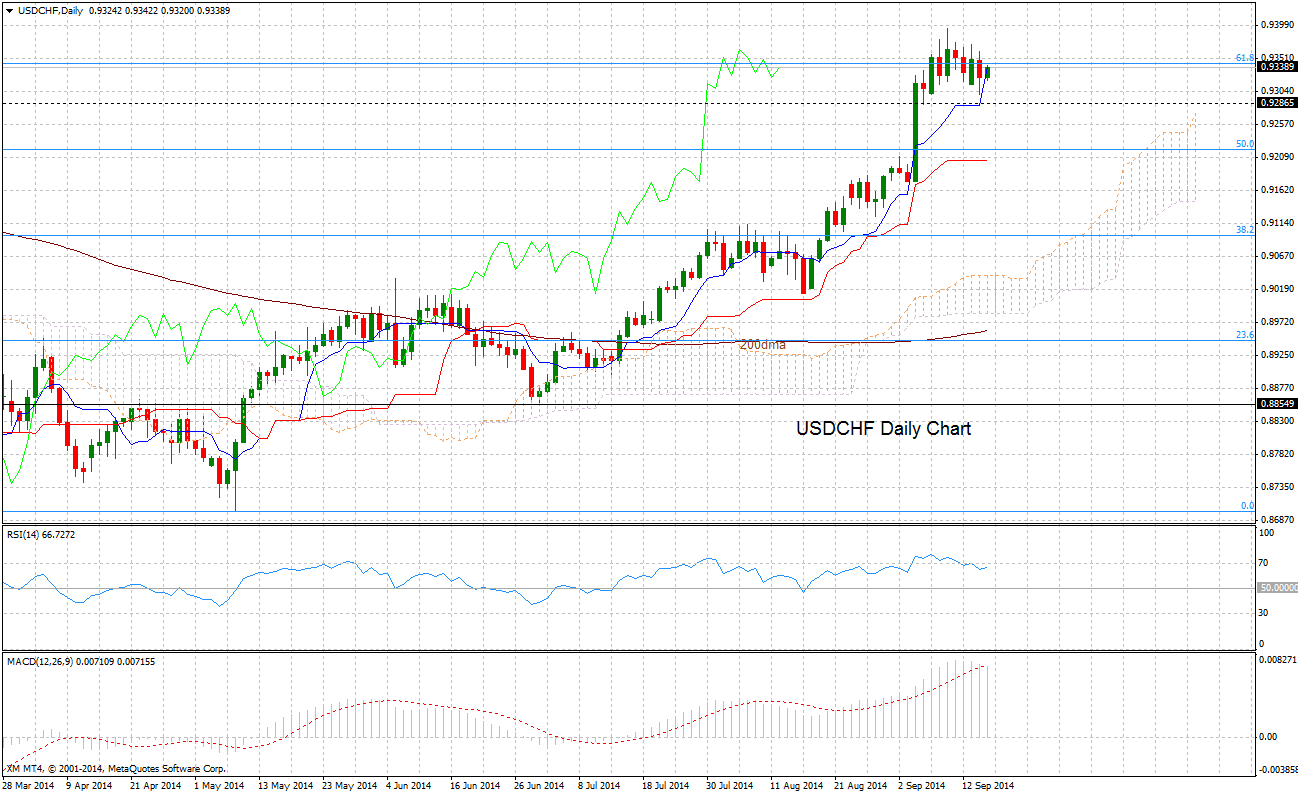

USD/CHF hovers at 1-year high

USD/CHF is hovering near 1-year highs and currently pivoting around 0.9343, which is the 61.8% Fibonacci retracement of the 0.9749 – 0.8698 downleg.

The short-term technical structure is positive – tenkan-sen and kijun-sen are positively aligned and momentum oscillators are in bullish territory (RSI and MACD).

A break of the September 10 high of 0.9394 will accelerate a move towards the September 5 high of 0.9454.

Near-term support is seen at 0.9286 (September 5 low).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD/CHF Hovers At 1 Year Highs, GBP Rises On “No” Expectation,

ByXM Group

AuthorTrading Point

Published 09/17/2014, 03:05 AM

Updated 05/01/2024, 03:15 AM

USD/CHF Hovers At 1 Year Highs, GBP Rises On “No” Expectation,

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.