Russia’s recent ban on civilian visits to Turkey serves as the first result of the latest tensions between the two countries, amidst a conflict that started last week when Turkish military shot down a Russian airplane. The Russians hope this measure will inflict some pain on Turkey’s tourism industry and other parts of their economy, as Russian tourists make up 10.00% of all visitors to Turkey within a year on average. The inability to visit this popular destination means that Turkey may miss out on up to 1.40% of their yearly GDP, which can be directly attributed to money spent by Russians when on vacation. This newest sanctions against Turkey throws a wrench in the plans of many people from Russia who are currently in Turkey, measured recently at 11,000, and those who had plans to visit later in the year. The number of cancelled reservations may sit at around 6,000 if latest estimates hold true, just the beginning of declines in a Turkish tourism industry that brought in only $21 billion during the first nine months of this year, a decline over the same period from last year. The percentage of Turkish GDP attributed to tourism is expected to decline -0.80% from last year, and -3.00% from two years prior.

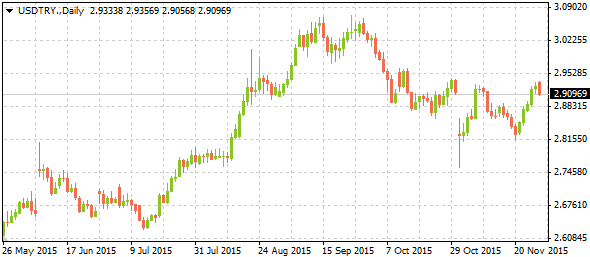

The deficit present in the Turkish government’s finances proves a sticky situation for the economy, and dropping revenues heavily outline the present budget shortfalls. Turkey’s solution so far has been to enact restrictions on credit, hopefully lowering domestic demand and bringing some equilibrium to the trade balance going into 2016. According to official figures, combining the exports to Russia and Russian money exchanged within Turkish borders nets 1.40% of GDP, which is set to drop dramatically as the FOMC rate hike and this latest event focus market attentions. The Turkish currency, the Lira (TRY), has been one of the worst performers of 2015 as Syrian troubles and clashes with Kurdish soldiers drop investor sentiment in the region. With rising tensions likely to see the potential cancellation of pipeline projects and energy collaboration, the Turkish economy can fall much further if tensions do not abate. The latest trends have the USD/TRY pair on a hot streak, pushing upwards to new highs as the situation gets increasingly tangled.