We expect offshore drilling powerhouse Transocean Ltd. (NYSE:RIG) to beat expectations when it reports second-quarter 2016 results after the closing bell on Wednesday, Aug 3.

In the preceding three-month period, the Vernier, Switzerland-based firm delivered a massive positive earnings surprise of 165.38% despite the challenging environment posed by the steep drop in commodity prices throughout the quarter. The outperformance came on the back of a significant decline in operating and maintenance expenses.

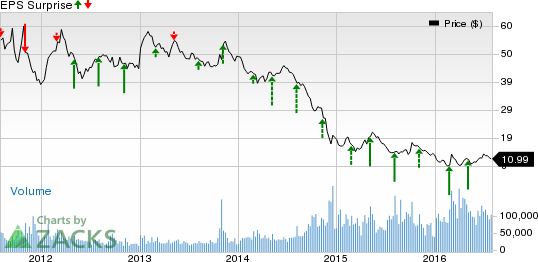

Importantly, Transocean has outpaced the Zacks Consensus Estimate in all of the past four quarters with an average beat of 111.84%.

Let’s see how things are shaping up for this announcement.

Why a Likely Positive Surprise?

Our proven model shows that Transocean is likely to beat earnings in the to-be-reported quarter because it has the right combination of two key ingredients.

Zacks ESP: Earnings ESP for this company stands at +150.00%. This is because the Most Accurate estimate stands at a penny, whereas the Zacks Consensus Estimate is pegged lower at a loss of 2 cents. A favorable Zacks ESP serves as a meaningful and leading indicator of a likely positive earnings surprise.

Zacks Rank: Transocean carries a Zacks Rank #3 (Hold) which, when combined with a positive ESP, makes us confident of an earnings beat.

Note that stocks with Zacks Ranks #1 (Strong Buy), 2 (Buy) or 3 have a significantly higher chance of beating earnings. On the other hand, the Sell-rated stocks (#4 and 5) should never be considered going into an earnings announcement.

What's Driving the Better-Than-Expected Earnings?

As is the case with other offshore drillers, Transocean’s revenues/earnings have borne the brunt of the freefall in realized commodity prices over the past 2 years. As oil remains in a bearish territory, the top energy companies have cut spending (particularly on the costly drilling projects) on the back of lower profit margins. This, in turn, has meant less work for the beleaguered drillers as offshore exploration for new oil and gas projects has almost come to a standstill.

However, Transocean has come up with certain strategy initiatives to overcome the industry-wide slump and outperform earnings estimates yet again in the second quarter.

Firstly, with an aggressive cost reduction program, Transocean is looking to shore up its operational performance even in this weak oil and gas pricing environment. As part of this strategy, the company has embarked on a policy to optimize overhead and maintenance expenses.

Secondly, Transocean has zeroed its focus on reducing out-of-service times by carefully planning the frequency of its in-service maintenance and shipyard repairs.

Finally, Transocean has set itself an ambitious target to achieve a very impressive 95% revenue efficiency for 2016. As it is, the company is coming off three consecutive years with revenue efficiency at or above 95% The continuation of this trend will aid operating margin in the to-be-reported quarter.

Other Stocks to Consider

Transocean is not the only company looking up this earnings season. Here are some companies from the energy space which, according to our model, also have the right combination of elements to post an earnings beat this quarter.

Concho Resources Inc. (NYSE:CXO) has an Earnings ESP of +33.33% and a Zacks Rank #2. The company is anticipated to release earnings on August 2.

Legacy Reserves L.P. (NASDAQ:LGCY) has an Earnings ESP of +12.50% and a Zacks Rank #2. The company is expected to release earnings results on August 3.

Devon Energy Corp. (NYSE:DVN) has an Earnings ESP of +4.55% and a Zacks Rank #2. The company is likely to release earnings on August 2.

TRANSOCEAN LTD (RIG): Free Stock Analysis Report

DEVON ENERGY (DVN): Free Stock Analysis Report

CONCHO RESOURCS (CXO): Free Stock Analysis Report

LEGACY RESERVES (LGCY): Free Stock Analysis Report

Original post

Zacks Investment Research