Today, the US Gross Domestic Product annualized reading was released by the US Bureau of Economic Analysis during the start of the New York session. The forecast was slated for a 3.0% rise in the second quarter of 2014, compared to the 2.1% decrease in the first quarter. The outcome was way above the forecast, as the output of goods and services produced by labor and property located in the United States grew by 4.0%. Moreover, the previous reading of the first quarter was also revised up from -2.9% to -2.1%. So, overall the outcome was on the positive side for the US dollar. The reaction in all the major pairs was volatile, as the EURUSD and GBPUSD pairs dived post release, and the USDJPY pair jumped above the 102.80 level. The report published highlights that the jump in the GDP was mainly due to positive contributions from personal consumption expenditures (PCE), private inventory investment, exports, nonresidential fixed investment, state and local government spending, and residential fixed investment.

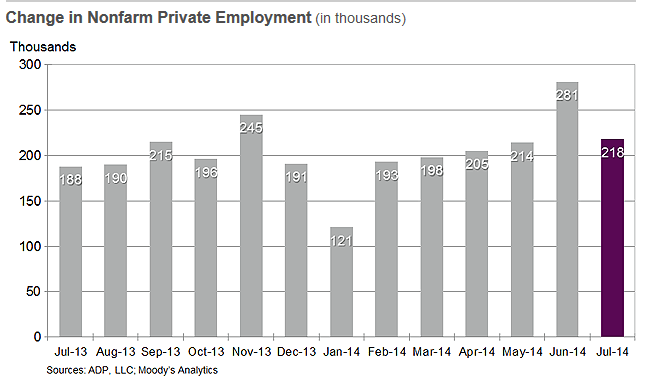

US ADP Employment Change Data

Just before the release of the US GDP, the US ADP Employment Change figures were released by the Automatic Data Processing, Inc. The market was expecting a decline from the previous reading of 281K to 230K. However, the outcome was a bit more on the lower side, as the Private-sector employment increased by 218,000 from June to July, according to the report published. The US dollar was seen trading a touch lower after the release, but soon jumped back higher after the US GDP release. The main thing to note from the release is that although there was a decline in the jobs numbers, it is 4th consecutive reading above the 200K mark, which is definitely on the positive side.

Technically, the EURUSD pair fell below the 1.3400 support level, but showing some signs of life around the 1.3360-50 support area. However, the most important point here is the break of the 1.3400 support area, which is an important pivot area for the pair. So, there is a lot of pressure on the Euro bulls from both sides, as the US continues to impress in terms of fundamentals, and the Euro zone continues to deteriorate. The next possible support can be seen around the 1.3320-00 area, which must hold the downside for now in the pair.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Dollar Bears Crushed As GDP Expanded 4% In Q2

Published 07/31/2014, 05:08 AM

Updated 07/09/2023, 06:32 AM

US Dollar Bears Crushed As GDP Expanded 4% In Q2

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.