A couple of months ago we wrote about how the U.S. had sent a shipment of Liquid Natural Gas (LNG) to the United Arab Emirates (see Coals to Newcastle). The notion of natural gas being extracted under a field in Pennsylvania, processed and then transported by pipeline to Louisiana, chilled and condensed to liquid form, loaded onto an LNG tanker and then sent to a part of the world that’s the world’s major hydrocarbon supplier is amazing.

It probably reflects better than most things how the worlds of natural gas and crude oil have been upended by the Shale Revolution. So far this year, U.S. sourced LNG has also shipped to Brazil, Chile, Portugal, China, India, Jordan and Kuwait.

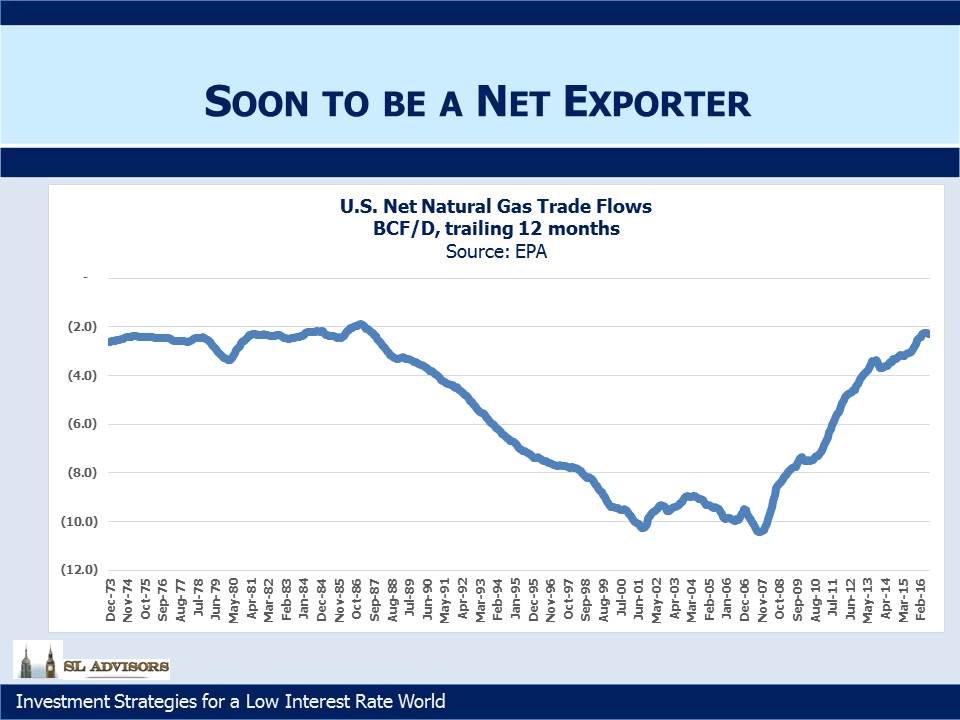

Ten years ago when the U.S. was importing around 10 BCFD (Billion Cubic Feet per Day) of natural gas, the idea that some of that would arrive by LNG tanker was uncontroversial. Cheniere Energy Inc (NYSE:LNG) began planning facilities such as Sabine Pass to accommodate such flows. As natural gas became steadily more abundant in the U.S., Cheniere reversed themselves and planned for its export via LNG tanker.

Although their chosen site had deep water access and connectivity to the domestic network, switching a facility from LNG imports to exports isn’t trivial. Former Cheniere President Charif Souki, who led the company through this metamorphosis, is one of the industry’s most colorful characters.

