Talking Points

- US Dollar May Turn Lower as July’s Jobs Report Falls Short of Forecasts

- British Pound Unlikely to Find Lasting Driver in Manufacturing PMI Data

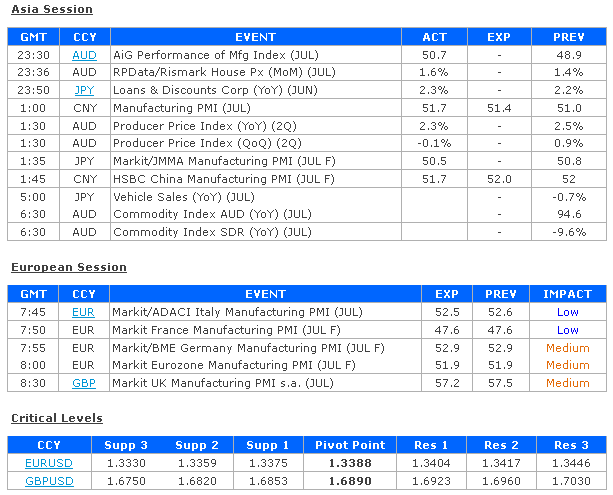

The spotlight is firmly pointed at July’s US Employment figures through the end of the trading week. Consensus forecasts are penciling in a 230,000 increase in nonfarm payrolls, marking a slight slowdown compared with the 288,000 jobs gain recorded in June. Worrying cues from PMI data produced by Markit Economics open the door for a downside surprise however.

The research firm reported that the pace of manufacturing employment growth eased for the first time since April in July, marking the smallest increase in 10 months. On the service sector side of the equation, Markit said the rate of job creation markedly eased this month compared with June.

A soft reading may fuel speculation that the time gap between the end of QE3 asset purchases in October and the first Fed interest rate hike will be a relatively long one, weighing on the US Dollar after the benchmark unit soared to a new 4-month high against its leading counterparts yesterday.

The UK Manufacturing PMI figure headlines the European data docket. Expectations point to a narrow slowdown in the pace of factory-sector growth, with the index slipping to 57.2 in July after printing at a seven-month high of 57.5 in June.

UK data flow has increasingly deteriorated relative to consensus forecasts since late February, hinting analysts have tended to over-estimate the resilience of the economy and opening the door for a downside surprise. Such an outcome may undermine BOE interest rate hike bets and weigh on British Pound. Follow-through may be limited however, with traders unwilling to commit to a directional bias until after US jobs data is in the rearview mirror.