“A little help, please!”

So reads the subject line of an email I received recently. The reader was responding to a pervious sermon of mine about the supreme importance of earnings in determining future stock prices.

Specifically, the troubled reader wanted to know exactly which earnings metrics to monitor.

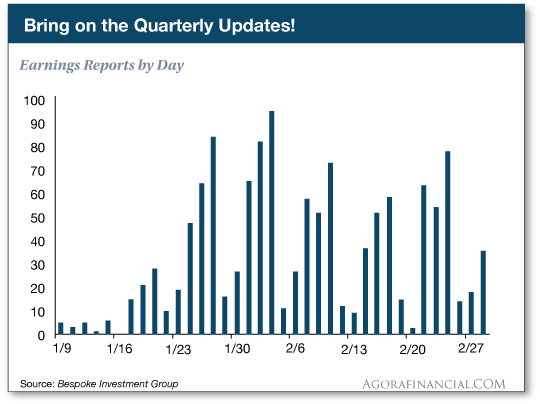

The request is certainly timely. Earnings season is now officially in high gear. As you can see in the chart below, it started in earnest last week and continues this week, with over 250 companies set to report.

Not to mention earnings are taking on a renewed importance with the transition of power in Washington, D.C. As a headline at MarketWatch points out, “Outlooks for the Age of Trump Are Top Focus of Earnings Season.”

As you know, I’m always eager to lend a helping hand. But before I share the only two metrics you need to be tracking, I must dispel a persistent myth…

What Is Alcoa (NYSE:AA) Good For? Absolutely Nothing. Ever Again.

Although the practice remained popular with many investors, treating Alcoa’s results as a bellwether for the rest of the stock market has always been a big mistake.

Historically, they’ve been good for… well, absolutely nothing when it comes to predicting the trajectory of stock prices.

In case you need a refresher on why, pick your poison from the archives…

You can review my original findings from 2012 or FactSet’s statistical analysis.

The good news is this age-old debate finally got put to rest last year when Alcoa split up into two separately traded companies.

One trades under the old ticker AA, which consists of the former company’s raw aluminum operations. The other is known as Arconic Inc (NYSE:ARNC), which consists of the higher-growth business of manufactured goods for automotive and aerospace markets.

Not only did the company split in two, but each company reports on different days now. In other words, Alcoa’s results are truly meaningless when it comes to divining the future direction of the entire stock market.

So what earnings stats should we focus on, then?

Just Beat It, Beat It!

Go ahead and dust off the cassette tape and cue up Michael Jackson’s 1983 hit “Beat It.”

It’s the most appropriate theme song for the fourth-quarter earnings reporting season. Because the only two metrics we should be tracking are the earnings beat rate and the revenue beat rate.

Both measure the percentage of companies that beat expectations for earnings and revenue.

Simply put, the more beats, the better. Why? Because analysts are notoriously wrong. And when results check in ahead of their unreliable expectations, investors are forced to adjust. They bid up shares to levels that reflect the actual health of each business.

Already, we’re seeing this trend play out.

Heading into the reporting season, analysts expected S&P 500 companies to report a 3.1% increase in earnings. But so far, companies are on track to report a 4.2% increase.

Is it any wonder, then, that the market recently hit new highs? It shouldn’t be now.

Sizing up Expectations

In terms of gauging the total impact of beat rates on stock prices, a little perspective helps.

The average EPS beat rate since 1999 is 62%, according to Bespoke Investment Group. Meanwhile, the average revenue beat rate checks in slightly lower, at 60%.

That means the higher above the average each beat rate checks in, the more likely stocks will rally.

Right now, we’re dealing with a mixed bag.

At the end of last week, the earnings beat rate stood at 64%, barely above the long-term average, while the revenue beat rate stood several points below the long-term average at 56%.

Granted, there are still a lot of reports to come. Nevertheless, the market has reached a critical test. We need companies to beat it! They need to put up better-than-expected sales and earnings numbers if there’s any chance of the market climbing higher from here.

Naturally, I’ll be monitoring the activity and providing information on any urgent developments. But you don’t have to rely on me for updates. Both Bespoke Investment Group and FactSet provide periodic updates as the earnings season unfolds.

Ahead of the tape,