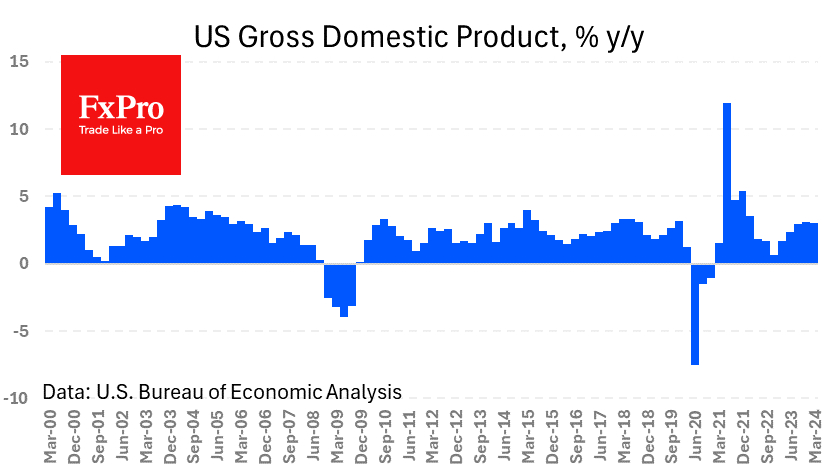

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast. Disappointment increased given that exceeding forecasts has become the norm. GDP growth for the same quarter a year earlier fell to 3.0% from 3.1%.

In contrast, the price index showed a 3.1% increase from 1.6% previously. Thus, the U.S. economy simultaneously faced increased inflationary pressures and slowing growth. This has caused even more concerns among those who fear stagflation.

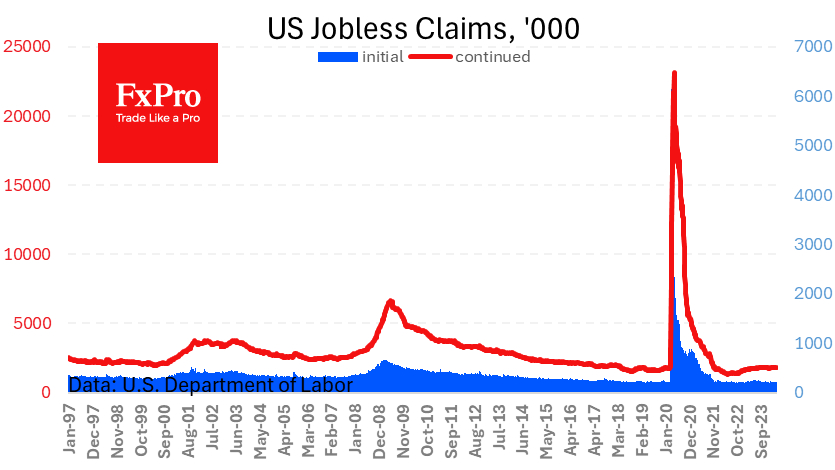

At the same time, a new batch of very positive weekly unemployment data was released. Initial jobless claims fell to 207K, the lowest since February. The number of repeat claims fell to 1781K - the lowest in three months.

It is worth noting that these are very low figures by historical standards. The tense situation in the labour market will create domestic inflationary pressures even if commodity prices start to decline.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Economy: Slower Growth With Stronger Inflation

Published 04/25/2024, 10:45 AM

US Economy: Slower Growth With Stronger Inflation

Latest comments

Maybe the numbers are manipulated?

Better yet and I'm investing in cryptocurrency lol

Do you believe Fed could cut rates despite inflation if the dollar continues to strengthen?

Whether the Federal Reserve will cut interest rates in the presence of inflation depends on many factors, including economic conditions, the level of inflation, employment, and monetary policy objectives. Typically, when the level of inflation rises, the central bank may consider raising interest rates to curb inflationary pressures rather than cutting them.

However, the Fed may make decisions based on overall economic conditions and inflation expectations. If the U.S. economy faces slower growth or other unfavorable factors, the Fed may pause interest rate hikes or even cut interest rates even if inflation rises in order to support the recovery or avoid an excessive slowdown.

In addition, a stronger U.S. dollar may also have an impact on exports and international competitiveness, which may be of concern to the Federal Reserve. Thus, a stronger dollar may affect the Fed's monetary policy decisions, but it is usually not the only factor, and other economic indicators and factors are also taken into account.

Come on and I'm investing in cryptocurrencies to make the right choice

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.