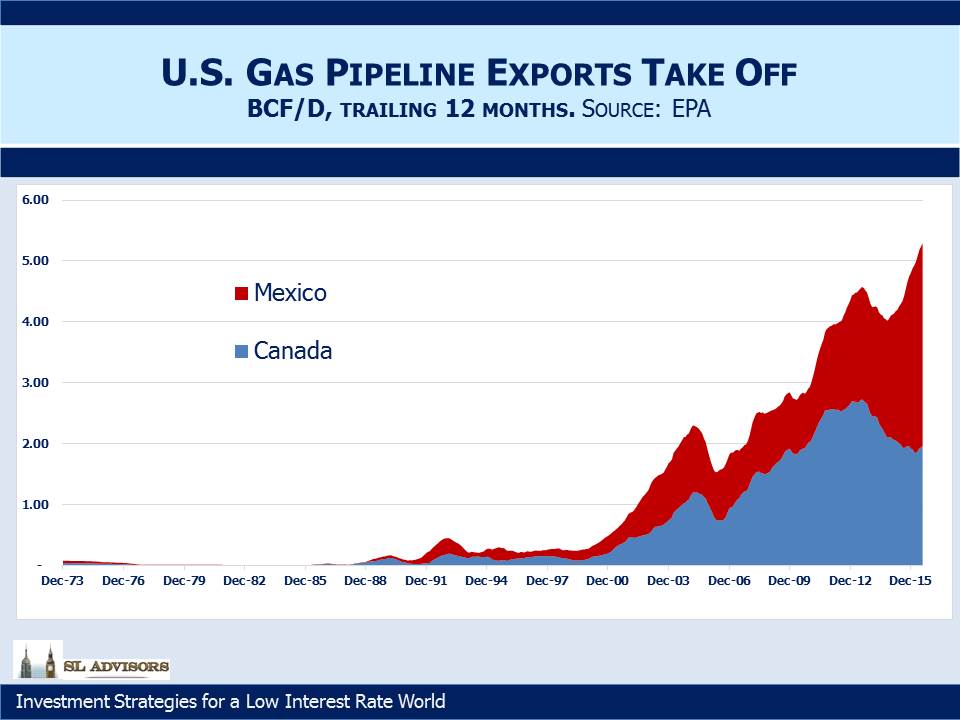

The U.S. is within sight of being a net exporter of natural gas. Additional LNG export facilities are at various stages of development. However, other countries are also increasing their export capability and it’s quite possible the world will have more LNG available than it needs for several years. So far, virtually all the shift in the U.S. balance of trade in natural gas has taken place through pipelines. Canada has long been a net exporter to us although flows go both ways and our net imports from Canada are down by almost half in ten years. We’ve exported to Mexico for thirty years but in recent months volumes have really taken off. Early last year exports to Mexico exceeded those to Canada and the gap keeps growing.

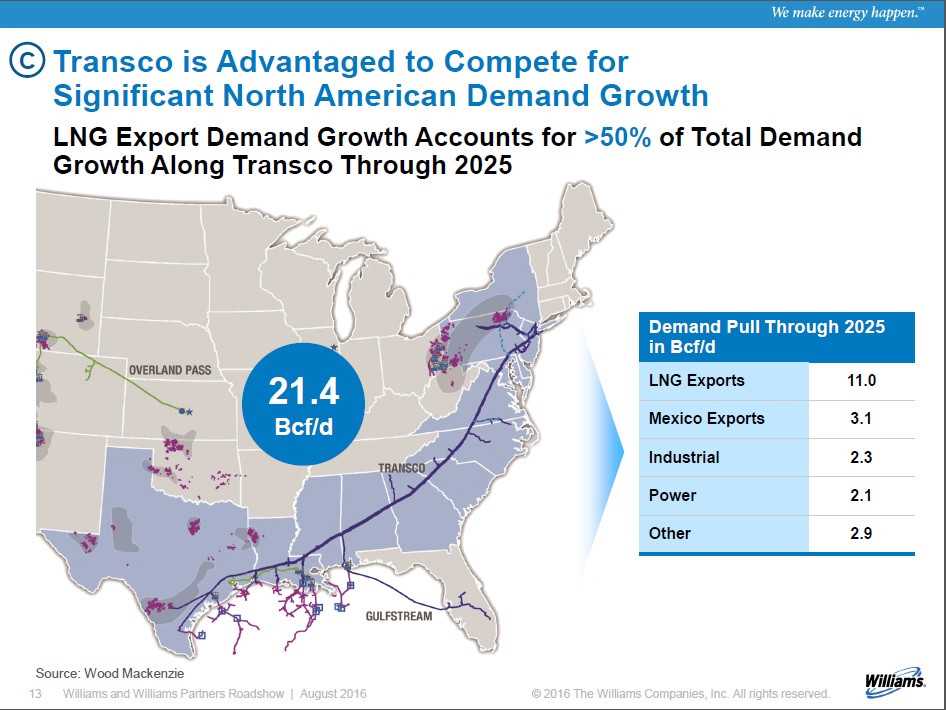

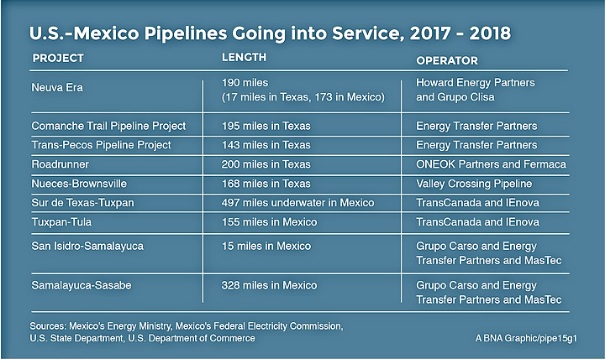

Several new pipeline projects are at various stages of development. Between supplying gas for LNG export facilities and increasing Mexican exports, there’s a lot of energy infrastructure being built. One of the clear beneficiaries is Williams Companies (NYSE:WMB), whose Transco pipeline is the main recipient of their capital expenditures to accommodate growing demand.

But other midstream infrastructure companies involved in Mexican trade include TransCanada (NYSE:TRP), Spectra (NYSE:SE), Energy Transfer Equity (NYSE:ETE) and Oneok (NYSE:OKE).

In many cases their Master Limited Partnership (MLP) will build the assets and then share the Distributable CashFlow with their General Partners (GPs) via Incentive Distribution Rights as is common. This asset growth will benefit the GPs. Just as asset growth for a hedge fund benefits the hedge fund manager, or GP, so does asset growth for an MLP benefit its GP. An MLP GP is like a hedge fund manager.

Disclosure: We are invested in ETE, OKE, SE, TRP and WMB