The Canadian dollar has ticked lower in the Friday session. Currently, USD/CAD is trading just above the 1.35 line. On the release front, Canada will publish key inflation data. Core CPI is expected to edge up to 0.3%, while the forecast for CPI stands at 0.2%. In the US, the sole economic release is the CB Leading Index, with an estimate of 0.1%. The markets will be more interested in hearing from four FOMC members, who will deliver speeches during the day. This follows Janet Yellen’s testimony before the Joint Economic Committee on Thursday.

US numbers were generally positive on Thursday, as the economy continues to move in the right direction. Unemployment Claims sparkled at 235 thousand, much lower than the estimate of 257 thousand. This marked the lowest weekly claims total since 1973. CPI matched expectations at 0.4%, but Core CPI came in at 0.1% shy of the estimate of 0.2%. The Philly Fed Manufacturing Index dropped to 7.6 points, short of the forecast. On the housing front, Housing Starts remained unchanged at 1.23 million, above expectations.

The US dollar posted sharp gains on Thursday against the Canadian currency, following Fed Chair Yellen’s appearance before a congressional committee. Yellen did not explicitly acknowledge that the Fed would raise rates at the December 13-14 policy meeting, but she did say that the rate hike would be “relatively soon”. Yellen make no mention of Donald Trump’s potential economic policies, which could include greater fiscal spending, as she reiterated that future rate hikes should be “gradual”. The odds of a rate hike next month stand at 90 percent. Commenting on Yellen’s testimony, Jonathan Wright, a former Fed economist, summed up market sentiment – “a rate hike in December is a done deal, barring a significant surprise in the next jobs numbers or in financial markets”.

USD/CAD Fundamentals

Friday (November 18)

- 10:30 US FOMC Member James Bullard Speaks

- 8:30 Canadian Core CPI. Estimate 0.3%

- 9:30 US FOMC Member William Dudley Speaks

- 9:30 US FOMC Member Esther George Speaks

- 10:00 US CB Leading Index. Estimate 0.1%

- 21:45 US FOMC Member Jerome Powell Speaks

*All release times are EST

*Key events are in bold

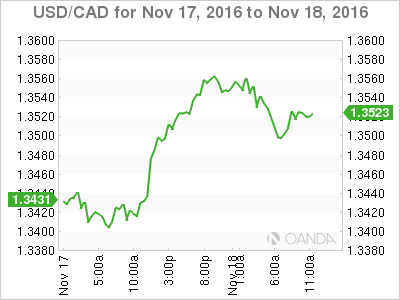

USD/CAD for Friday, November 18, 2016

USD/CAD November 18 at 6:20 EST

Open: 1.3536 High: 1.3564 Low: 1.3511 Close: 1.3515

USD/CAD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.3253 | 1.3371 | 1.3457 | 1.3551 | 1.3648 | 1.3782 |

- USD/CAD was flat in the Asian session and has posted losses in European trade

- 1.3457 is providing support

- 1.3551 was tested in resistance earlier and is a weak line

Further levels in both directions:

- Below: 1.3457, 1.3371, 1.3253 and 1.3120

- Above: 1.3551, 1.3648 and 1.3782

- Current range: 1.3457 to 1.3551

OANDA’s Open Positions Ratio

USD/CAD ratio is unchanged in the Friday session. Currently, short positions command a strong majority (64%), indicative of trader bias towards USD/CAD continuing to lose ground.