Thinking of joining the “Great Resignation” crowd and dumping your 9-to-5 gig? Let’s talk about how you can do it with outsized 7%+ dividends that easily keep the bills paid.

I’m going to show you the powerful secret some of these “quitters” are using today. It all turns on a unique kind of asset called a closed-end fund (CEF) that’ll be our source for those rock-steady 7%+ dividends (paid monthly, to boot!).

More Investors Discover The Income-Producing Power Of CEFs

First off, a funny thing is happening as people dump their day jobs: they’re investing more, with the number of new investors jumping 15% in 2020, and scores of folks who already invest building out their portfolios further.

Some of that cash has flowed into CEFs, and it’s easy to see why: these potent income plays yield 6.9%, on average. As evidence of their new-found popularity, CEFs also trade at some of their narrowest discounts to net asset value (NAV) ever: just 1.5%, compared to 7.2% a year ago. We’ll delve into three specific CEFs with outsized dividends up to 10.8% below.

(By the way, the discount to net asset value, or NAV, is a quirk of CEFs that refers to the fact that these funds’ market prices often differ from the per-share value of their portfolios—and most trade at discounts.)

The investors who’ve found their way into CEFs are finding true financial freedom! Drop $100K into the typical CEF and you’re looking at $6,900 paid out every year—and most CEFs (around 350 of the 450 or so out there) pay dividends monthly, so your payouts align with your bills.

CEF Investors Beat The Trend

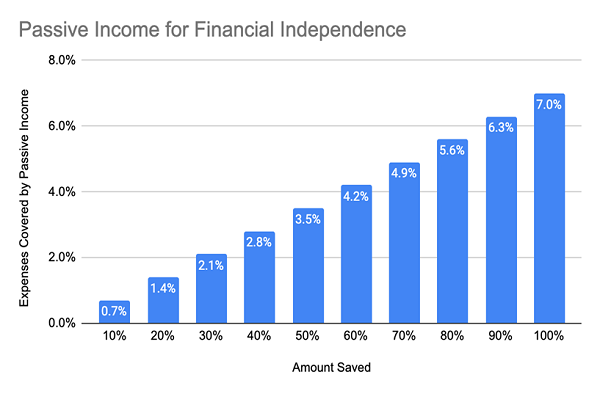

An income stream like this changes the equation, because as soon as your passive income exceeds your bills each month, you can quit your job. This is, after all, how retirement works. And the more you save, the earlier you can retire.

Source: CEF Insider

If we consider a worker who invests 10% of their wages in a CEF that gets them a 7% income stream, after one year, their passive income will cover 0.7% of their salary.

That doesn’t sound like much, but look at how it goes up the more you save: 70% of your income invested means 4.9% of your salary is covered by passive income in a year. Add in a rate of return based on historical stock-market performance and reinvested dividends, and financial independence would come in just five years for someone saving that much.

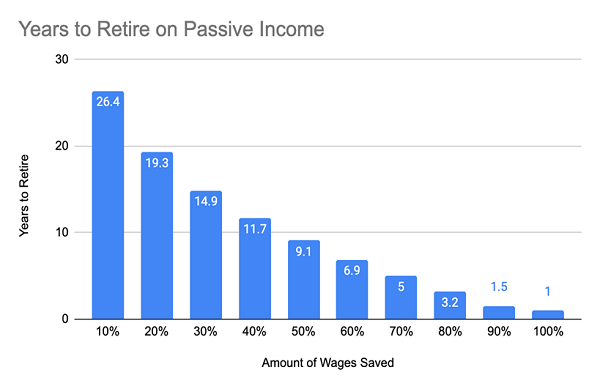

Source: CEF Insider

Of course, these numbers aren’t absolute. As mentioned, I’m basing this on the long-term average return of the S&P 500, but you’ll want to diversify and focus on groups of assets that outperform the benchmark index (one of the funds we’ll touch on below did just that, doubling up the S&P 500 since inception).

Second, most people don’t need to cover 100% of their paycheck with passive income. Retirees don’t need to spend money on commuting, for example. As well, they can often move to an area with a lower cost of living. Their tax burdens will often be smaller, too.

If you factor those into your own personal situation, you might find that saving half your income will get you financially independent much faster than the 9.1 years you see in the chart above.

