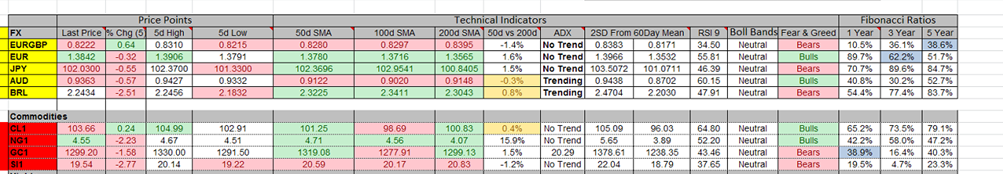

Currencies

- EUR/USD: The pair is trading above the 50 day and 100 day moving average on a 60 minute time frame. The next support is at 1.3747 and the next resistance is at 1.3875.

- USD/JPY: The pair has bounced from its support zone (101.43-101.20) on a 60 minute time frame. The support is at 101.43 and resistance at 103.04.

- GBP/USD: The pair has broken its resistance zone (1.6820-1.6780) on a 60 minute time frame. The resistance is near the 1.6858 and the support is at 1.6621.

Indicators

Indices

- Asian Markets closed mostly mixed by recovering their losses from yesterday. The Hang Seng index was the best performer during the session and it closed higher with a gain of 0.28%. The index is up nearly 2.30% in the past 5 days.

- European stock markets are trading lower during the early hours of trading. The FTSE MIB index is the worst performing index during the session and it is trading lower with a loss of 0.43%. The index is down by almost 2.71% in the past 5 days.

- US Indices futures are trading lower ahead of the building permits data. Most indices closed higher yesterday and the NASDAQ index was the best performer with a gain of 1.29%.

TOP News

- The Australian new motor vehicle sales data came in at -0.3%, which is much worse than the previous reading of -0.1%.

- The Japanese consumer confidence data came in at 37.5 lower than the forecast of 40.2 and the previous reading of 38.5.

- The German PPI m/m data came in at -0.3%, which was a weak reading as compared to the forecast of 0.1%.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Things to Remember

- Stops are your biggest friends so make sure use them.

Market Sentiment

- Gold: The precious metal is trading below the important level of $1300 which is a bearish sign for gold. The next resistance is at 1340 and the support is at 1280.

- Crude Oil: The black gold is trading near the resistance zone of (104.62-105) on a 4 hour time frame. The next support is at 100 and the resistance at 108.

- VIX: Volatility index dropped nearly by 9.16% yesterday.

News Agenda For Today

12:30 GMT

CAD – Core CPI m/m

12:30 GMT

USD – Unemployment Claims

14:00 GMT

USD – Philly Fed Manufacturing Index

14:30 GMT

USD – Natural Gas Storage

Trend

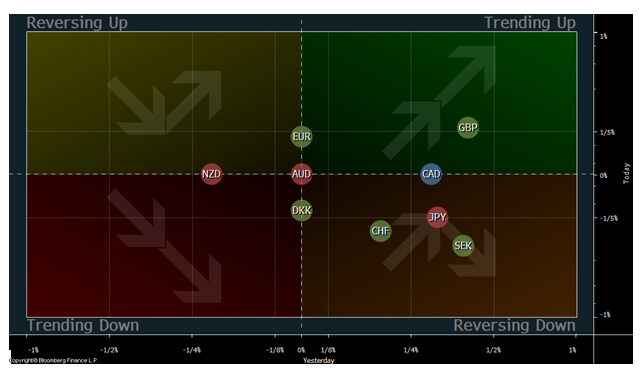

The GBP and EUR are trending up against the USD, while the SEK and DKK are trading lower against the USD on an intra-day basis.

Disclosure & Disclaimer:

The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader. by Naeem Aslam