Traders appear to be placing new bets on the reflation trade through equity sector bets in energy, basic materials and industrials stocks, based on a set of exchange traded funds. It’s too early to know if this is a sustainable shift, but the change in tone in recent days is too hard to ignore.

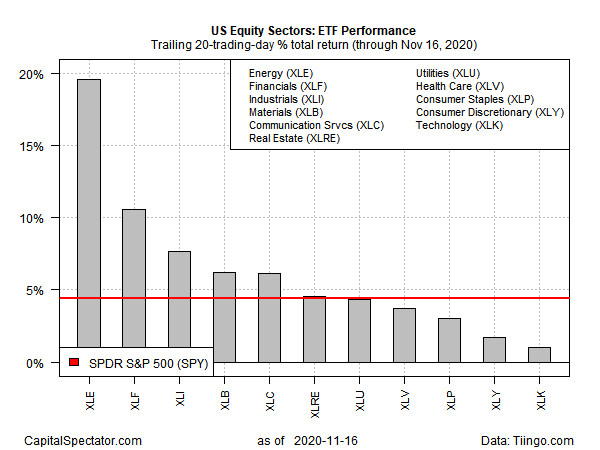

The leading clue: surging energy stocks. For the trailing 20-trading-day window through yesterday’s close (Nov. 16), Energy Select Sector SPDR (NYSE:XLE) has surged ahead of the field with a near-20% rise. Meanwhile, the darling sector—tech—for much of the rebound following the coronavirus crash in March has fallen to last place over this period. Technology Select Sector SPDR Fund (NYSE:XLK) is up a thin 1% over the past 20 trading days.

A month is hardly a reliable sign for calling a change in sector leadership, all the more when you consider that tech’s strong run is vulnerable to profit-taking. But the revival of energy shares in recent days is nonetheless striking. No one knows if this is a dead-cat bounce or a sustainable reversal and so caution is required. But after a relentless decline this year, the crowd is suddenly rethinking its uber-bear outlook on the largest names in the energy patch.

Despite the strong bounce, Craig Johnson, chief market technician at Piper Sandler, remains cautious. “This chart for the XLE is below a declining 200-day moving average, the longer-term trend is still very much in a secular decline,” he tells CNBC on Monday.

“With Chevron (NYSE:CVX) and Exxon (NYSE:XOM) representing 45% of this index and those charts aren’t showing any sign of a turnaround at this point in time, I would largely view this as just one of these sort of relief rallies and a short covering rally and I’d be looking to be reducing positions in the energy space at this point in time.”

Meanwhile, several other sectors that have been out of favor in recent months have been reviving: financials (XLF), industrials (XLI) and basic materials (XLB). XLF, for instance, closed at a new pandemic high.

A key catalyst in the rally for stocks generally: another upbeat report on coronavirus vaccine development. Moderna (NASDAQ:MRNA) on Monday announced that its vaccine is 94.5% effective against Covid-19, based on early data.

“The global population couldn’t have asked for more from the Moderna vaccine,” notes Seema Shah, chief strategist at Principal Global Advisers. The news “should solidify the market rally that has been in play since last week. Today’s vaccine news should make investors more tolerant of the surging virus cases, permitting them to look through to the strong dynamics that seem to be taking shape for 2021.”

If the market is pricing in brighter days for next year, the recent trading actions suggest that investors are voting in a new slate of sector leaders. Perhaps, but some analysts advise that it’s premature to discount the bullish momentum in tech because the fundamental driver—earnings growth—remains intact.

The question is whether the crowd will abandon tech’s hard numbers for earnings for a speculative reflation run in 2021? Pitching money to the latter has been relatively easy, thanks to left-for-dead energy stock pricing and headline-grabbing news on coronavirus vaccine R&D. Maintaining the bullish revival in energy and other sectors on the short list of expected rebounds in the weeks ahead is a higher bar, which will require cooperation via upbeat economic reports.