By Continuing Down Today, ES has Raised the Odds of a Fake Breakout from the Red Flat-Topped Megaphone

Over the weekend I posted longer-term scenarios for ES that included the mega-bullish possibility of a run to 2250-2260.

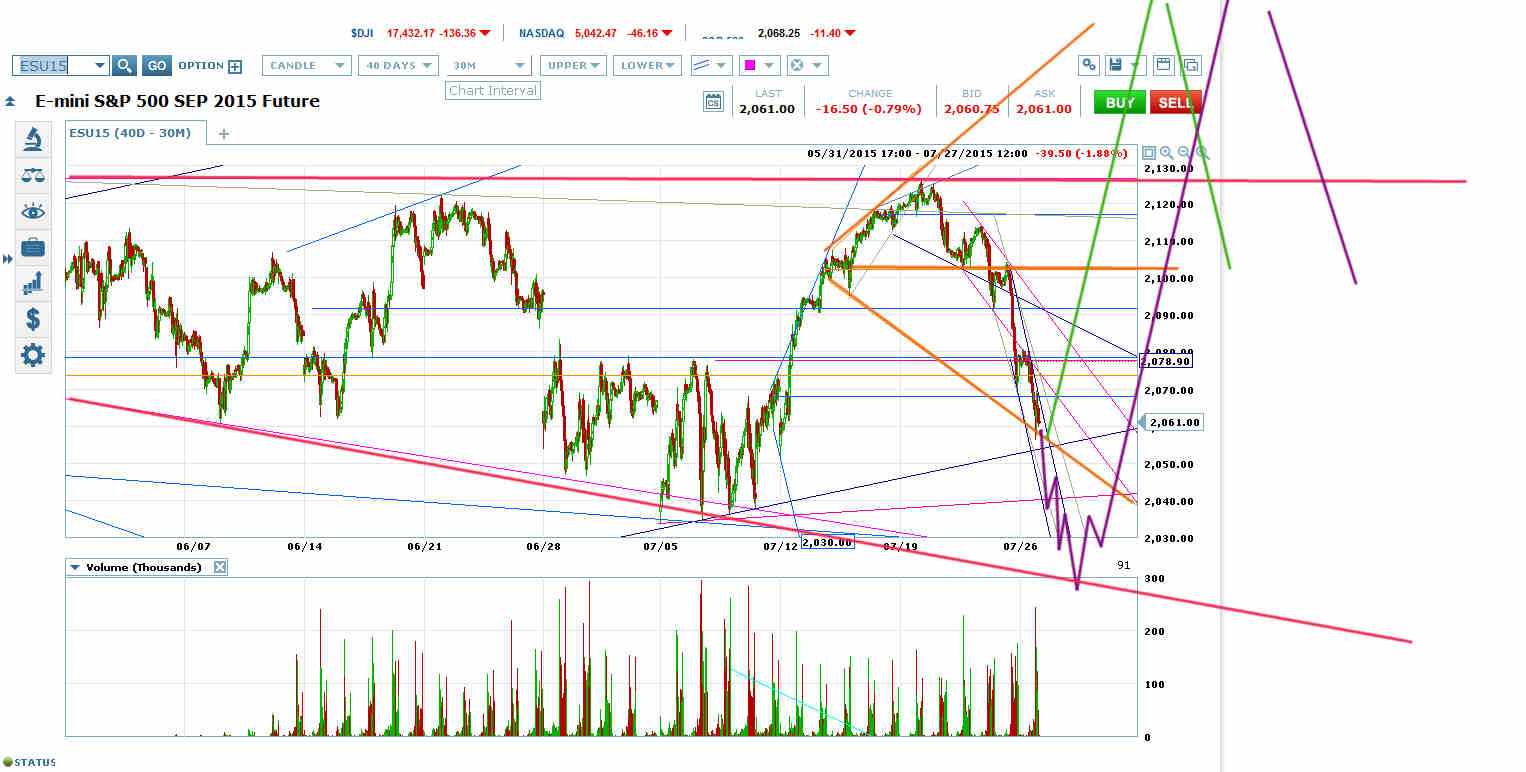

But that scenario required a retrace from Friday’s low to 2100. That retrace would have set up a downward breakout from the orange megaphone on the chart above. If ES had then continued down to the bottom of its 3-year+ price channel, all requirements of the orange megaphone would have been met and we could have erased it from the chart.

Instead, ES continued down to the orange megaphone bottom without a retrace to its VWAP. That’s ominous, because if ES continues down from here to the bottom of the red, flat-topped megaphone without putting in a retrace to 2100 first, it keeps the orange megaphone on the chart–with all of its requirements.

That’s important because it would make the most likely longer-term scenario a fake breakout through the top of the red flat-topped megaphone as ES returns to its orange megaphone top. The orange megaphone would require a retrace to at least its VWAP at 2100, causing the price to reenter the red flat-topped megaphone. But a failed breakout from the red flat-topped megaphone would usually mean a much bigger plunge.

In fact, the failed breakout from the red flat-topped megaphone would likely put in the top of the entire move out of the 2009 low.

So the question is whether ES can retrace to 2100 before reaching its likely target at the bottom of the red flat-topped megaphone. It can’t go much lower without losing the opportunity and blowing the chance of a run to 2250.