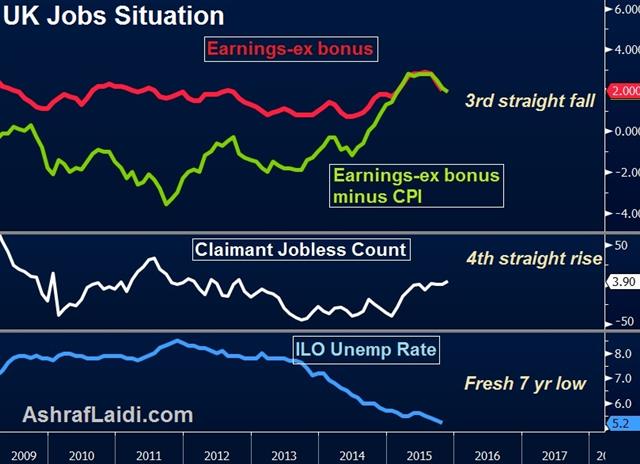

Today's release of the UK jobs figures confirms the suspicions of the doves at the Bank of England, with earnings (pay) growth continuing to decline, joblessness pushing higher for the fourth straight month even as the unemployment rate hit a fresh 7-year low of 5.2%.

Click To Enlarge

Earnings Growth at 7-month Lows

While the front page headlines will be dominated by the unambiguous increase in UK employment – and nearly decade low jobless rate-- GBP traders are concerned with slowing earnings' growth. The average rate of earnings growth (excluding volatile bonus payments) for the three months ending in October slowed to a seven-month low of 2.0% y/y, posting its third consecutive decline. The earnings figure including bonuses also hit seven month lows at 2.4%.The figures are well below the 3.0% that BoE governor Carney said would like to see before considering raising rates.

Sterling's decline caught the market's attention in October when a combination of negative inflation figures and stalling business activity eliminated all expectations that the BoE would hike this year. Plummeting oil prices and the delayed impact of the strong pound have made “deflation” a regular term among the mainstream media.

BoE chief economist Andy Haldane stated earlier this month that downside inflation risk was getting worse, four weeks after the BoE made sharp downward revisions to growth and inflation. Haldane added there was evidence that earnings growth was starting to slow, hitting into the very foundation on, which sterling had been rallying for most of Q2.

In addition to a dovish central bank, the UK Treasury has been forced to make prolonged budget cuts across a number of cabinet departments (ministries) as defence obligations back the UK decision to join the allied strikes in Syria.

Such are the dynamics confirming our GBP bias in the Premium Insights, which many clients had questioned back in October, until the tide started to turn against the pound. GBP/USD traders will experience rising volatility arising from today's Fed decision (as well as the usual 1-2 day post-announcement fallout), but clarity continues to remain in GBP crosses.