ArcBest Corporation (NASDAQ:ARCB) provides freight transportation services and solutions. The company’s Freight Transportation segment offers transportation of general commodities; motor carrier freight transportation services; business-to-business air transportation services; ocean transport services; global customizable supply chain solutions and integrated warehousing services. Its Premium Logistics & Expedited Freight Services segment provides expedited freight transportation services to commercial and government customers; premium logistics services; and domestic and international freight transportation with air, ocean, and ground service. ArcBest Corporation, formerly known as Arkansas Best Corporation, is headquartered in Fort Smith, Arkansas.

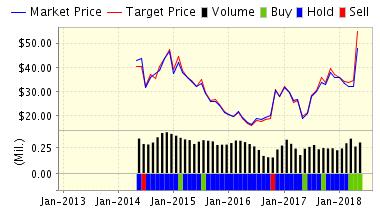

ArcBest has been upgraded by our models to STRONG BUY. The stock has put in a nice leg up thanks to some very strong earnings results. Analysts expected a loss of $0.07/share and when the company reported last week they posted earnings of $0.37/share. That’s a huge beat. Sales expectations were also exceeded handily, with the company reporting sales of $700 million vs. the expected sale for Q1 of $690.4 million.

“Strong market demand for our supply chain solutions and purposeful yield management contributed to our positive first quarter results,” said Chairman, President & CEO Judy McReynolds. ”We are pleased that customers are finding value in our enhanced market approach and are utilizing us as a trusted partner for more of their logistics needs.”

McReynolds went on to note that:

As expected, tighter capacity in first quarter resulted from the new Electronic Logging Mandate and other factors, and general economic trends were favorable. We expect these trends to continue in 2018. These positive developments, combined with ArcBest’s ability to offer full supply chain solutions, create a backdrop for us to push forward with many initiatives to continue improving our customer experience. In addition, we were pleased that a tentative contract agreement between ABF and the International Brotherhood of Teamsters was reached at the end of the first quarter, allowing our employees to continue focusing on exceeding customer needs.

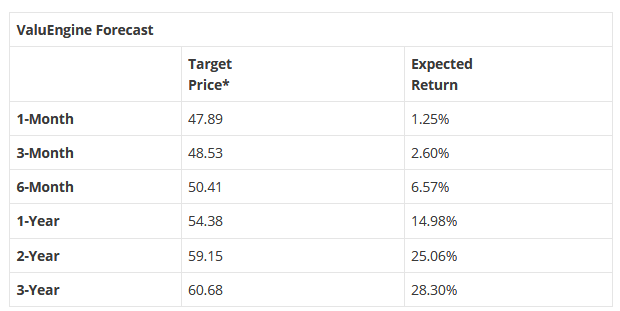

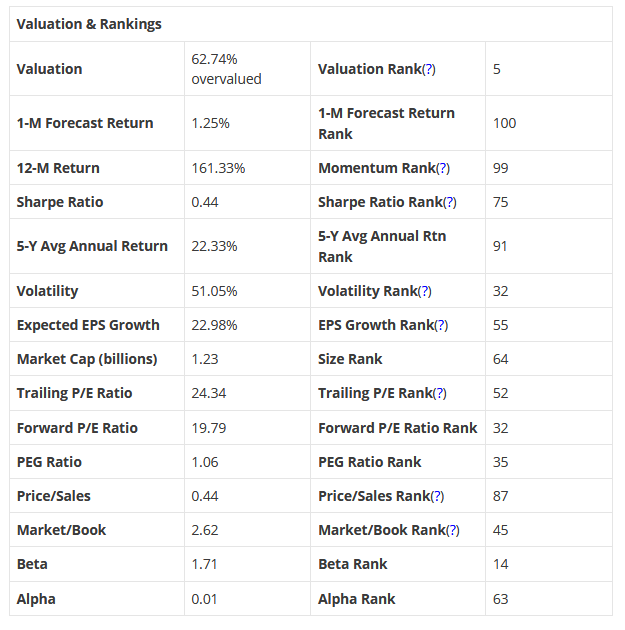

This news was welcomed by investors and the stock is up more than $10/share since last Thursday. ValuEngine updated its recommendation from BUY to STRONG BUY for ArcBest Corporation on 2018-05-11. Based on the information we have gathered and our resulting research, we feel that ArcBest Corporation has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and Price Sales Ratio.