Actionable ideas for the busy trader delivered daily right up front

- Thursday higher, medium confidence.

- ES pivot 1649.50. Holding above is bullish...

- Friday bias higher technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader remains short at 1643.00.

Things were looking good for a lower close early on Wednesday. Then the Dow made a brief pop when the Fed minutes came out but that went pfft and we ended lower after all (though the SPX did post a small gain). But this all created an interesting candle which we will now examine as we proceed to dissect the charts as we do every night. Scalpel!

The technicals (daily)

The Dow: After four straight days of respectable gains, the Dow gave us a clear star on Wednesday. And because of the steepness of the rising RTC, it also just barely exited, for a bearish setup. And the stochastic also barely squeaked out a bearish crossover (%K of 91.51 just moving under a %D of 91.94). So this chart is now looking officially bearish to me.

The VIX: Meanwhile, the VIX is back in its "Help I've fallen and I can't get up" mode, dropping another 0.98% on Wednesday with a bearish engulfing candle that canceled Tuesday's doji. So it remains in a downward RTC and the lower BB just keeps falling away. With no support now until 13.62 (just above the lower BB at 13.56) I now think the VIX can move still lower.

Market index futures: Tonight all three futures are sharply higher at 1:39 AM EDT with ES up by a very strong 1.11%, a number you don't often see at this hour of the night. On Wednesday, ES put in a classic star that coupled with highly overbought indicators suggested a reversal lower. But the overnight action is just trashing that idea with a big gap-up that just now touched the upper BB and leaves us right at the all-time high resistance line set back in May. With RSI now pegged at 100, I'd like to say we're due for a move lower, but Mein Gott, I'm not going to step out in front of this raging bull.

ES daily pivot: Tonight the pivot inches up from 1643.42 to 1649.50. We were way above the old pivot and remain way above the new pivot, so nothing but bullish there.

Dollar index: Ha - so naturally just when I stopped believing the dollar would ever move lower, it did, dropping 0.64% on Monday to bring the indicators almost off overbought.. Even at that though, it remains in a rising RTC, But with the dollar alternating up and down days for eight sessions in a row now, the only conclusions I can draw is that Thursday will be higher.

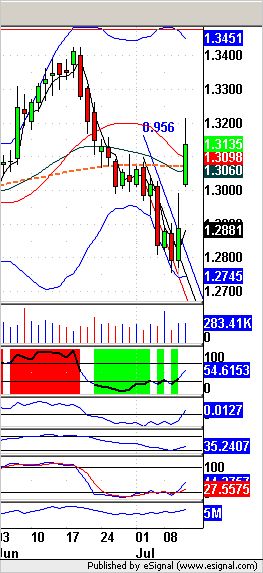

Euro: Holy moly! This one deserves a picture. Just look at this chart of the euro. On Wednesday it put in a bullish engulfing pattern that closed just outside the descending RTC for a bullish setup and then would you look at the overnight (last bar on the right) - the euro is now up an amazing 1.92% on a giant gap-up green candle that rocketed straight through the 200 day MA in one fell swoop, evidently thanks to the BOJ. I scrolled the daily chart all the way back to 2007 and was unable to find any instance of anything even remotely close to this.

In any case, this is now a bullish trigger, though with such a big move and such a big gap, I'd expect at least some retracement on Thursday - maybe back to the 200 MA which is now support. Bottom line, I think we can safely say the latest euro downtrend is now officially over.

Transportation:Last night I wondered if a pause wasn't on the way here after Tuesday's big gains. Well we got one and then some as the trans dropped 0.72%, bouncing off the upper BB. It isn't fatal since we remain in a rising RTC, but the indicators have now all turned lower from overbought and the stochastic squeaked out a bearish crossover so like the Dow, this chart is now looking bearish to me.

With the futures seemingly headed to the moon, Alice after a one-two punch from Uncle Ben and the BOJ, and the VIX unable to make any headway at all, the only reasonable course of action is to call Thursday higher.

ES Fantasy Trader

Portfolio stats: the account remains at $115,000 even after 14 trades (11 for 14 total, 6 for 6 longs, 5 for 8 short) starting from $100,000 on 1/1/13. Tonight we go remain at 1643.00 and take some considerable heat.