You have to be dead to not know that oil fell hard over the back half of 2014. It was all over the news. You saw it at the pump. It was not so visible the rise in bond prices unless you follow that sort of thing.

But it is equally as interesting that not one economist had predicted that bonds would rise in 2014. These moves in themselves for Crude Oil and Treasury Bond prices were incredible. But when looked at together, a really spectacular phenomenon shows up.

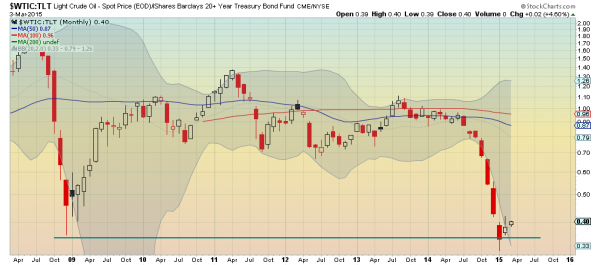

The chart above shows the ratio of Crude Oil to the Treasury Bond ETF (ARCA:TLT). Two things stand out. The first is the fast spike down at the height of the financial crisis in 2008. It recovered from that fairly quickly and settled into a consolidation zone. The relationship between the two was constant. For 4 years. Then the second spike down occurred. What is interesting about it form a technical perspective is that the second spike ended at the same place as the first spike. A possible double bottom. February saw an inside month or Harami in Japanese Candlestick vernacular.

And although it is early in March, the ratio is following through to the upside. Confirmation at month end would be best, but this price action sets up a mean reversion trade back to the 50 month SMA and the prior sideways action. You can trade this best by being long Crude Oil against short Treasuries, but it also gives you a possible indication of a bias higher in Crude and lower in Treasuries.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.