Here’s the interesting set of questions from the “Mish Mailbag” summarized as follows: How Accurate and at What Cost is BLS Data? Why isn’t there a private industry alternative?”

The questions are from reader “Trevor”, a grad student, forwarded from his professor.

When I first read the questions, I thought they were about jobs because the BLS stands for Bureau of Labor Statistics.

Just as I was about to hit “send” with my analysis on jobs, I re-read the email and realized the question was about the CPI, not jobs.

This is what happens when you get hundreds of emails and you make a concerted effort to answer them quickly.

So, Trevor gets a bonus two answers for one question. Let’s deal with jobs first as that was my initial response.

Private Jobs Reporting

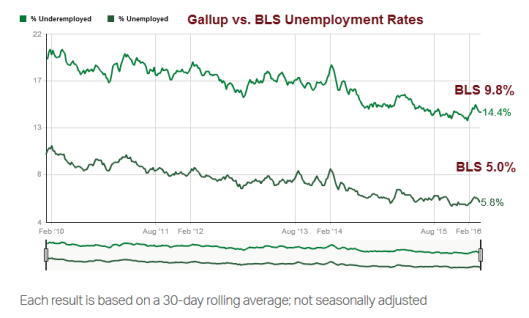

- Gallup produces employment data continually. I believe its reporting is as accurate as the BLS.

- TrimTabs estimates jobs via tax collection data, also with free reporting.

- ADP offers free advance reporting every month, but then goes to great lengths to smooth its data to match the BLS.

BLS Jobs Conversation

I still believe the BLS double counts part-time jobs. In telephone conversations, the BLS admits my assertion it is possible.

A simple sort-merge program weeding out duplicate social security numbers would settle the debate.

I contacted ADP twice on this issue and received no response.

The BLS told me they would like to weed out duplicates but they do not have access to the data for security reasons.

This about that for a second. What is the problem here?

The answer is unencrypted social security numbers. If social security numbers were encrypted in government databases, then matches on encrypted hash keys would reveal duplicates without disclosing the underlying social security numbers to anyone.

A simple sort merge program on raw data could do the same, coming up with a count only, so there would be no reason for anyone to see the social security numbers.

TrimTabs maintains that tax collection analysis is the key, but as I said, the BLS does not have access to that data. However, tax collection has its own problems, such as quarterly filings, seasonal variations in vacations, etc.

The BLS also picks up increases in self-employment which TrimTabs doesn’t because of delayed reporting. Of course, the BLS counts those selling trinkets on eBay as well as newbies getting sucked into various multi-level-marketing schemes while labeling that a job.

Topping things off, BLS goes to great lengths to make sure it weeds out every conceivable person from the labor force that it can. Working one hour a week selling trinkets on eBay or in a MLM scheme lands you in the employed bucket.

This is why Gallup’s CEO calls BLS reporting a “big lie”.

Gallup vs. BLS

Here’s Gallup’s latest US Unemployment Report.

BLS – CPI Reporting Discussion

Every month, when the BLS produces its CPI report I wonder why the labor division collects the data, and not the BEA, Bureau of Economic Analysis.

The best answer I can come up with is “We are dealing with the government. Things do not have to make sense, and they usually don’t.”

As to why private industry does not measure prices aside from things like the “Big Mac Index” the best answer is …

- There is no reliable basket of goods and services

- No one can agree on what the basket should be

- It cannot be done

The basket of goods and services for someone with kids in school is dramatically different than someone retired. Does it really make sense to average that out?

The BLS does a substitution of goods. For example, if the price of beef is up, the BLS says consumers will buy more chicken. Does one want to to duplicate that nonsense, or report what’s really happening.

What about those with freezers?

I strongly advocate people buy meat when it’s on sale and freeze it. Sale prices on meat have risen very, very slowly over time. I know this for a fact as I remember prices well from when I worked in grocery stores in the late 1960s and early 1970s.

For example, in 1968 whole chickens on sale were a loss leader at $0.21 per pound. Farmers came in to buy them saying they could not raise them for that price. Today you can find them on sale for $0.59 per pound. This is something like 2% annualized.

People remember every uptick in price but seldom decrease. When the price of gasoline rises again to $2.50 people will be whining about gas that has gone up 25%.

BLS Home Price Nonsense

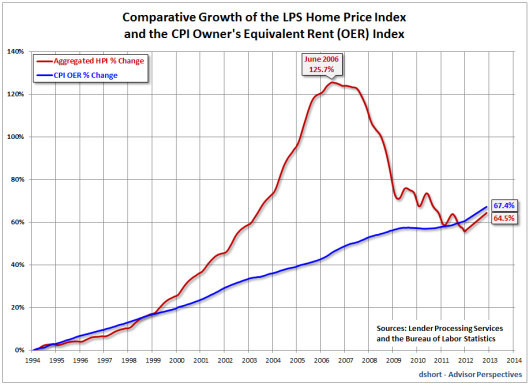

The biggest weight in the CPI is Owner’s Equivalent Rent (OER). The BLS actually asks people how much they would rent their own house from themselves, if they were to rent their own house.

No one in their right mind would want to duplicate that thought process.

One gets dramatically different results if home prices are in the CPI instead of rents. Renters of course are more concerned about rent.

I have discussed this perversion many times. It’s an important discussion.

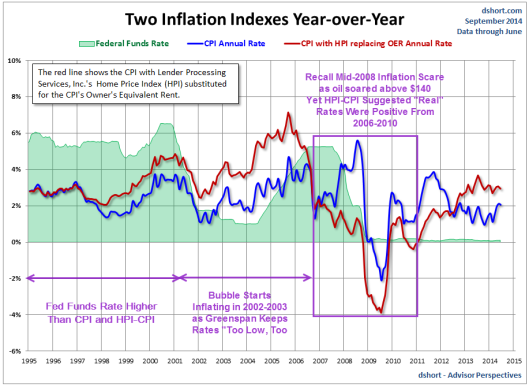

I compute what I call the HPI-CPI (Home Price Index CPI) by adjusting the CPI for home prices instead of using the OER.

Comparative Growth in HPI vs. OER

HPI CPI – Two Inflation Indexes

The above charts explain how and why the Fed blew a massive housing bubble. The short answer is the Fed ignored housing prices in the CPI.

Why would anyone want to duplicate such foolishness?

ShadowStats, a Private Measure

There is a private measure that I nearly forgot about: John Williams’ ShadowStats.

ShadowStats estimates the unemployment rate is between 20% and 25%.

Williams claims “Shadow Government Statistics is an electronic newsletter service that exposes and analyzes flaws in current U.S. government economic data and reporting, as well as in certain private-sector numbers, and provides an assessment of underlying economic and financial conditions, net of financial-market and political hype.”

Instead of political hype, Williams offers his own nonsensical counter-hype.

Williams predicted hyperinflation in the US on numerous occasions. For example please consider my 2010 article Williams Calls for “Great Hyperinflationary Great Depression”; A Very Easy Rebuttal

In 2015 I wrote Deconstructing and Debunking Shadowstats

Williams offered an update “Hyperinflation 2014” following “Hyperinflation 2012” while noting in 2012 “the forecast has been in place since 2006”.

Williams now offers “Hyperinflation 2015”.

These people simply do not understand the deflationary forces of debt that cannot be paid back. Nor do they understand the deflationary forces of demographics and the deflation effects of technology.

In light of the above, my simple position is that a basket of prices cannot be accurately measured, any such basket fails to consider asset prices, and there is no such thing as an aggregate basket in the first place.