One nice thing—and probably the only nice thing—about the 2022 market selloff is that it’s given us dividend investors an opportunity to grab 10% yields we can count on for the long haul.

They come to us from closed-end funds (CEFs), a (too) long-neglected asset class that, frankly, is looking better and better every day for those looking to retire on dividends alone—and frankly, we all should be.

I do want to emphasize the long haul here, though, because, at this stage of the market correction, you can put some money to work effectively, either by picking up individual funds here and there or by dollar-cost averaging (DCA) to build up your income stream (and portfolio) at a reasonable price.

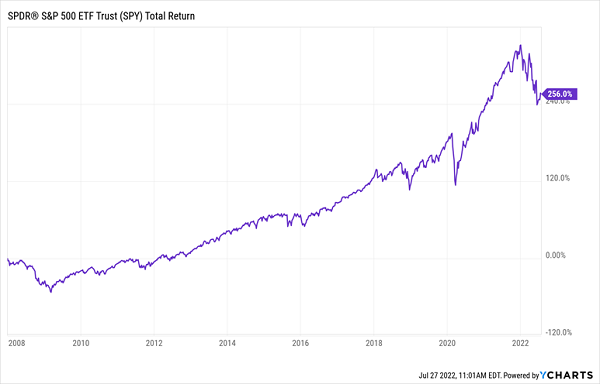

To see what I mean, think back to the 2008 recession. If you’d started buying then, no matter the stage of the crash, you’d be doing just fine today, 14 years later, even with the tire fire that has been 2022:

Buying Into The ’08/’09 Mess Paid Off On The Long Run

You’ll put yourself in a better position with CEFs, because you’re getting a big slice of your return in cash dividends. With the three funds below, you can get a yield right around 10%, meaning $100 per month in passive income for every $12,000 you put into them. Bring that investment up to $600,000 and suddenly you’re getting over $5,000 per month in passive income, just for holding three funds that diversify your holdings across hundreds of companies and thousands of assets.

Then there’s the upside: the big discounts to net asset value (NAV) these funds boast are a plus in any market—if stocks keep gaining, these discounts should close, helping propel their market prices higher. In a falling market, a wide discount helps a fund’s price hold up, as bargain-hunters are drawn in.

That’s the strategy at play here. Now let’s talk tickers.

Start With a 9.7% Yield From Small Cap Tech …

The BlackRock Innovation and Growth Trust (BIGZ) is an oversold fund in an oversold market. As I write this, BIGZ, which focuses mainly on innovative tech companies with strong revenue-growth potential, yields 9.7% and trades at a 14% discount to NAV, meaning we can get its portfolio for just 86 cents on the dollar:

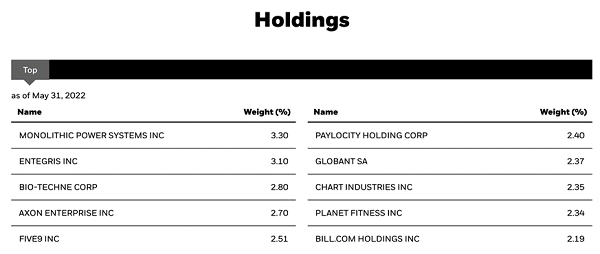

Source: BlackRock (NYSE:BLK)

In addition to smaller techs like Monolithic Power Systems (NASDAQ:MPWR), Bio-Techne (NASDAQ:TECH), and Five9 (NASDAQ:FIVN), BIGZ also invests in companies like Planet Fitness (NYSE:PLNT). The gym owner recently saw a 72% jump in revenue year-over-year in the second quarter of 2022 and is ridiculously oversold, given the strong desire to get back to the gym following COVID lockdowns.

BlackRock, the world’s largest investment firm, oversees this portfolio of large, mid, and small-cap firms, and the company’s deep research resources and strong talent base help it sustain its 9.7% payout, while getting you exposure to 88 high-quality companies at the same time.

Then Add A Real Estate CEF Trading At 12%

Even with the work-from-home revolution, there has been a big uptick in demand for property that has caused a lot of commercial and residential real estate to explode in value. That’s in part thanks to people looking to move to the suburbs or small cities and partly due to demand for different kinds of office space that are suitable to the post-COVID working culture. This is why a fund like the CBRE Global Real Estate Income Fund (IGR) is worth a close look right now.

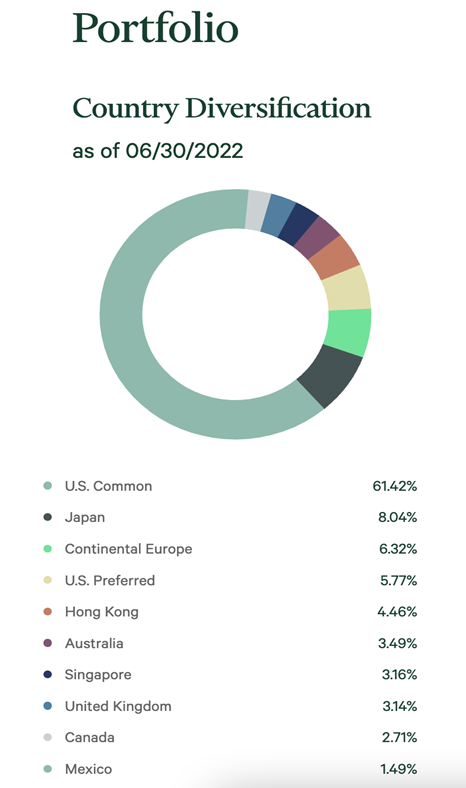

Adding appeal are IGR’s dividend yield (9.6%) and its discount (3.7%), the latter of which is lower than the 1% discount at which it traded in mid-June. The fund’s portfolio is sustained by a portfolio of 86 different real estate investment trusts (REITs), which themselves own hundreds, sometimes thousands, of different properties in the US and around the world.

