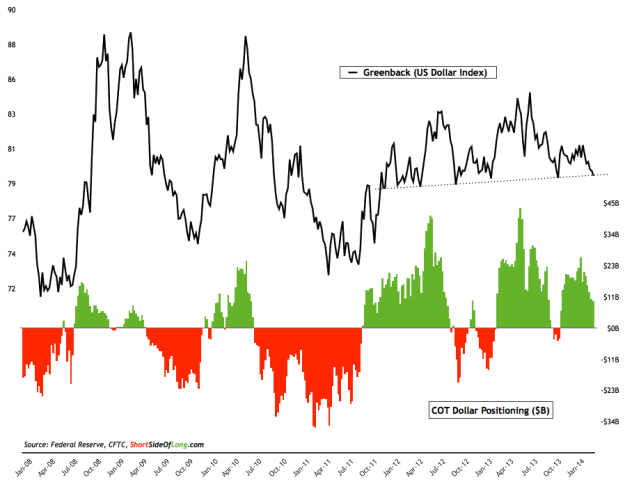

US Dollar Index finds itself at a major support (demand zone)

The US dollar index has not performed particularly well over the 6 months. Despite the Federal Reserve taper announcement, which created an abundance of Dollar bulls coming into 2014, the index itself has under-performed other global majors. Side Note: we do have to admit that the Greenbacks has performed very well against GEM currencies, just not the majors.

Technically, the US Dollar Index finds itself at a major support level, which has acted as a demand zone for bulls for two years. This demand will be tested over the coming weeks, however this time around sentiment measured by Commitment of Traders report shows that hedge funds still remain net long the Dollar (as opposed to net short during previous tests in 2012 and 2013). Public Opinion on the USD is slowly turning towards pessimism levels, but not yet there.

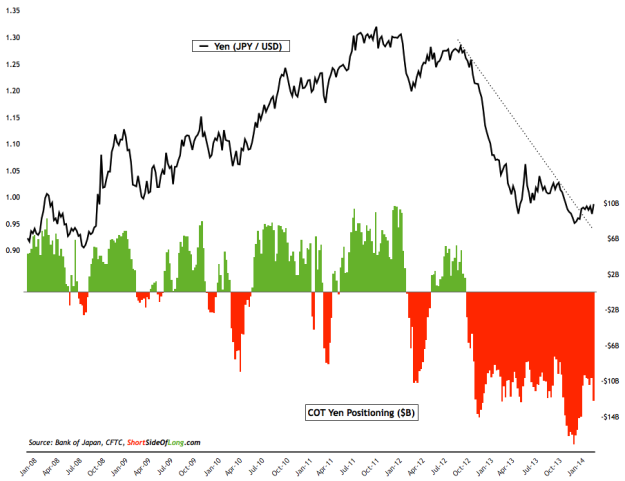

One of the reasons US Dollar Index might experience some weakness is due to a possibility of a Japanese Yen short squeeze. The currency seems to be putting in an intermediate degree low from which a relief rally could occur. Yen has been one of the worst performing currencies over the last three years, so contrarians could expect somewhat of an improvement here. Nevertheless, the USD Index is heavily weighted towards Euro content currencies, so major movements in the EUro, Pound and Franc will determine its next direction.

Japanese Yen could be basing, after being extremely oversold!

JPY/USD COT Chart" title="JPY/USD COT Chart" width="474" height="242">

JPY/USD COT Chart" title="JPY/USD COT Chart" width="474" height="242">