USD/CAD

The Canadian dollar is firm on Monday, as USD/CAD trades in the mid-1.08 range early in the North American session. It’s a very quiet day on the release front, with the US markets are closed for the Memorial Day holiday. There are no Canadian releases on Monday.

Canadian inflation numbers continues to hover at low levels, as CPI and Core CPI softened in April. CPI dipped to 0.3%, a three-month low. However, this did match the estimate. Core CPI, a key release, edged down to 0.2%, which also matched the estimate. Low inflation, which is indicative of an underperforming economy, continues to weigh on the Canadian dollar.

US employment releases disappointed on Thursday. Unemployment Claims has looked sharp over the past two releases, but the short streak came to an end, as the key employment indicator climbed to 326 thousand, up from 297 thousand a week earlier. This missed the estimate of 312 thousand. With future QE tapers by the Federal Reserve contingent on solid economic data, key employment releases such as Unemployment Claims will continue to be closely scrutinized by the markets. Elsewhere, key housing data was a mix, as Existing Home Sales fell short of expectations, while New Home Sales improved sharply in April and easily beat the estimate.

The Federal Reserve minutes were released last week, and there was no dramatic response from the markets. In the minutes, policymakers discussed an exit strategy from its QE stimulus program, which is set to terminate at the end of 2014. This will likely mean an increase in interest rates, but the minutes didn’t provide a timetable as to when rates might go up, and by how much. Low inflation levels means there is less pressure on the Fed to raise rates next year, but the economic conditions could change in the meantime. The Federal Reserve remains comfortable with its accommodative stance, and will want to see stronger growth and employment numbers before making changes to monetary policy, such as raising rates.

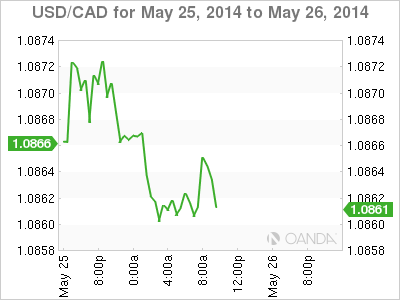

USD/CAD for Monday, May 26, 2014

USD/CAD May 26 at 14:30 GMT

USD/CAD 1.0857 H: 1.0873 L: 1.0871

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.0706 | 1.0775 | 1.0852 | 1.0906 | 1.1000 | 1.1094 |

- USD/CAD has edged lower on Monday.

- 1.0852 has reverted to a support level and is under strong pressure. Will the pair break below this line? There is stronger support at 1.0775.

- 1.0906 is the next resistance line. The key line of 1.1000 is stronger.

- Current range: 1.0852 to 1.0906

Further levels in both directions:

- Below: 1.0852, 1.0775, 1.0706, 1.0678

- Above: 1.0906, 1.10, 1.1094, 1.1177 and 1.1319

OANDA’s Open Positions Ratio

USD/CAD ratio is almost unchanged in Monday trading, continuing the trend we saw last week. This is consistent with what we are seeing from the pair, as the Canadian dollar is rangebound. The ratio has a majority of long positions, indicative of trader bias in favor of the US dollar breaking out and posting gains.

USD/CAD is showing little activity on Monday. The Canadian dollar is unchanged in the North American session.

USD/CAD Fundamentals

- There are no Canadian or US releases on Monday.