3 CEFs That Let You Resign Sooner Than You Thought (And Keep The Lifestyle You Love)

The crux of all of this, of course, is that 7%+ income stream, so let’s dive into three CEFs that’ll get you there.

1. BlackRock

Our first pick is the BlackRock Science & Technology (NYSE:BST), which, as the name says, is run by BlackRock, the world’s biggest investment manager, with $7 trillion of assets (and the top-notch management talent that such scale attracts).

BST, as the name also suggests, focuses on tech stocks, particularly large cap techs, with Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon.com (NASDAQ:AMZN), and Mastercard (NYSE:MA) populating its top-10 holdings.

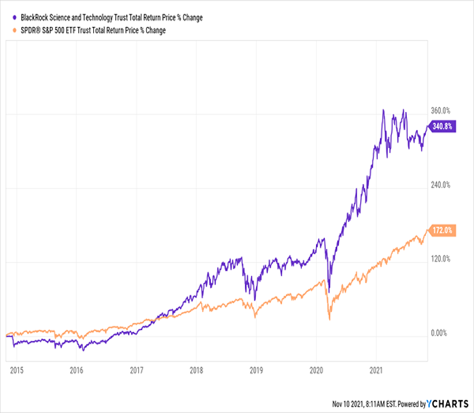

If we reinvest our payouts in BST while we’re taking our fast track to financial freedom, we can expect it to grow our nest egg (and future income stream) fast: as you can see, BST has doubled up the total return (or price gains plus reinvested dividends) of the benchmark SPDR® S&P 500 (NYSE:SPY) since its inception in 2014:

BST Builds Investors’ Portfolios And Income Stream

BST yields 5.4% today, which is a bit light for CEFs, but its dividend has grown 150% since inception in 2014 (it most recently hiked payouts in October). And we can expect that to keep coming, thanks to the fund’s soaring NAV, which is up 377% since inception and roughly 35% in the last year alone. A healthy slice of those portfolio gains will likely flow our way as dividend hikes.

Best of all, BST trades at a 4.5% discount to NAV as I write this, so you’re essentially getting its portfolio of strong tech names for 95 cents on the dollar! That may not sound like much, but in today’s pricey market, we’ll take any deal we can get.

2. Brookfield Real Assets - A 1-Click Way To Tap The Biden Infrastructure Plan For 10.8% Payouts

To diversify beyond the tech names BST holds, consider adding the Brookfield Real Assets Income (NYSE:RA), which yields an impressive 10.8%. RA splits its portfolio roughly three ways between bonds, mortgage-backed securities and shares of infrastructure companies. Utility NextEra Energy (NYSE:NEE), its largest equity holding, stands to benefit from the Biden Administration’s infrastructure and environmental spending. RA also holds growing mobile-network operators like T-Mobile US (NASDAQ:TMUS) and Crown Castle International (NYSE:CCI).

This CEF does trade at an 8.9% premium to NAV, so we can’t expect a whole lot more price upside here. But it has traded at higher premiums of 10%+ in the past few months, and we’re getting a baked-in 10.8% return from the dividend (which is paid monthly). This payout is also as solid as they come, having held steady through the COVID-19 crisis, giving shareholders the reliable income stream they needed to weather the storm.

3. PIMCO Dynamic Income Fund - A 9.7% Dividend From One of the Top Names in CEFs

Finally, we’ll add exposure to government and corporate bonds through the 9.7%-yielding PIMCO Dynamic Income Fund (NYSE:PDI), which has a broad mandate to invest in the fixed-income securities management. Right now, PDI holds about a third of its portfolio in high-yield corporate debt; another third is in mortgage-backed securities; and the rest is held in emerging market, investment-grade and municipal bonds.

PIMCO is a leading name in CEFs, with the talent and expertise to produce some of the strongest funds on the market. Trouble is, everyone knows it, which is why PDI trades at a 9.2% premium as I write this. But this fund has traded at premiums as high as 16% in the past year, so we could still grab some nice upside to accompany our 9.7% payout.

The Final Word - An 8.6% Yield That Could Move Retirement Day A Lot Closer

That gets you a portfolio that yields 8.6%, which brings a passive income stream that could make you financially independent even faster than suggested in the scenario above. Someone saving half of their income now, for example, would only have to wait 6.1 years to retire, going by our earlier figures. That’s a lot better than the decades you’d have to wait by investing in a low-yielding index fund.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."