Source: CBRE

CBRE is one of the world’s largest real estate investors, with offices in all the countries where it invests, giving it plenty of boots-on-the-ground experience. Buy this one and you essentially become a global landlord without having to do any of the work “regular” landlords do. And you’ll collect a 9.6% dividend, too!

Finally, Consider This ESG Play As A Short-Term, Discount-Driven Buy

The Nuveen Core Plus Impact Fund (NPCT) is one of the most interesting CEFs out there. With an ESG mandate, it’s focused on making sustainable investments from an environmental, social and governance perspective through companies like Renewable Energy Group (NASDAQ:REGI) and privately held Topaz Solar Farms. Since ESG investing is one of the hottest concepts on Wall Street these days, there’s reason to think more investors will turn to NPCT in the future.

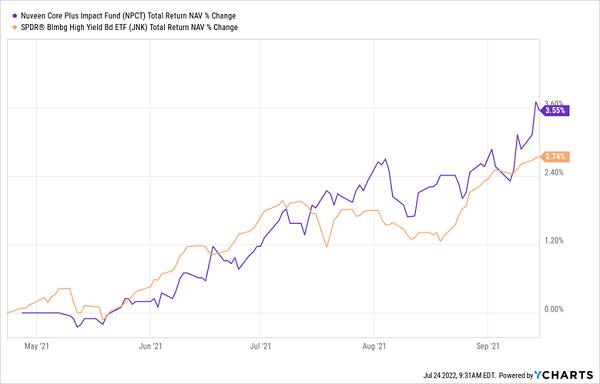

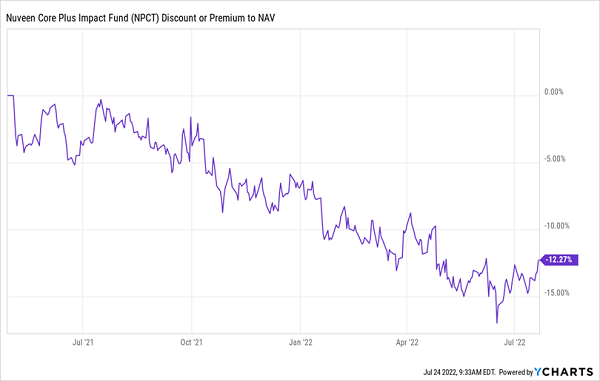

That hasn’t happened quite yet, however. With a 12.3% discount to NAV, NPCT has seen limited buy-in. But there’s a good reason for that: the fund was launched in mid-2021 and got off to a hot start:

NPCT’s ESG focus didn’t hurt returns, with the fund outperforming the broader high-yield corporate-bond market by a big margin. But when the 2022 bear market hit corporate bonds, the fund’s discount to NAV fell—although we see it beginning to come back.

NPCT’s Discount Bounces, Setting Up a Buying Opportunity

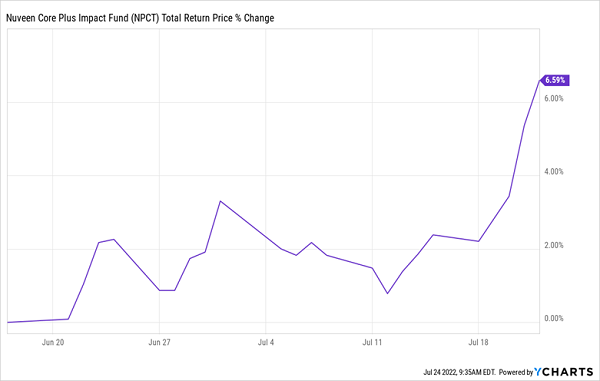

Buying into a fund whose discount is showing upward momentum is a proven way to build wealth in CEFs. If NPCT’s discount hits the 2% mark at which it traded when the fund was outperforming the market, we could see 11% capital gains on top of the fund’s 10.2% dividend. That would be on top of capital gains from the rising value of its portfolio, which has already seen a nearly 7% recovery since the market last bottomed, in June.

NPCT’s Recovery Has Begun

All told, we’re looking at the potential of a 40% total return over the short term if NPCT continues its current trajectory—and the strength of the ESG trend (at least for now) suggests this sort of gain could be on the table.

But remember, too, that interest in ESG tends to wax and wane with the broader economy, so this one may not be quite the long-term hold the above two funds are. You’ll want to keep a close eye on NPCT and be ready to sell if its narrowing discount stalls or reverses course.

Putting It All Together

With these three funds, you’ve got major diversification across stocks, bonds and real estate, with an additional dash of trending ESG investments. Plus you’ll get yourself an outsized 10% yield, and I think you’ll agree that a payout that big is attractive in any market, including today’s.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets."