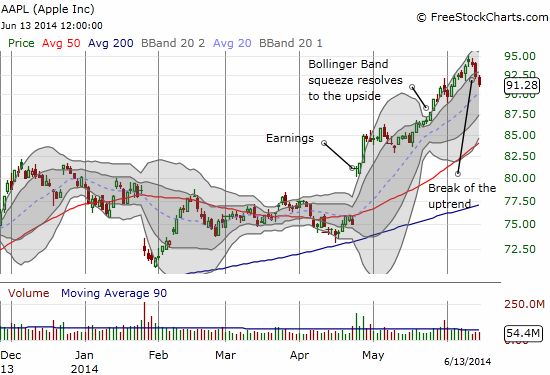

Apple (NASDAQ:AAPL) finished its first post-split week in disappointing fashion. Sure a sell on the news reaction should have been expected, but the strong trade going into the split, right through the Worldwide Developers Conference (WWDC), produced some hope AAPL could hold its own. Apple even entered the week featuring a dramatic shift in trading sentiment to a bullish advantage. Next, the stock even gained the first two post-split trading days. Unfortunately, not only did AAPL end the week down 1.1%, but it also broke the primary uptrend since last May’s big breakout.

The good news for Apple is that trading volume on the selling fell off a cliff. The bias for excitement remains with the buyers. This dynamic bodes well for trading in the coming week when buyers should return to take advantage of the small dip. I would prefer a neat test of the 20-day moving average (DMA) as support. The Apple Trading Model (ATM) projects an 88% chance for Apple to close Monday with a gain, so a dip would give me an extra margin for profit. Daytraders should probably not chase a gap up as the odds of a fade from the open are a relatively high 75%.

I am still quoting projections from the ATM because last week the model turned in as good a performance as I can expect. Regular readers know that I was bracing myself for post-split trading to change patterns enough for me to give the model a rest until more data come in.

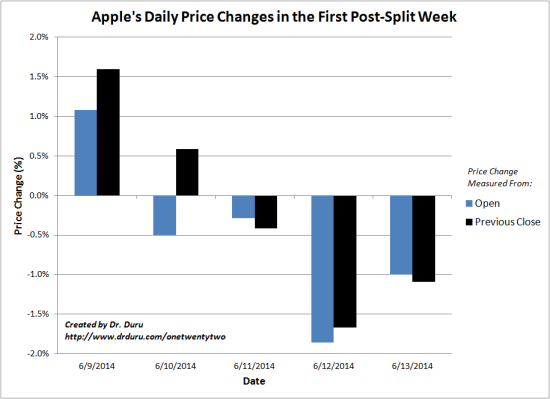

Here is a chart of the daily price changes I am using for the model check-in:

- 6/9/14: Correct on gain from previous close; incorrect on fade from open

- 6/10/14: Correct on gain from the previous close; incorrect on gain from the open

- 6/11/14: Incorrect on gain at the close; incorrect on fade from the open

- 6/12/14: Incorrect on gain at the close; correct on fade from the open

- 6/13/14: Correct on loss from the previous close; correct on fade from the open

Note that these projections are only based on data from 2014. When using data from 2013, the model contradicted itself four of five times on projections from the open and only twice on projections from the previous close. So, I was much more confident in the latter projections. Nailing three out of five trading days is exactly where I expect the model to perform.

I will treat this coming week as a major moment for confirmation. If I get that, I will be back to trading the model aggressively. Last week, I only traded numbers of options and achieved a “meager” 6.5% gain that was essentially erased by commissions. (I also could have eliminated one of the losing positions with better execution).

Be careful out there!

Disclosure: long AAPL call options