Here are four stocks with buy rank and strong value characteristics for investors to consider today, January 23rd:

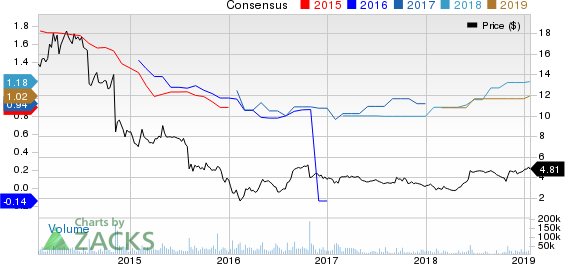

Ready Capital Corp (RC): This real estate finance company has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 1.7% over the last 60 days.

Ready Capital Corp Price and Consensus

Ready Capital has a price-to-earnings ratio (P/E) of 8.19 compared with 11.10 for the industry. The company possesses a Value Score of A.

Ready Capital Corp PE Ratio (TTM)

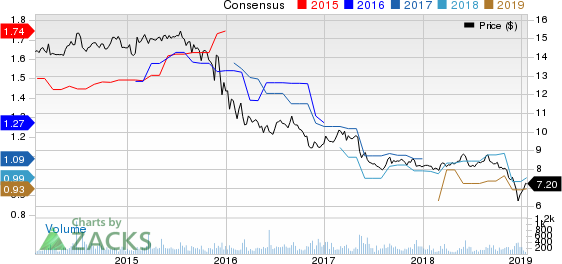

Genworth Financial (NYSE:GNW), Inc. (GNW): This insurance and homeownership solutions provider has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 0.9% over the last 60 days.

Genworth Financial, Inc. Price and Consensus

Genworth Financial has a price-to-earnings ratio (P/E) of 4.72 compared with 9.70 for the industry. The company possesses a Value Score of A.

Genworth Financial, Inc. PE Ratio (TTM)

Garrison Capital Inc. (GARS): This business developer specializing in investments has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 2.1% over the last 60 days.

Garrison Capital Inc. Price and Consensus

Garrison Capital has a price-to-earnings ratio (P/E) of 7.72, compared with 9.20 for the industry. The company possesses a Value Score of B.

Garrison Capital Inc. PE Ratio (TTM)

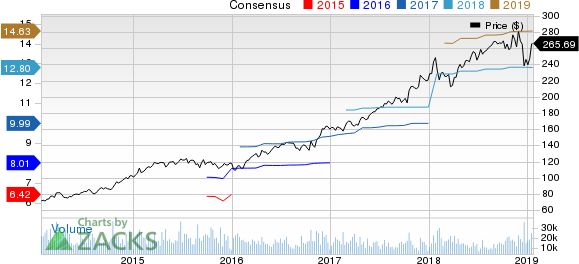

UnitedHealth Group Incorporated (NYSE:UNH) (UNH): This diversified health company has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 0.3% over the last 60 days.

UnitedHealth Group Incorporated Price and Consensus

UnitedHealth has a price-to-earnings ratio (P/E) of 18.16 compared with 46.00 for the industry. The company possesses a Value Score of B.

UnitedHealth Group Incorporated PE Ratio (TTM)

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

UnitedHealth Group Incorporated (UNH): Get Free Report

Ready Capital Corp (RC): Get Free Report

Genworth Financial, Inc. (GNW): Free Stock Analysis Report

Garrison Capital Inc. (GARS): Free Stock Analysis Report

Original post